8 Best Automated Trading Software For Pc [2023 Guide]

Try our top picks for the best trading software and choose your favorite

14 min. read

Updated on

Read our disclosure page to find out how can you help Windows Report sustain the editorial team Read more

Key notes

- Trading software can perform automated actions, such as trade entries and exits, based on rules that you define.

- Around 75% of shares traded on the US stock exchange happen because of rules triggered in automatic trading systems.

- See below our top picks for the best trading software that will help you save time and determine the best trading patterns.

Automated trading of stocks, futures, and options simply involves a computer program being able to create orders and submit them automatically to an exchange center or market.

Specifications and rules can be set by the user while the program monitors the market in order to find opportunities to trade according to these specifications. This kind of trading is often fast-paced and even enjoyable to participate in.

What is automated trading software?

Automated trading software uses an algorithm with pre-determined instructions to submit market orders, sales, and purchases.

The exact parameters that trigger action can be set up by individual users and generally include variables such as price shifts, time, and volume.

This means that traders can submit orders at the best price on the market in an instant, avoiding the risk of the price going up. The risk of human error is also minimized and the decision-making process is completely objective.

Traders use multiple types of automated strategies to pre-set their trading software. These include trend-following strategies, mathematical model strategies, percentage of volume, and index fund rebalancing.

What to look for in automated trading software?

- Access to various markets: lets you operate within the trading markets you prefer

- Backtesting feature for historical data: simulates strategies and creates predictions so you can change up your parameters for higher chances of profit

- Minimal latency: original prices change up in just a few seconds, so high response speeds are crucial for getting the best price

- Ease of use and configuration options: intuitive controls and access to real-time parameter customization

- Programming language: uses the industry-standard Matlab, Python, C++, Pearl, and Java languages and allows experienced users to write their own algorithms

- User interface: easy to use, allows users to make quick moves, even when on the go

- Built-in algorithms: although you can set up your own parameters, having access to pre-made algorithms can help you get started

How to choose the best trading platform?

Legitimacy is the most important thing to look for, in the first place. While most trading software claims to have great results, we recommend you look for proof that can back up these statements.

Not all trading platforms offer transparent reports on their returns and overall performance, but if they do, make sure they have good risk ratings and in-depth backtesting.

Another important thing to consider is price and fees. Some platforms set up a standard price, while others charge per purchase or place other fees. Make sure to thoroughly read the pricing options so you can make a plan on how much you will have to invest.

Other things to consider are compliance with your location’s regulations, a feature set that includes all the tools you need, and access to your preferred assets.

The tools also apply to these topics as well:

- Automated day trading software – Day trading means performing the transaction on the same trading day. This is the most common form and the software can be set up in this way.

- Cryptocurrency automated trading software – Only the software that allows performing trades with cryptocurrency.

- Fully automated trading software – This usually involves monitoring the news and applying such data in the decision-making process.

- Automated online trading software – Every trading software needs to be online to perform and execute the operations.

What are the best automated trading software for Windows PC?

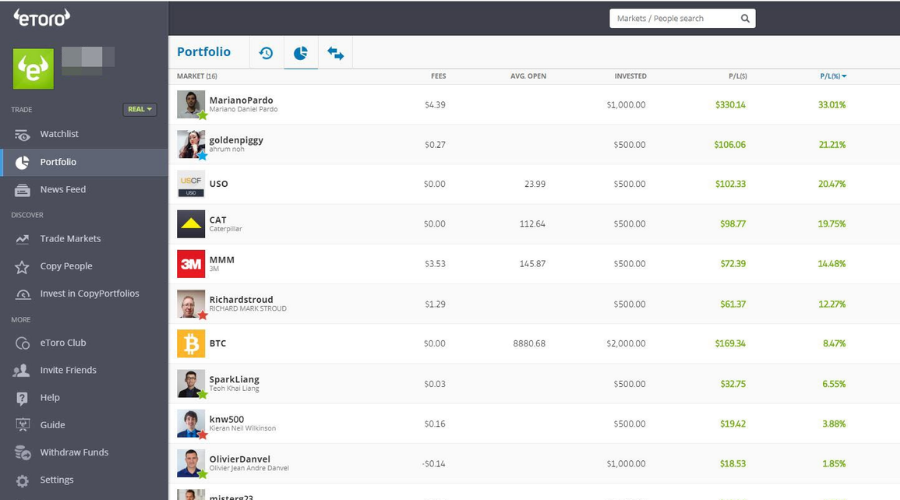

eToro – Award-winning CopyTrade technology

Disclaimer: Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

eToro is an industry-leading social trading platform equipped with automated tools created for investors who don’t have the time or experience to place trades themselves.

Both the eToro platform and app offer a plethora of financial assets to invest in via all types of devices.

eToro promises a secure and private trading experience. It is regulated by multiple leading regulatory agencies that cover trading laws worldwide (US, UK, EU, Australia, and more).

