Expense Tracker for Windows: 9 Best to Use in 2024

Greatest personal expense tracking software at your fingertips

8 min. read

Updated on

Read our disclosure page to find out how can you help Windows Report sustain the editorial team Read more

Key notes

- Looking for the best ways to cut down on costs and increase your savings? You're in the right place.

- It's never too late to manage your money and invest in your future business interests.

- Thus read along this article for more useful tools and tips to maximize your cash flow.

While budgeting can be a tedious and challenging experience, it needn’t be anymore with personal budgeting tools that can take the tedium out of the process.

These best personal expense tracking software not only shows you where your hard-earned cash disappears but also helps create and stick to a plan. Ultimately, these tools are all about making sense of your money.

A good spending tracker tool will help you answer questions like how much you have or owe, whether or not you spend wisely, and what investments you need to make.

We checked out the best expense tracker for PC devices that you can use. Some are free, others premium tools, but you’ll find those that connect to your bank account so you can pull and organize transaction data.

Or if you think forward, you should consider financial investment tracking software instead.

Best software to track your spending and money

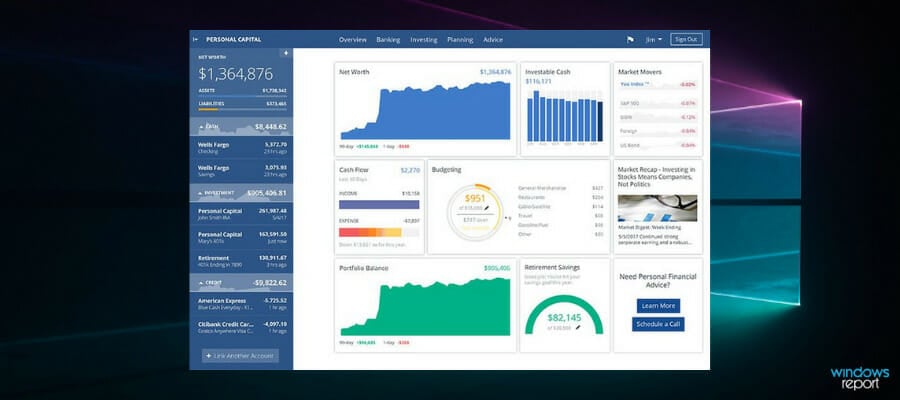

Empower – Inshigtful expense dashboard

This is the best software you can use to track your spending. With over 1 million users, Empower, which offers free financial tools, makes it easy to manage your entire financial life in one platform.

The tool allows you to connect your accounts to the dashboard so you can see both your spending and net worth, and even plan your future or meet an advisor to discuss your investing strategy.

The Fee Analyzer helps you spot such hidden fees in your accounts and funds, which, over time helps you control your spending and finances. Other tools include interactive cash flow tools that ensure you don’t spend more than you earn.

Unlike most other software for tracking expenditure, it does not let you create your own categories for your budget, so you’re stuck with whatever the software provides.

Otherwise, you can create many charts for spending and savings, plus compare your budget either weekly or monthly.

Once you register for Empower, you can access its powerful tools freely, plus the awesome dashboard, and easily manage your entire financial life in one place so you can reach your goals much faster and develop your long-term financial strategy.

Empower

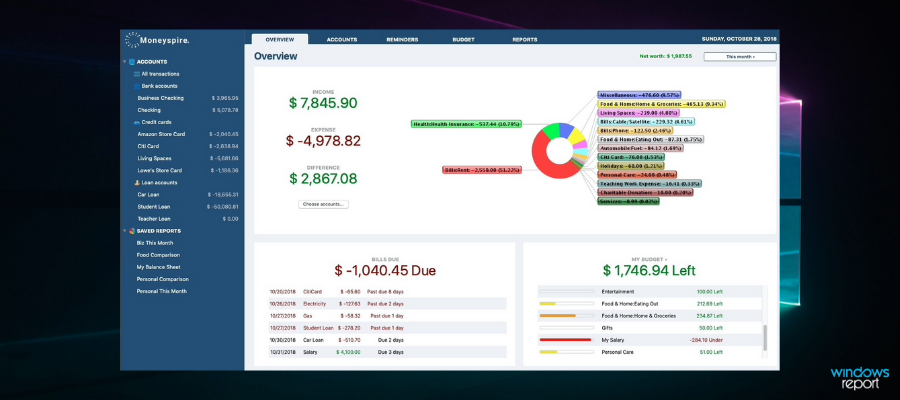

Manage your finances efficiently and control your spending habits with this compact software!Moneyspire – Suitable for small businesses

