7 Best Trading Platforms With No Fees

9 min. read

Updated on

Read our disclosure page to find out how can you help Windows Report sustain the editorial team Read more

Key notes

- Starting off trading can be less intimidating than ever as there are many options for trading platforms and software that require no trading fees.

- In this article, we explore the best options that are proven to be secure, reliable and require users to invest little to no money.

- We included trading platforms that offer access to many different markets, so make sure to check them all and see which applies best to your goals.

Online trading platforms have become crucial for investors as they offer easy access to multiple types of markets and offer impressive tools that help traders create researched strategies and learn best practices for their goals and markets of choice.

As the market and overall interest of the general public in trading have grown, these platforms have adapted their strategies and benefits in order to appeal to traders who are not willing to invest a huge amount.

If you want to start trading at a low price, know that there are several reliable trading platforms that require no trading fees for a number of markets.

We gathered below some of the best options that you have and the exact set of features they provide.

Make sure to read on and see which one of the following tools fits your investing goals and offers access to the market(s) of your choice.

In this article, we take a look at the best trading platforms that place no fee for stock and crypto trading, as well as ETF, options trading, and more.

Can you trade stocks without fees?

Many brokers give investors the possibility to trade stocks for free. There are plenty of online platforms that let you sign up for free and let you start trading without placing commissions.

These offer access to a multitude of markets, including ETFs, cryptocurrencies, and stocks.

Note however that financial laws and regulations are applicable in your area. Even if your trading software or platform does not charge you anything, your state may place a tax on your trades.

How can I start trading for free?

- Decide on your market of choice and find a reputable broker that offers access to it

- Sign up for the account that requires no deposit

- Use the resources of your platform to develop a good strategy

What are the best trading platforms with no commission?

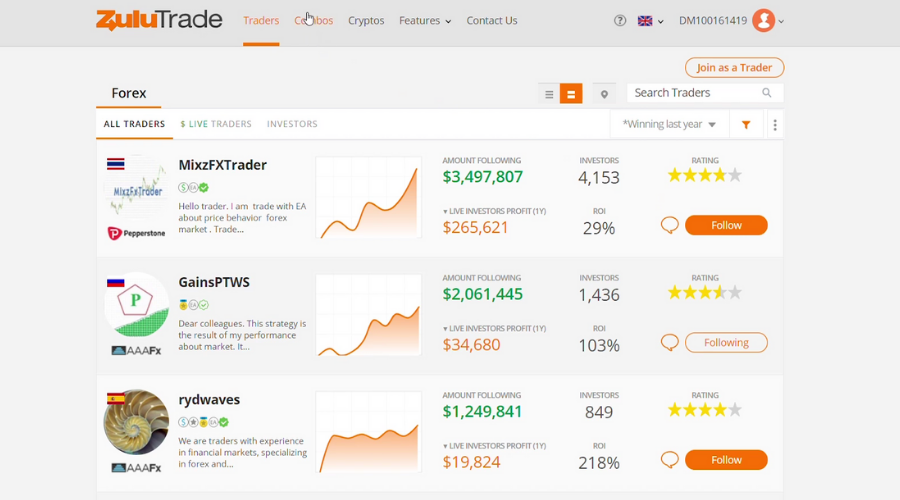

ZuluTrade

Pros

- Easy to learn and start trading

- Excellent collection of tools for beginners

- Mobile trading options

Cons

- One trading account per user

ZuluTrade is a Greek fintech company founded in 2007 and has become one of the dominant players in the social trading sub-sector. The company has partnerships with over 64 global brokerages and continues to expand globally.

With Zulu Trade, you can start trading for as low as $1. The platform does have this minimum requirement but places no additional trading fees.

Given the vast partnership, users have a selection of assets to trade on this social trading platform, including cryptocurrency. ZuluTrade offers two account types, namely Classic and Profit-Sharing Account.

The Classic account consists of higher spreaders to compensate both parties, so that is something to consider.

The Profit-Sharing account type, on the other hand, does require you to pay. It displays a fixed monthly cost as well as a 25% performance cost.

Unlike eToro, ZuluTrade doesn’t provide a trading platform. Investors will connect their MT4 trading accounts to their ZuluTrade accounts.

However, the user does get full statistics of all traders, performance ranks, and risk assessment.

ZuluTrade excels in the copy trading function as it allows you to search from 100s of Signal Providers using the feature-rich search tool.

Zulu Trade

Using this popular social trading platform you will double up your crypto investments and learn from the best.Robinhood

Pros:

- No trading fees

- No account minimum

- Very accessible user interface

Cons:

- No mutual funds or bonds

Robinhood is a trading platform developed by Robinhood Markets, a financial services company known for its commission-free options for sock trades, ETFs, and cryptocurrencies.

It is a really good platform to get started with as it has very low prices and no trading fees. On top of that, it also has a simple interface and offers fully capable and commission-free trading apps for mobile.

Traders can access the platform from the web or their mobile devices, all activities and updates being permanently synced between each device you decide to connect to your account.