Along with that, it lets users implement multiple layers of protection to authenticate to their accounts. It also monitors all activity and is able to block and notify users in case of fraudulent activity.

On the eToro platforms, users can find ready-made investing portfolios. This makes it easier to identify and invest in the type of businesses you are knowledgeable or passionate about.

eToro supports trading in over 2,500 stocks. It also lets users trade and uses 51 types of cryptocurrencies and 49 regular currencies.

However, US customers can only access cryptocurrencies using the eToro trading system. Different users can also invest in commodities such as silver, gold, natural gas, oil, and many more.

Features/Pros

- Award-winning CopyTrade technology, enabling users to automatically replicate the actions of an experienced investor

- Over 2000 available assets

- Social trading network

- Ready-made portfolios

- Clean and responsive interface

- Advanced charting

- Transparent fees

- Educational content via the eToro Trading Academy

Cons

- eToro USA LLC does not offer CFDs, only real Crypto assets are available

- A withdrawal fee of $5

eToro

Minimize your risks and copy the trades of the most successful investors across the world with eToro.Disclaimer: 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation.

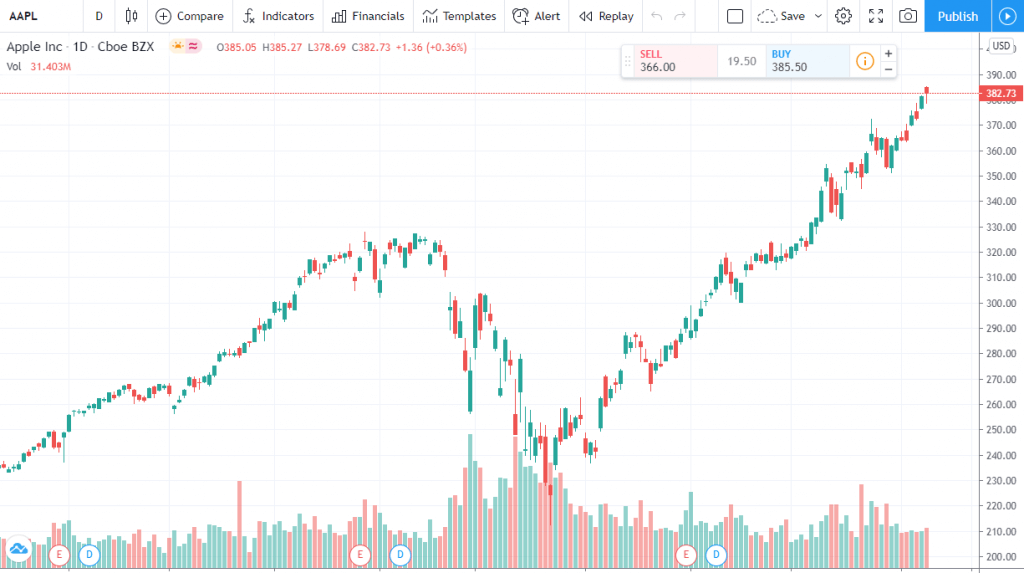

TradingView – Modern and intuitive interface

TradingView is a cloud-based trading platform with a social community of over 10 million investors. Its chart options and technical analysis tools are the main features that make it stand out.

TradingView can be accessed directly from a browser, as the web app requires no installation. Users only have to provide their credentials and they can start trading right away.

It does, however, offer a desktop and a mobile application for users that prefer to access it this way.

Regardless of the platform you pick, Trading View will send trade alerts regarding price, indicators, and strategies whenever an opportunity arises.

TradingView also has a live streaming platform where users can broadcast their trading activity and interact with each other, answer questions, create guides, and discuss marketplaces.

The platform has a strong trading community where users share ideas and trading analyses on their own experience. Anyone can join and share their own tips and tricks.

Features/Pros

- Over 100,000 strategies generated by the community

- Automated analysis

- Modern and intuitive interface

- Wide library of technical indicators, including over 5000 indicators made by users

- Pine Script Native language, allowing scripts and indicators to be created with fewer lines of codes

- Direct market access

- Cloud-based and server-side trading alerts for price, indicators, strategies, and drawing tools

- Mobile apps for iOS and Android

Cons

- Limited level 2 market data

- No offline usage

TradingView

Enhance your trading strategies and technical analysis skills with this advanced cloud-based trading platform.ZuluTrade – Strong user community