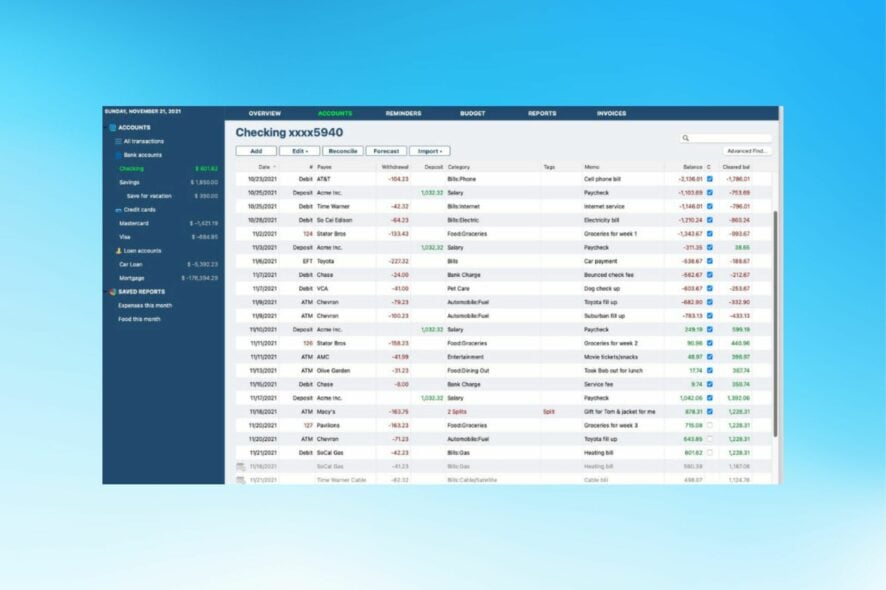

Financial control and money tracking are simple words, but mean a lot for economic-responsible people. With Moneyspire software, you can take good care of your income right away.

Managing your finances can be a time-consuming task, both personally and as a business. So, thanks to expense tracking functionality, you can track and manage financial resources without too much effort and efficiently for your budget.

This simple yet resourceful tool can help you with almost anything, from tracking the upcoming expenses to reminding you to pay the bills.

You can have valuable features choosing this software, including unlimited bank accounts in one place, budgets and reports, cloud synchronization, track of payees, and so on. Moreover, you can download it for free, and select the personal plan for all your devices at home.

The best part at Moneyspire is that you can customize it how you prefer. Having interactive reports or detailed balances for your account can give you freedom regarding all your financial activity.

Moneyspire

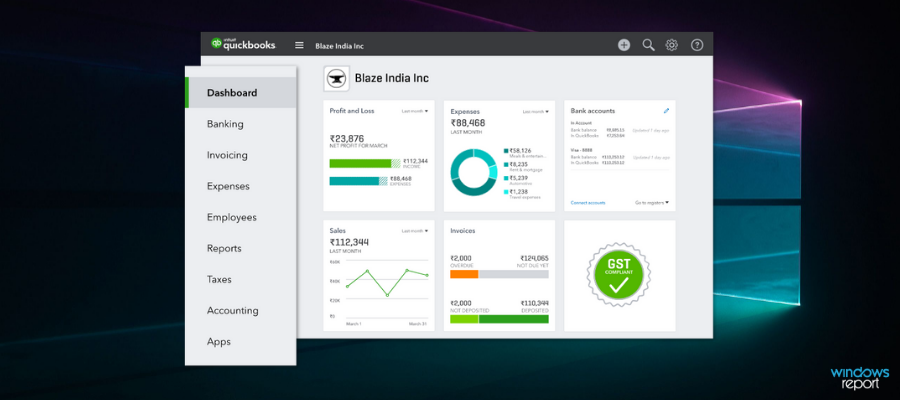

Manage your finances in the most productive way. Try this ideal expense management software without hesitation!QuickBooks – Best money tracking

If you want to manage your spending, QuickBooks might just be the perfect tool. This service provides you with cloud accounting, so you can easily manage your finances from any PC or smartphone.

