Payroll Programs for Small Business [Best Out of 25 Tested]

Track income & expenses with the best payroll software

11 min. read

Updated on

Read our disclosure page to find out how can you help Windows Report sustain the editorial team Read more

Key notes

- Reliable payroll software can help you keep track of your small business and help you with everything tax-related.

- If you find it hard to choose a specific tool, we narrow down the options for you with these suggestions, so keep reading.

- Good tools help you track income and expenses, create estimates, generate paychecks, and more.

- Many of these suggestions are really cost-efficient and also save you a lot of time while providing error-free tax procedures.

Small business owners face various challenges, not necessarily the same magnitude as those of corporations and enterprises, but they’re similar in many ways.

In the eyes of the tax collector, however, each and every form of business is liable for submitting and/or filing returns, thus small businesses that don’t do so get penalties in the form of fees or fines, including payroll errors.

However, there’s a lot that goes into working on the payroll system, much time and energy are also spent trying to understand it, but businesses opt to use payroll services instead, so they don’t have to worry about errors, or legal mistakes, and save time in the process.

If you’re looking for a payroll service for your business, consider the price, vital features, and functions, plus whether there’s a free product trial and demos so you can test run and see if it matches your needs.

Here’s a list of the best payroll software for small businesses to get their taxes, benefits, and other withholding calculations correct to the penny.

What are the best small business payroll services?

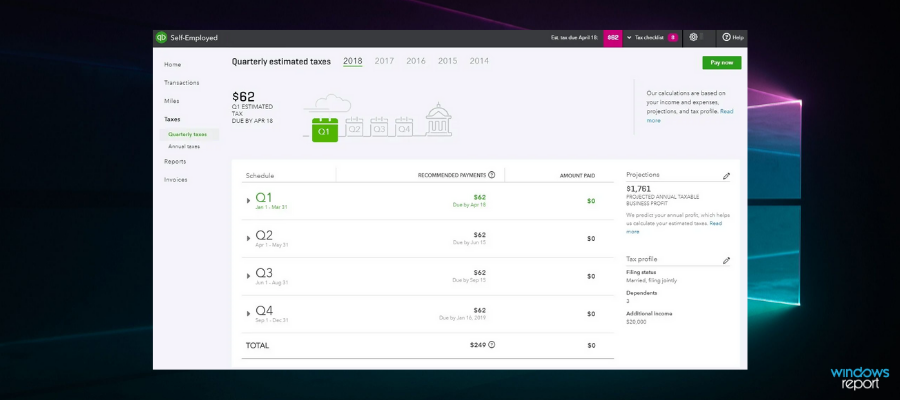

QuickBooks – The most popular

QuickBooks is one of the most popular bookkeeping software that supports small businesses, as well as big business environments.

The tool helps to secure data sharing with an accountant and it supports integration with Microsoft Outlook. Besides, it is easy to use anywhere, on any device, and by all the employees that you give access to, including your accountant.

Some of the most notable features include:

- Mileage tracking – Get shareable reports that break down miles driven and potential deductions.

- Track income & expenses- Import transactions from your bank, credit cards, PayPal, Square, and more. For easier use, sort transactions into categories.

- Create & send estimates – Customize estimates to fit your brand and business needs.

- Maximize tax deductions – organize income and expenses into tax categories and share them with your accountant to avoid tax surprises.

✅Pros

- Easy to use and learn

- Integrates well with other systems

- Flexible with 3rd party applications

- Provides good accounting reports

- Affordable price

- Easy to find and fix errors/mistakes

- Easy to look-up customer information

❌Cons

- Limitations on the number of users

QuickBooks

Be up-to-date with how your business is doing with sales, accounts receivable, and accounts payable.Turbotax – Focus on tax

