Microsoft might be in trouble, as competitor Databricks Inc. releases a powerful visualization tool

Databricks is currently valued at US$43 billion.

3 min. read

Published on

Read our disclosure page to find out how can you help Windows Report sustain the editorial team. Read more

In the bustling tech world, where innovation is the currency of success, Databricks Inc. has thrown down the gauntlet. This data software titan is stepping into the ring with a new visualization tool, AI/BI, aimed squarely at rivals Salesforce Inc and Microsoft Corp.

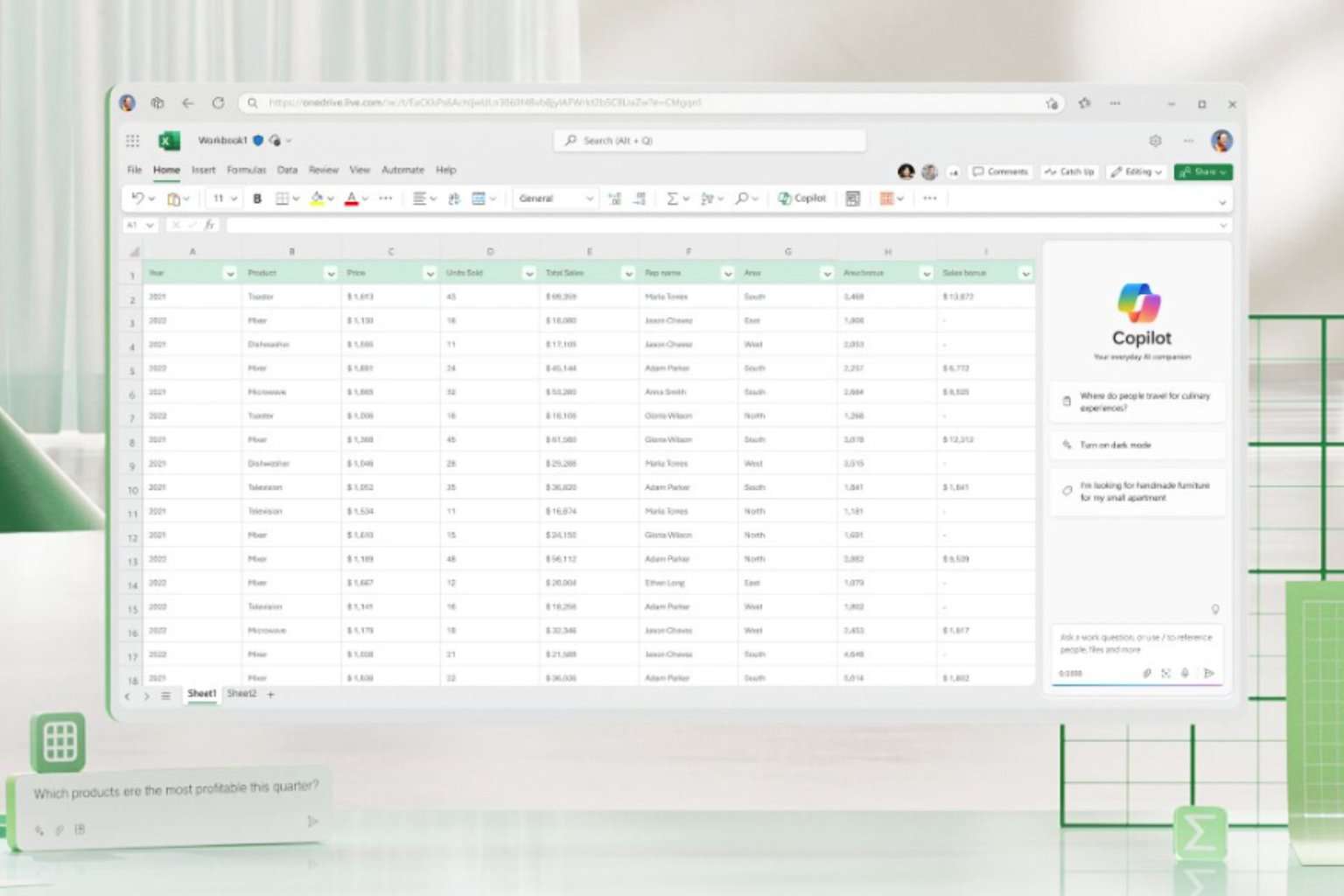

What makes AI/BI stand out? It’s not just another tool; it’s a game-changer that integrates artificial intelligence. It allows users to ask questions about their data and see the answers come to life in charts and graphs. Imagine the ease of typing a question and watching as the system automatically crafts the visual data story for you.

Today, we are excited to announce Databricks AI/BI, a new type of business intelligence product built from the ground up to deeply understand your data’s semantics and enable anyone to analyze data for themselves. AI/BI is built on a compound AI system that draws insights about your data from its full lifecycle across the Databricks platform – including ETL pipelines, lineage, and other queries.

Databricks

Databricks’ CEO, Ali Ghodsi, points out a crucial difference: while others have awkwardly tacked AI on their platforms, often leading to errors, Databricks’ tool learns from each customer’s data, improving its query understanding over time. This is thanks to the brains at MosaicML, a company Databricks acquired for a cool US$1.3 billion.

This tool, which is free for customers, aims to keep data visualization within the Databricks ecosystem, ensuring fresher data and simpler controls. It’s a bold move in a competitive field, especially as Databricks, valued at a whopping US$43 billion, prepares to go public.

The company’s aggressive strategy doesn’t stop at innovation; it also expands through acquisitions, like the recent purchase of Tabular. According to Ghodsi, this is part of a broader consolidation phase in the industry.

But Databricks isn’t just about flashy tools and acquisitions. The company is on a financial tear, anticipating a jump in annualized revenue to $2.4 billion in the year’s first half alone. This growth isn’t accidental; it attracts new customers and deepens existing ties.

CFO Dave Conte shared these figures at an investor briefing, highlighting the company’s resilience in a fluctuating market. With a net revenue retention rate higher than 140% last fiscal year, Databricks is doing something right. And let’s not forget that this growth is partly fueled by its data warehouse product, which has already topped $400 million in annualized revenue.

So, what’s the takeaway here? Databricks is not just surviving; it’s thriving, outpacing competitors and setting new data visualization and AI integration standards. With its eyes set on an IPO and a strategy that blends innovation with smart acquisitions, Databricks is a company to watch. Whether you’re a tech enthusiast, an investor, or just curious about the future of data analytics, Databricks’ journey is a compelling story of ambition, innovation, and success.

User forum

0 messages