The application supports expanse tracking, so you can keep a close eye on the smallest expenses.

If you’re running a business, you’ll be pleased to hear that QuickBooks supports invoicing, so you can easily create and send invoices. The software also supports accounting reports, allowing you to easily see how your business is performing.

QuickBooks has cash flow management support, so you can easily enter your bills and pay them. In addition, you can schedule recurring payments so you don’t miss them.

The service also has an automatic backup, so all your sensitive data will be backed up and secured. It’s worth mentioning that QuickBooks uses 128-bit SSL encryption, therefore your data will be completely protected from third parties.

Overall, QuickBooks is a great service if you want to manage your spending, and it’s available on all major platforms, so be sure to try it out.

QuickBooks

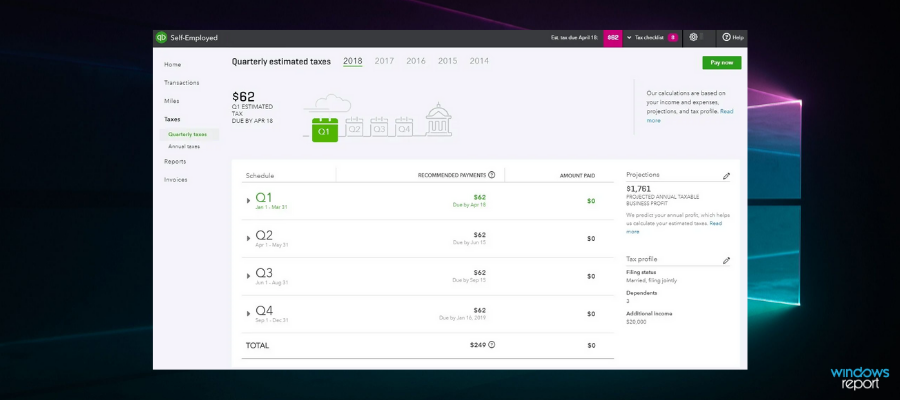

Track expenses and check profitability quickly and easily with the very best accounting software!Turbotax – Expense and taxes done right

As the name itself hints, TurboTax is a software that specializes in tax calculation and tax deduction. Although it’s not a dedicated bookkeeping app such as Mint, for instance, you will definitely get to enjoy its advantages in budget tracking once you start using it.

Using Turbotax is effective for tax deductions and maximizing your refunds, thus it saves you money. But there is a catch (a constructive one, we dare say): you have to be very organized about your receipts in order to make tax time easier.

Keeping this in mind, you can easily work with accounting software to track and categorize your spending and when the time comes, simply allow the TurboTax to take over.

There is no complicated migration process involved either since the tool is designed to perfectly blend with third-party financing apps such as QuickBooks, ProConnect, and Mint.