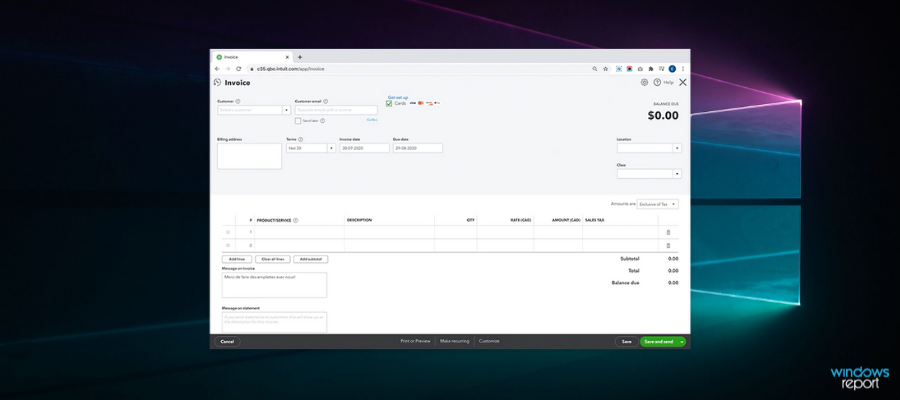

Similarly, with QuickBooks, TurboTax is an app also owned by Intuit, that focuses on facilitating the process of filing tax returns for small businesses.

One of the best things about it is that it’s free to use for certain operations, such as filing your federal and state taxes, importing your return from a previous year from similar tax software, or offering guidance in case of an audit.

With the free account, you also get access to an online community of specialists and customers, where you can share ideas and get informed about various processes.

Furthermore, with the paid plans the software also helps you find the best tax break depending on how you choose to itemize deductions from expenses, auto-import your investment info and tax data, get one-to-one specialized help if necessary, and even turn donations into big deductions.

TurboTax is suitable for both small businesses and self-employed entrepreneurs alike.

✅Pros

- Cheaper than seeing a professional

- Quicker turnaround time

- You are in control of the tax return

- User Friendly

- Will save you time if you know what you’re doing

❌Cons

- The software is only as good as what the user inputs

TurboTax

Get your W-2 income or EIC situations covered and claim the standard deduction with this user-friendly software.Papaya Global – Great for remote work

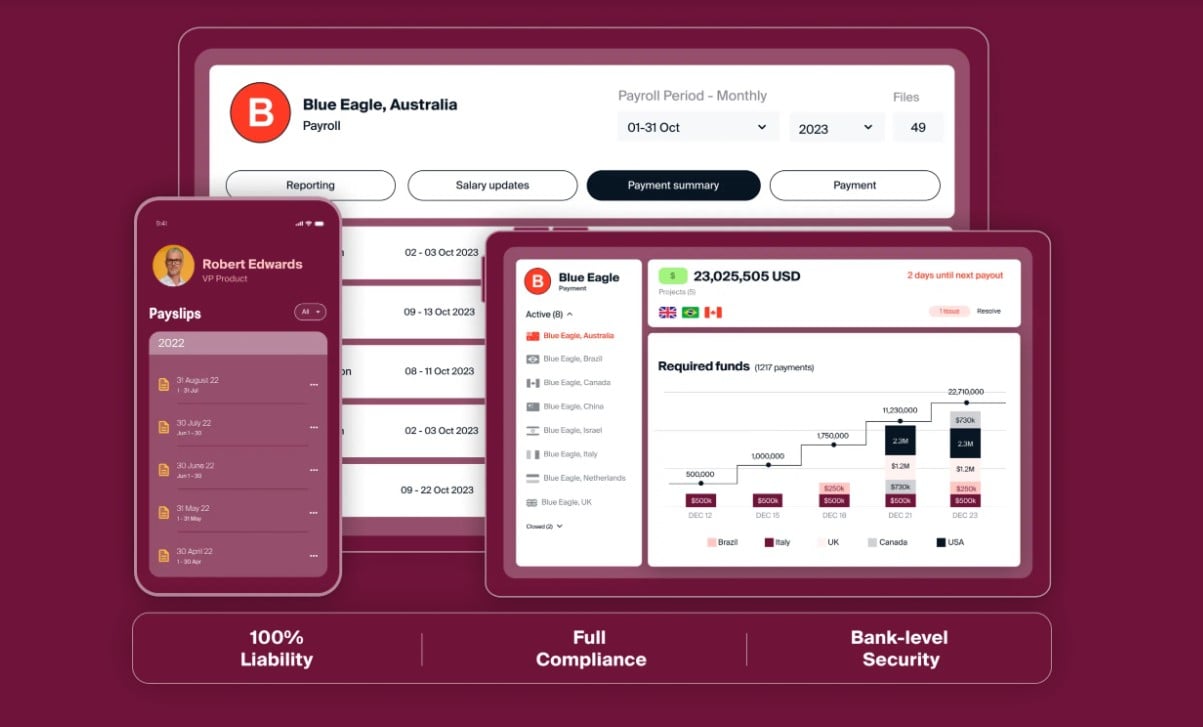

Papaya Global is a great software that comes packed and fitted with amazing tools that will certainly help you with your payroll needs in the modern world.