Robinhood combines historical data and other prediction statistics to decide what’s the best time to trade. It strives to get the best price for its customers. Their statements show that they have good success rates.

Another important benefit of this platform is that it offers easy-to-digest educational tools for investors.

The platform aims to be a good fit for traders of all levels, even absolute beginners, so you get very many easy-to-understand resources.

All in all, Robinhood is one of the easiest and most straightforward trading platforms that allows users to make quick and easy trades without requiring them to invest a fortune.

TD Ameritrade

Pros:

- Free access to lots of trading platforms

- Tons of educational resources

- Mobile friendly

- Free research

- 24/7 specialized support

Cons:

- Some platforms require a learning curve and may be intimidating for beginners

- No fractional shares

- Pretty high margin rates

The TD Ameritrade electronic trading network is a very resourceful tool that allows users to invest in multiple types of assets.

It offers free access to a multitude of trading platforms.

Not only that, but it also offers educational resources to help you get started. The tool places $0 commission on online stock trades, ETFs, and online option trades.

The platform has dedicated educational resources for each of these investment products.

TD Ameritrade gives investors access to various platforms that can be accessed either via desktop or web applications or directly from mobile devices.

The platform integrates powerful research tools that you can use for market analysis, stock overview and charts, screeners, and more.

TD Ameritrade has multiple account packages that you can choose from when you enroll. The best package for you is highly dependent on your objectives and strategy.

Fidelity

Pros:

- no fee for stock, ETF and option trades

- Specialized team of financial advisors

- Mobile application

- Resourceful research options

- Easy transfers between your Fidelity account and your bank

Cons:

- No crypto trading

- No forex trading

Fidelity is another reliable platform that requires no account fees and does not place any commission on your trades.

Traders of all leels can benefit from zero fee trading for ETFs, stocks, penny stocks and options.

The platform offers useful informative tools that help you decide what’s the best course of action for your goals.

Fidelity offers planning and advice solutions that include their digital investment Robo advisor, personalized planning and advice, wealth management, and more.

Fidelity offers two major packages that users of different investment and financial goals can benefit from.

Both packages offer personalized investment strategies based on each user’s finances and goals. All investments are carefully managed by a team of professionals.

The main difference between the plans is that the Fidelity Personalized Planning and Advice plan includes unlimited one-on-one planning calls with the Fidelity advisors.

The Fidelity Go plan, on the other hand, does not include this option. If you find yourself in need of specialized advice, you can benefit from it, but they will charge a fee if you use this package.

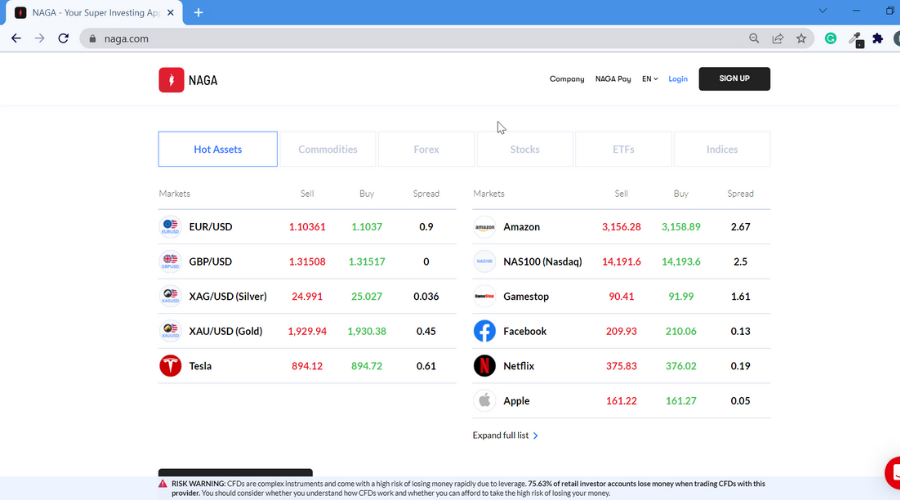

NAGA Trader

Pros

- No minimum deposit

- Proprietary web-based social trading platform

- Good customer support

Cons

- Spreads are comparatively high

- Hidden costs

NAGA Trader, also known as SwipeStox in its early days, is a social trading platform that offers investment services and trading solutions for multiple markets.

The broker has over 750+ tradable assets covering Stocks, Commodities, Cryptocurrencies.

The platform requires no trading fees, but it does have some withdrawal fees based on your account and also a minimum amount of $50 to authorize the withdrawal.

It also has its own cryptocurrency called Naga Coin which was among the top 20 tokens sold in 2017.

NAGA Trader offers its own proprietary trading platform powered by TradingView.

That said, you can also connect your MetaTrader 4 and MetaTrader 5 accounts to start trading.

For beginners, the broker has a good collection of tutorials and conducts regular webinars to educate the user on how to use the platform.