Turbotax

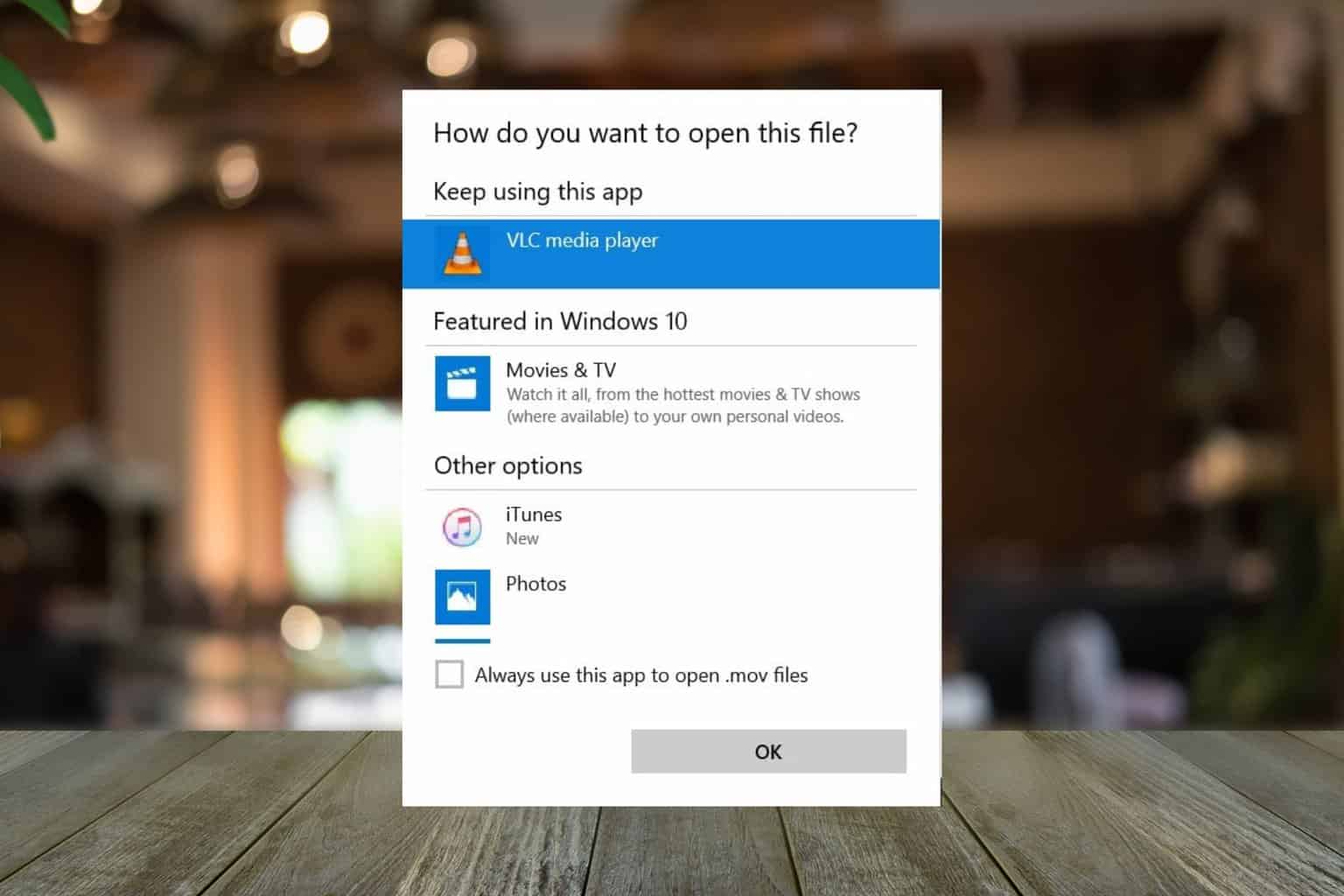

Save your receipts, then let Turbotax track your expenses and save you money!Quicken – Map spending and prioritization

Quicken is a reliable and infamous personal finance software that monitors all your expenses in a single dashboard.

With 20+ million customers and 40 years of experience, this financial service is exactly what you need to increase your savings and improve money management.

You can use this all-in-one app to keep track of any spending, taxes, or income that you need to manage and distribute. There are customizable dashboards for creating 1-year budgets or simply managing your salary.

Not only that, you can have financial security due to bill or tax categories for better income management.

Lastly, Quicken is the most suitable tool for projecting your budget and organizing future investments or retirement plans.

Quicken

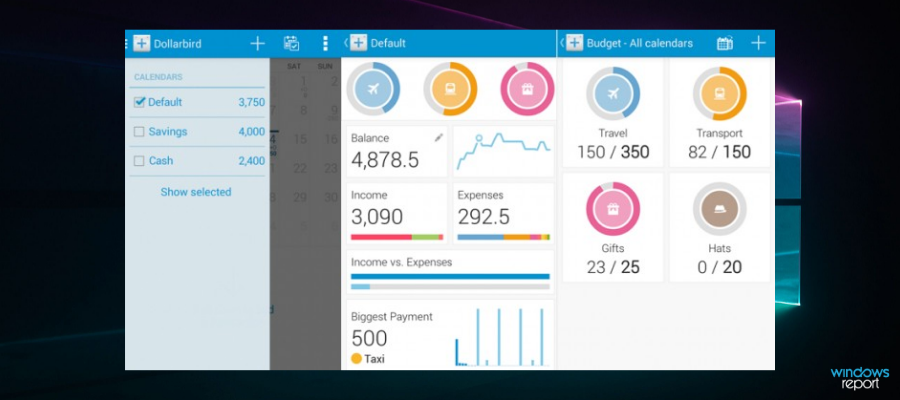

See all your expenses in one glance with this trusted finance manager.Dollarbird – Shared income for families