This software is the world’s first integrated, licensed, and regulated global payroll and payment system. It offers support for 12 currencies and 160+ countries.

Papaya Global can also create complex reports and facilitate the hiring process especially when it comes to nowadays remote work trends.

All the data you need about your employees is gathered within a single platform, making it much more easy to handle.

Another great feature of Papaya Global is that it also comes with a mobile app that grants you access to most of the more complex aspects of running your business and handling payrolls.

This is one software you should take a serious look at if your business employs quite a few remote workers.

✅Pros

- Transparent pricing

- Supports hiring and payroll services in more than 160 countries

- Strong automation tools

- Includes plan just for contractors

❌Cons

- Limited third-party software integrations

Papaya Global

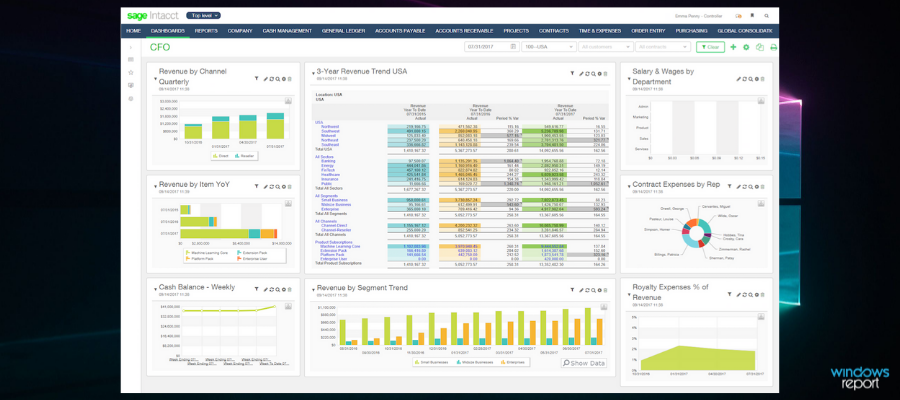

Check out this amazing software for handling payroll for globally remote workers.Sage Intacct – Built-in report templates

This accounting software is based on a merger by Sage Group and ERP Solutions, which bought Intacct, a 19-year-old software accounting company.

This merger combines the expertise, experience, and world-class quality of Sage, the result of which is Sage Intacct, a comprehensive accounting and payroll system.

With this payroll software for small businesses, you can manage cash, purchases, billing, vendors, revenues, contracts, projects and funds, inventory, and subscriptions, while generating financial reports, all through the cloud system.

It is both flexible and accurate in a bid to improve your business performance and employee productivity in the long run.

The benefits of using this tool include HR accounting which covers aspects such as payroll, benefits, time tracking, and insurance with its single, connected payroll system in different locations to give a view into your payroll structure, its performance, and activities therein.

It is also recognized by AICPA (American Institute of Certified Public Accountants) as a top financial app provider with numerous industry awards to its belt.

Additionally, it has a wide range of accounting capabilities, and you can use built-in report templates to create reports that are configurable and analyze your business’ performance, track sales, and much more.