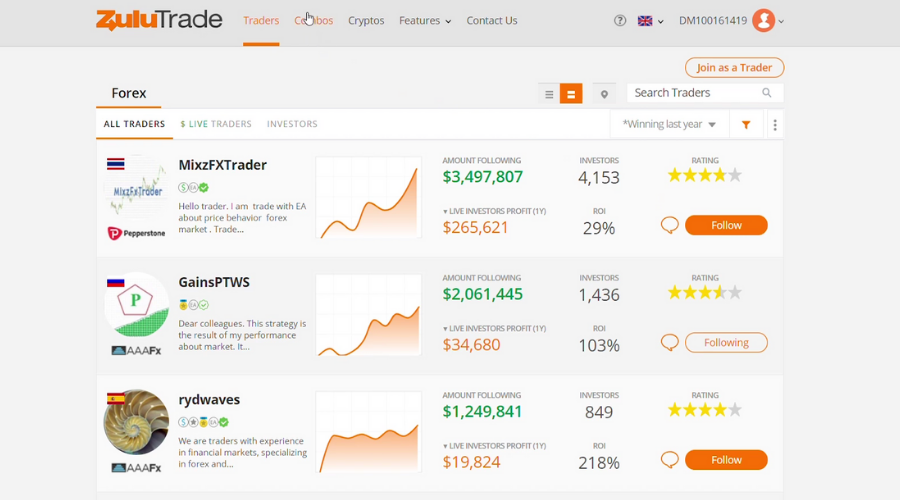

ZuluTrade was founded in 2007. It’s an online trading platform with some social elements and the ability to copy trading options and add automation.

Regulated by the HCMC, they offer APIs for traders, scripts, and auto-execution options. They’ve gained a lot of respect back in 2015 when the platform was awarded an EU Portfolio Management License.

ZuluTrade users can analyze and plan their trading with the help of insightful statistics of all traders and performance ranks.

The platform has a strong user community that primarily interacts via forums and comments. They also offer guides and tutorials on how to get started with the trading process.

Since you are looking for automated trading software, here are the 3 main features of ZuluTrade.

- The Automator

- As early as 2016, this functionality was added.

- Based on the rules that you add, when certain events occur, the Automator will send you an email notification or will automatically execute certain actions.

- ZuluScript

- Basically, this offers the chance to talk to trading bots by creating scripts.

- This trade automation allows you to perform much more trades than if you were to place orders manually.

- ZuluGuard

- With so much automation going on, you might risk losing everything in case of glitches.

- This unique feature for risk management asks for the amount of capital you have available and calculates a trading exit value for all opened trades.

In case the specified threshold is achieved, then all open positions will be automatically closed, thus minimizing any potential loss.

If you are still unsure, there’s the ability to create a Demo Account as well.

ZuluTrade

Create an account at ZuluTrade to benefit from ZuluScript, ZuluGuard, and other exclusive features for automated trading and more.Learn2Trade – Pro-level educational support

Learn2Trade is a forex signals service that employs its own private telegram channel. Just like the above-mentioned platforms, it is a highly secure service, acknowledged for its well-researched signals.

The platform provides forex market analysis and live market updates. Their main assets include commodities, indices, cryptocurrencies, and forex trading.

It has an extensive knowledge base with in-depth tutorials on best trading practices, strategies, forex trading courses, and more.

Learn2Trade is a very good platform for experienced and beginner traders alike. Its Learn Center feature includes information on financial instruments, trading platforms, trading trips, brokers, and more.

In terms of automation, the tool lets users copy trade experienced investors.

Premium users of the platform get instant, real-time notifications on their emails and mobile devices whenever a new trading signal is issued.

Features/Pros:

- Pro-level educational support

- Risk management guides

- Up to 10 signals per day

- Daily technical information

- Secure, real-time alerts via Telegram

- Free forex signals

- 24/7 chat with pro traders for VIP users

Cons:

- Signal accuracy can be quite low

- Unotified auto-renewal of subscription

SierraChart – Lightweight and easily customizable

Sierra Chart is a leading charting/technical analysis software program for the financial markets. It has a large set of tools and indicators. It is totally compatible with Windows OS.

Sierra offers access to market statistics through ts Market Statistics Data Feed feature. Here users can see in-depth information regarding the stocks that are down in price, advance-decline ratio, and many more insights.

Personal chart data can be accessed anytime, even when offline, as the tool stores all received data locally on the user’s computer.

The platform supports major external data and trading services. This means that users get real-time trading access to global futures, options markets, stocks, indexes, and more.

Features/Pros:

- It is lightweight and can easily be modified

- Simple, stable and offers helpful Support

- Very good trading software

- It is appealing

Cons:

- The built-in backtesting is buggy and not very elegant when it comes to designing systems to backtest

- Loss of internet connection usually results in malfunction

Ninja Trader – Great technical support

NinjaTrader is a trading platform that can be used to trade your brokerage account. It is compatible with Windows OS.

Ninja Trader has multiple interfaces such as the Chart Trader, SuperDOM, and the FX Board. Users can easily switch between them depending on their needs and preferences.