This software uses a calendar-based personal finance management approach designed for real life. You can add past, future, or recurring transactions and categorize them, whether on mobile or through a web interface.

Dollarbird lets you view your expenses and income, see where your money goes, and be smarter about your finances. The balances are automatically calculated for each day, month, or year, so you can understand your financial situation easily.

You can also share calendars with your partner, family, or team to track spending and manage finances together while staying up-to-date with common money issues.

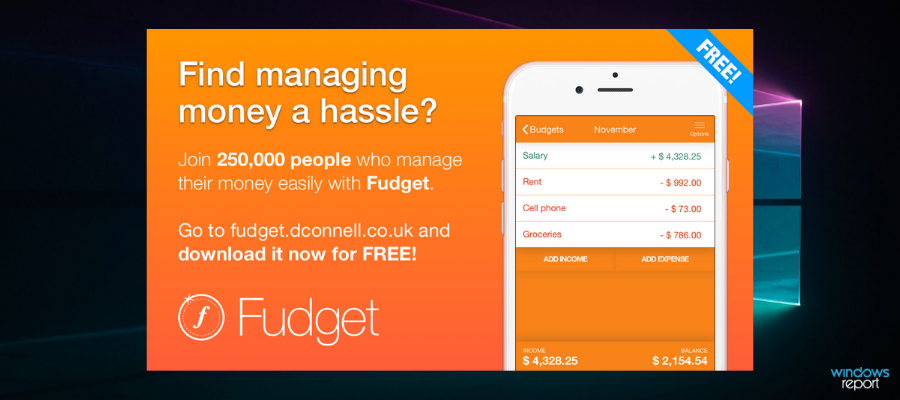

Fudget – 5 budgets at once

This software is as simple as they get and you can use it on the go at the touch of a button.

Simply add your income plus expenses which will then be labeled and rearranged to display your balance on a simple timeline.

You don’t need folders, savings categories, graphs, or other complicated stuff, it’s an easy interface that displays the numbers as they are.

If you’re in need of a fast, nimble, feature-rich, and stress-free app, then Fudget is your best choice.

With its one-tap adding and editing features, simple list creation to keep track of balances, and choice of currency symbols, you can use it monthly or weekly, however, you like.

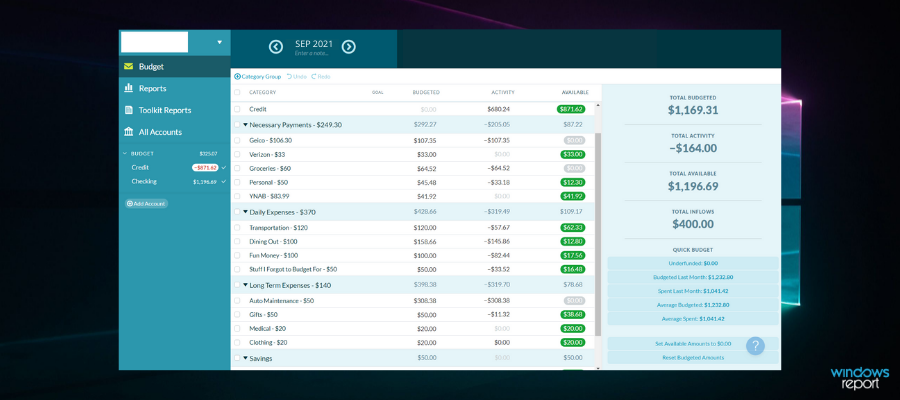

YNAB – At peace with your finances

The acronym simply stands for You Need A Budget – don’t we all?

This software keeps your personal budget with you all the time and lets you quickly refer to your accounts, and budget categories, and also add transactions or modifications to your budget on the fly.