✅Pros

- Customization of reports and views

- Templates available for all activities

- Integration between any other platforms

- Bank reconciliation is very good with few clicks

❌Cons

- The audit trail is not up to the mark

Sage Intacct

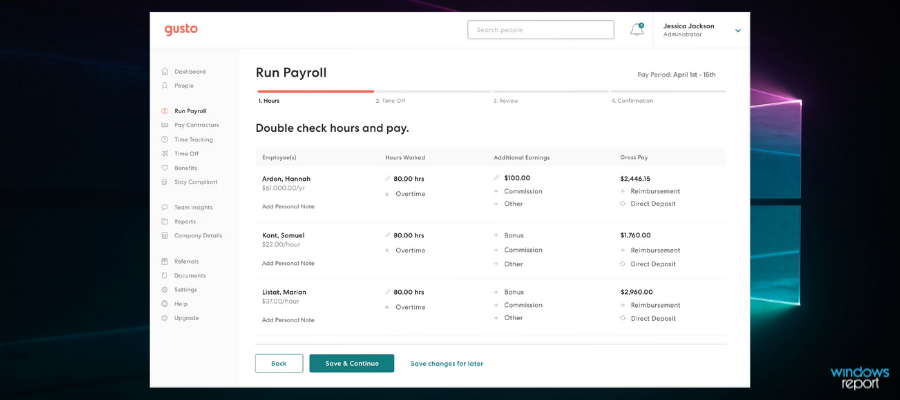

Grow your business and manage your finances smartly with this robust ERP software!Gusto – Streamline and automatize

Previously known as ZenPayroll, this tool is a cloud-hosted software that combines payroll, administration of benefits, human resources, and compliance capabilities in one simple package.

The software is built for small businesses that want to manage their payroll system and HR needs, and it handles this by streamlining and automating the calculation, payment, and submission of payroll taxes while ensuring your business is fully compliant to avoid critical errors.

It doubles up as an HR solution to manage your team without all the paperwork, emails, and spreadsheets and keeps all employee data synced.

Among its advantages include the elimination of human errors, and full compliance with HIPAA, ACA, and ERISA standards while checking data automatically to prepare reviews, send notices, and maintain employee privacy.

It also simplifies the management and administration of benefits, employment tax reporting, payments, workers’ insurance, and budget plans, and you can set up and/or manage 401(k) plans easily.

✅Pros

- Processes payroll

- Files taxes, new hire forms

- Stores team information

- Provides high-quality customer support

❌Cons

- No mobile app for expense reporting

Gusto

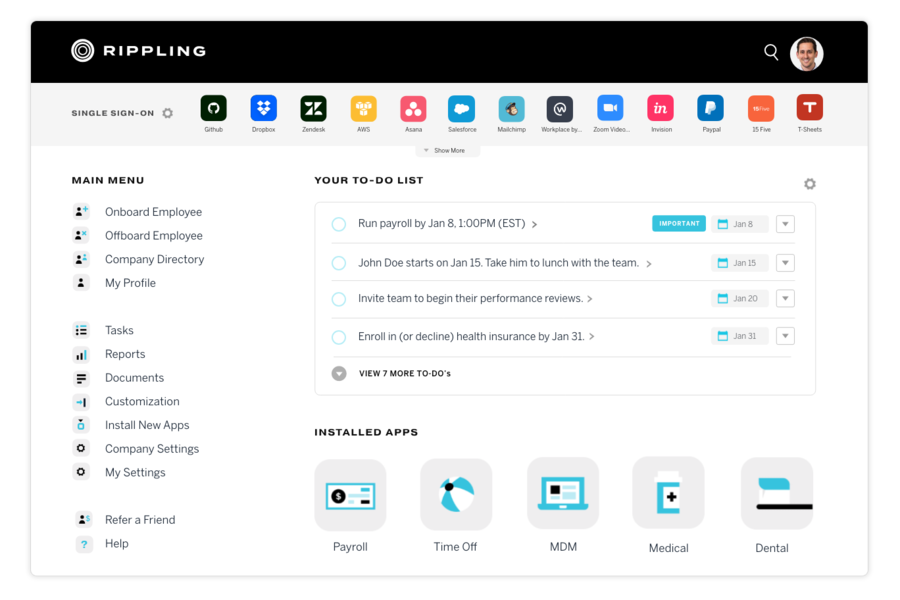

Simplify payroll and human resources management with Gusto.Rippling – Very customisable

The faster your employees get their pay, the more productive they will be. With Rippling, you can provide a simpler and faster way to manage your employee’s payroll.

Payroll running was never an easy task. While Rippling syncs all your business’s HR data, you will never have to manually introduce data or use a calculator again. With all data synced, you just have to press a button to run payroll.

Since it has access to all data about money, it brings an automatic tax-filing feature. Ripple automatically calculates payroll taxes and files them to the IRS and other federal agencies when tax season is close.

For efficiency purposes, you can now create any type of report, containing any information that Rippling has data about. Also, you can visualize and share reports so every department will make faster and better decisions for the business’s future.