The Chart trader includes drawing tools and allows users to place and modify orders from one main window. It also includes some trade management features such as profit targets and more.

The second interface option, The Super Dom is configured as a real-time visual order book. It offers live insights into the markets.

The FX Board displays trading trends in a tile-type layout. Users can quickly submit orders and check all active orders in just a few clicks.

Features/Pros:

- In milliseconds, users can submit and manage their stop loss and profit target orders

- Orders and trades can be placed and managed directly within a chart

- Order Entry Hot Keys: Drive order submission, cancellation, modification, and close positions

- Users can run automated trading strategies

- Various orders can be submitted in order to protect an open position, when one is filled, the other is canceled automatically

- Users can set up complex alerts that will trigger based on pre-defined alert conditions

- Users can make use of tabbed windows in order to maximize screen real estate and enhance the efficiency of the workspace

- SuperDOM Indicators and Columns

- Demo mode is free to use

- Several brokerage offerings

- C# programming provides extreme flexibility

- Several charting types are supported

- Great technical support

Cons:

- The data feed is not included

- Programming is usually longer compared to other platforms

- Loss of internet connection will result in a malfunction

- Low supported brokerages

AvaTrade – Risk tolerance

AvaTrade is one of the best trading solutions. It is customized perfectly for each trader’s preferences. It is compatible with Windows OS.

In terms of automation, AvaTrade gives access to copy trading platforms and cryptocurrency trading.

It ensures secure and compliant trading, following international regulations. Plus, it implements its own risk-limiting tool, AvaProtect.

AvaTrade offers support for Forex trading, CFD trading, and cryptocurrencies.

It offers easy-to-use trading applications for desktop and mobile trading and it is compatible with all major device platforms.

Traders can also benefit from useful information regarding earning releases, market analyses, and more.

AvaTrade is also one of the most beginner-friendly trading platforms, with lots of in-depth guides and strategies that help newbies get started.

Features/Pros:

- Risk tolerance

- Management tools

- Over 1,000,000,000 strategies are available

- A user-friendly interface

- Simple Usage

- Enables advanced strategies for all traders

- Automatic Updates. It updates directly on the platform daily, to ensure strategies and current market status synchronize

- Traders from all levels can easily benefit from their services

- Unique Algorithm

Cons:

- Loss of internet connection usually results in malfunction

Protrader – Professional-looking design

The Protrader software is an all-in-one trading application that combines professional tools with a customizable interface.

It is compatible with Windows OS. It has a high-level functionality and offers access to trade in several markets with low latency.

Sierra offers access to market statistics through ts Market Statistics Data Feed feature. Here users can see in-depth information regarding the stocks that are down in price, advance-decline ratio, and many more insights.

Personal chart data can be accessed anytime, even when offline, as the tool stores all received data locally on the user’s computer.

The platform supports major external data and trading services. This means that users get real-time trading access to global futures, options markets, stocks, indexes, and more.

Features/Pros:

- Market analysis

- Running of Algorithmic strategies

- Risk management

- Investors are able to set up their trading terminal exactly the way they desire it to be, even down to the color scheme.

- Workspaces view creation

- ProTrader trading platform has two pre-loaded workspaces, the Beginner and Professional, in order for users to select the one that fits their requirements easily without bothering about customization

- The overall design is professional-looking and beautiful

- The platform contains market features that a lot of investors are in need of

- It allows the trading of a wide range of instruments and assets, providing investors the option of selecting forex, stocks, options, CFDs, and futures

Cons:

- The charting area of the ProTrader platform is small

Automated trading software comes with lots of advantages and very few disadvantages. These solutions enable users to trade while sleeping, lower emotion due to its ability to make non-subjective trades, and also it has a micro-second decision processing ability.

Go for the one most suitable for you. Click on the software link available at the end of the description.

Is automated trading worth trying?

Automated trading is not inherently more profitable than human-monitored trading, but it has the benefit of saving a lot of time and completely removing emotion-based decision-making.

They can be very beneficial for beginner traders, as they can automate and copy trades of more experienced investors.

Pros:

- Backtesting

- Increased order speed

- It lets you trade from multiple accounts simultaneously

- Objective decision making

- Convenient

Cons:

- Algorithms may fail

- Risk of overfitting and wrongfully predicting positive results

- Highly dependent on good connection speed

Can you automate day trading?

Day trading can be automated with the help of the above-mentioned tools. Users prefer to implement automation when they already have good indicators that their strategy is going to have a positive outcome.

Automated trading software can be just as valuable for saving time, getting the best price, and removing some of the risks of day trading as they are for any other type of trading.

There is always a risk of loss, both in manual and automated strategies, so it is highly dependent on the user’s intentions and preferences.

To learn more about trading and the tools that help, visit our dedicated Trading Hub.

If you are looking for the right tools to accelerate your business, visit our Business Software section.