The app also syncs with your devices like smartphones, tablets, and even your computer so you can stay updated on your spending. The web version has a variety of educational tools to help you be financially disciplined.

It’s also easy to use as it doesn’t have complicated features, plus you can sign up for classes online if you need further assistance as the app’s accountability partner helps you stay focused and not stray from your budget.

⇒ Get YNAB

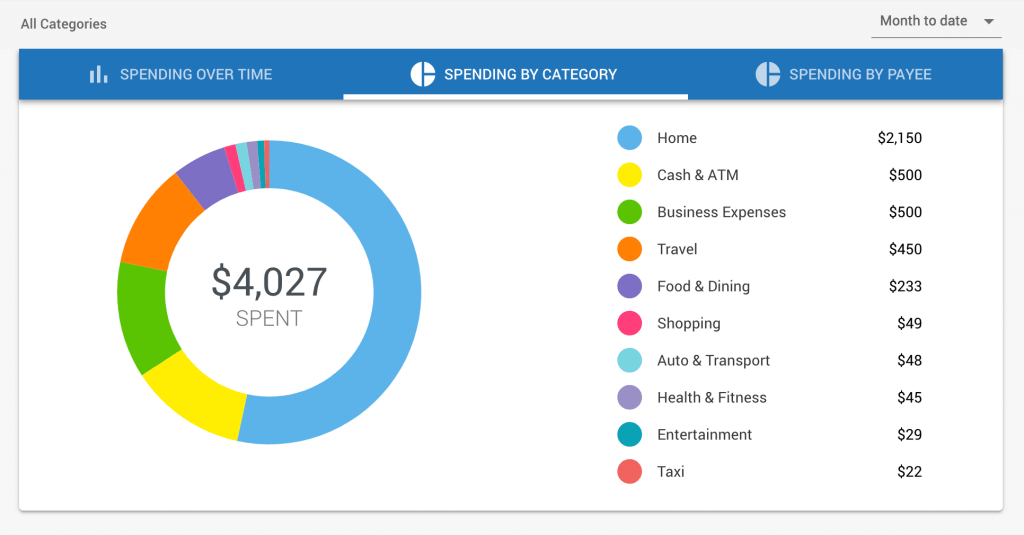

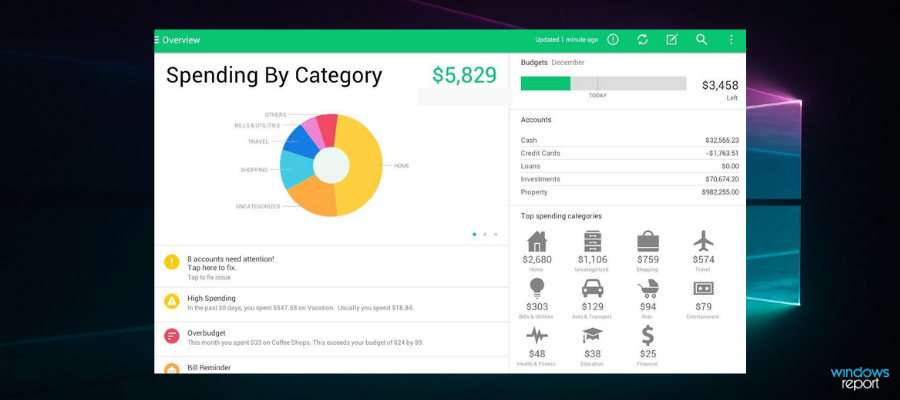

Mint – Multiple accounts app

This software, by Intuit (makers of QuickBooks) helps you track your spending (income and expenditure) plus your overall financial status. You can sign up for free to join Mint and use it to track and manage your financials all from one single screen.

It also gives you advice and tips so you can know your investment style with the right tools, and lets you connect with your bank and other lenders while sending you alerts when your monthly bills are due for payment, on an easy-to-understand and navigate dashboard.

Once you sign up and sync your bank account, you’re only seconds away from financial freedom.

It is also secure as it uses VeriSign to scan and ensure protection for sensitive data transfer, its multi-factor authentication helps protect access to your account using a 4-digit code that only you can use instead of just a login and password.

⇒ Get Mint