Better productivity and efficiency? See where you can make improvements by knowing everything about how your employees work by choosing Rippling.

✅Pros

- An intuitive user interface

- Paystub is easy to see

- Employee Self Service

- Present outstanding tasks when action is needed

- Spreadsheets/personnel management

❌Cons

- Hard to find certain applications

Rippling

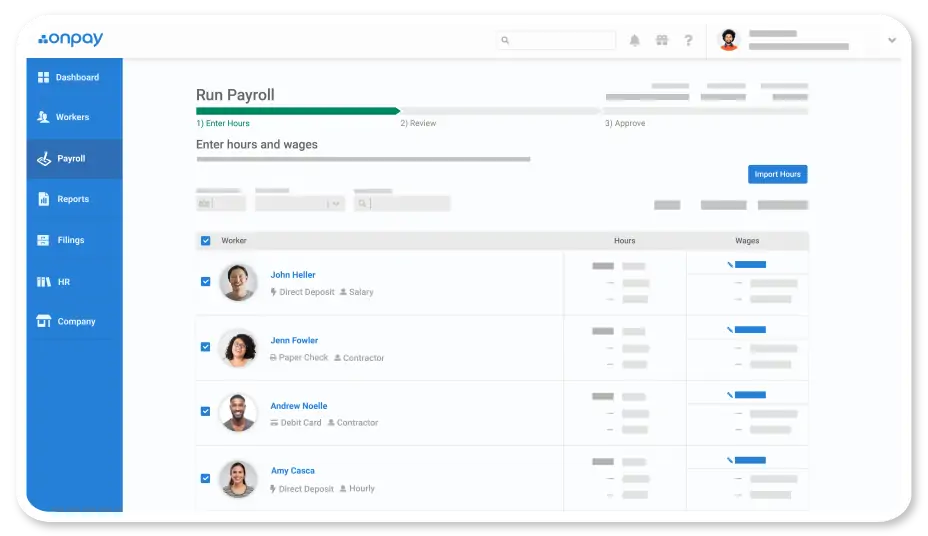

Get complete control over every aspect of payroll and simplify the process.OnPay – Reimbursement management

This payroll software doesn’t have advanced features and add-ons as the others listed here, but its pricing model is simple, and OnPay offers straightforward necessities for small businesses.

Among its features include unlimited pay runs, tax filings, deposits, and check-printing, plus a mobile-friendly system that’s easy to use and quick. You can run your payroll in minutes, and its simple interface makes entering payroll elements like hours, tips, bonuses, and reimbursements a walk in the park.

Other things it can do for you include covering compensation and insurance, as the software is a licensed health insurance broker, with fully integrated 401(k) plans.

You can also perform HR functions such as employee self-onboarding to save time, automatic new hire reports to the government on your behalf, online access for employees, guaranteed payroll compliance, and automated payroll taxes.

OnPay also works with any employee type, and if you or your employees prefer direct deposit, pre-paid debit cards, or doing your own checks, it is possible to pay without any added costs. If you need assistance, OnPay’s Certified Payroll Professionals are on standby to assist via phone.