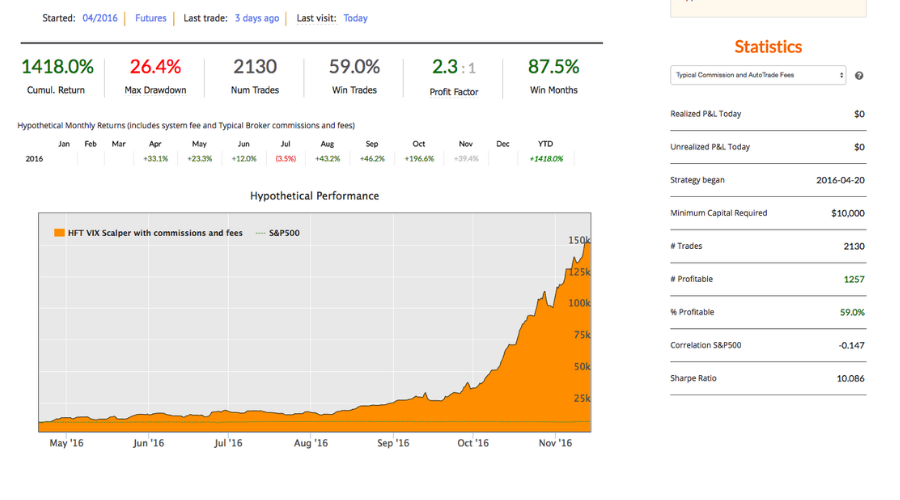

Collective2

Pros

- Automated trade copying

- Multi-broker AutoTrade feature

- Social communication features

Cons

- No demo accounts

- Not the best commission system

- Now own broke solution

Collective2 is offering social trading services since 2012 and is fully regulated by CFTC. It is also a member of NFA with over 90,000+ currently registered users.

Amongst its services, Collective2 provides access to a commission-free investment platform that requires no additional fees on top of the regular monthly subscription.

Collective2 is one of the non-brokers services to U.S based traders. It accepts clients that have an account with their 20+ patterned brokers.

If you decide to get a professional trading strategy from a broker, you will have to pay the set price required by that specific broker.

If you want to copy trade without additional fees, you can get the Portfolio Plus plans which include unlimited strategies. The plan is however on the pricier side.

Other features of Collective2 include the ability to trade any system you want, unlimited trade size, multiple systems can be traded at once, AutoTrading supports Forex, Options, Futures, and Stocks for US clients.

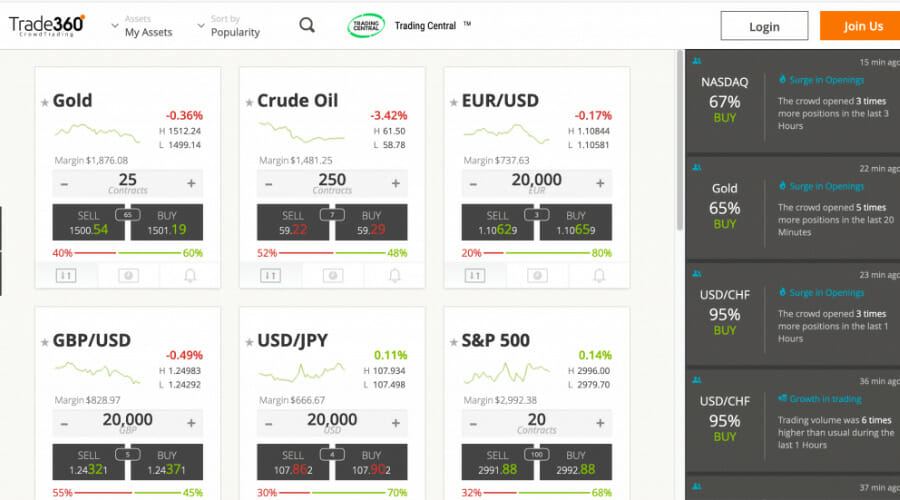

Trade 360

Pros

- CySEC regulated

- Commission-free trading available

- Can trade multiple assets class

Cons

- Lacks market analysis

Trade 360 is yet another popular social trading platform. It was founded in 2013 and is regulated by the CySEC.

The platform requires no withdrawal fees and lets you deposit as little as $1 to open an account and get started.

It offers six different trading accounts that are commission-free and comes with a number of features, including varying minimum deposits.

The pricing structure is usually higher than the competition, which places the trader at a disadvantage.

While the deposit and withdrawals are free from the broker’s side, the broker does not disclose potential third-party costs which represent a serious misstep.

You can trade over 48 currencies along with five commodities. Trade 360 account structure looks complex, and the broker does not grant equal access to all deposits.

So, these are the five best social trading platforms and networks that you can use to start social trade.

Consider bookmarking our Business Software Hub for more resources. Do check out our Trading Software section as we have some up-to-date and detailed resources for online traders.

Make sure to check out all services, and go through user reviews on Trustpilot before locking on a network that you think will serve you better.