✅Pros

- Integrating with QuickBooks

- Great Customer Service

- Consistency of Service

- Integrated 401k capabilities

- Makes onboarding a breeze

- Quick and intuitive web-based software

❌Cons

- The security roles need some work to limit access

OnPay

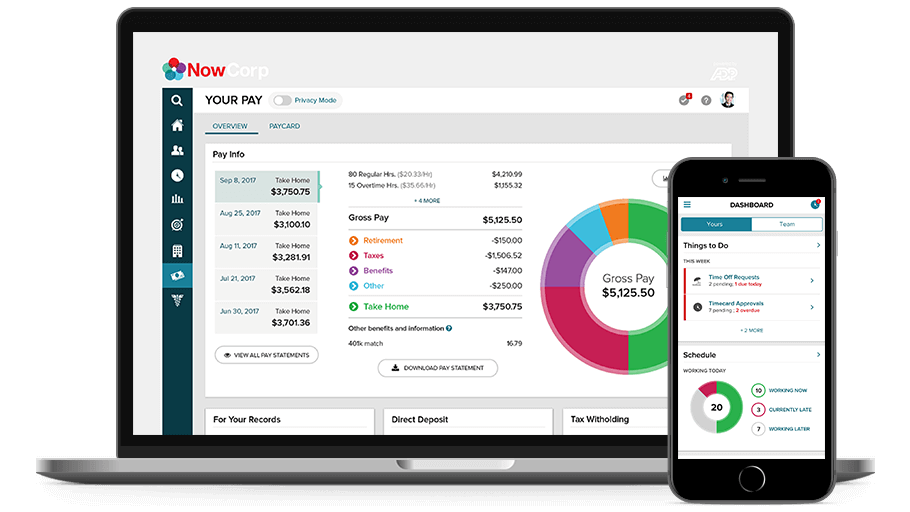

Maximize your productivity and enhance your business with OnPay, an all-in-one payroll tool!ADP – Easy cash flow management

If you wanted to do faster payroll and tax filing, you are in the right place. ADP is a payroll software that helps you process payrolls in minutes from anywhere. You can do the payroll at your desk, on the move or you can set it on autopilot.

Let the software do all your taxes for you. Save time by having your taxes calculated, deducted, and paid on time. ADP also includes tax and regulation updates across all 50 states. It has all information about tax and payroll requirements, wage and hour laws as well as many more.

ADP collaborates with world-class security organizations that will make sure that all employees’ information is safe and secure.

ADP also acts as a general ledger interface, giving you a great overview of all payments, all taxes and everything on the payroll. From this, you can create personalized reports for any information that you require.

For all good measures, ADP comes as a greatly optimized mobile app as well. You can now access all data and information from anywhere.

✅Pros

- Multiple products with multiple plans

- User-friendly browser interface

- 24/7 live customer service

- Comprehensive payroll and HR features

- Extensive built-in integration

❌Cons

- Reports can be confusing, cumbersome or clunky

ADP

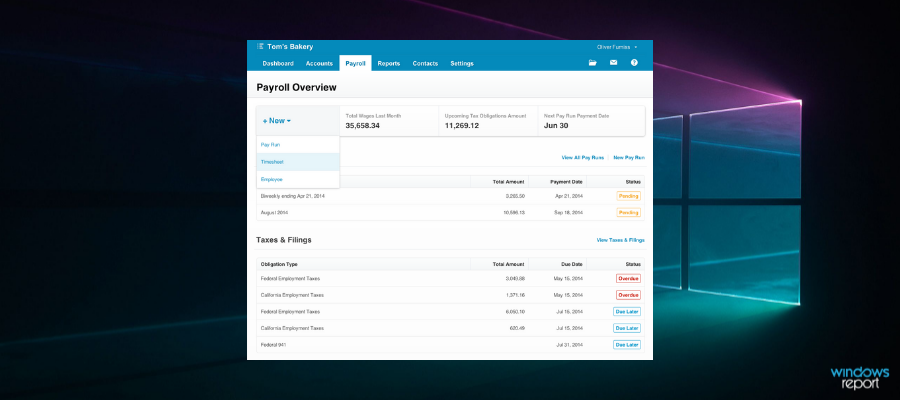

ADP is a spot-on payroll software that provides all that is needed for a small business to succeed.Xero – Adjusts taxes automatically

This is award-winning cloud-based accounting software that’s used in more than 180 countries across the world and is designed for small and medium-sized businesses.

Its functionalities include invoicing, inventory management, bank reconciliation, expense management and payment of bills, project tracking, multi-currency capability, business performance dashboard, sales tax calculation, and mobile apps, among others.

The unique thing about this payroll software for small businesses is that it processes and runs payrolls while adjusting taxes automatically. It is also very secure with its multiple approvals and two-factor authentication so fraud is minimized, each transaction has details such as dates, users, actions performed, and notes.

With Xero, you can get a summarized report of your financial activities, and keep detailed records of all your transactions including tax status, committed quotes, and purchase costs.

✅Pros

- Cloud-Based Convenience

- Connectivity with Advisors

- Real-Time Bank Feeds and Reconciliation

- Comprehensive Estimating and Invoicing

- Integration with Third-Party Apps

❌Cons

- Limitations on Certain Features

⇒ Get Xero

Doing your taxes is not an easy task regardless if you are working on your personal finances, or on your business’s finances, and using specialized services can be your best bet.

Is there payroll software for small businesses that you use and it’s really helpful? Share it with us in the comments section below.