9 Best Stock Portfolio Tracking Software in 2024

Check out the best stock tracking software on the market

11 min. read

Updated on

Read our disclosure page to find out how can you help Windows Report sustain the editorial team Read more

Key notes

- Tracking your financial investments helps you see overtime progress and see what patterns and actions need improvement.

- Automated investment management software let you connect your bank accounts and generate in depth reports of your investments and other financial activity.

- We gathered the most secure and reliable tools of this category and comprised overviews for each of them so you can easily decide which one is best for you.

Many people deal with high levels of spending from buying gifts to traveling or holidaying at resorts away from home.

Sometimes tracking how much we fork out turns into a challenging task. If you plan to make a change and get your finances in order, we’re here to help you out.

You basically need the best financial investment software to create a budget and track your finances and portfolio of stocks, mutual funds, bonds, and real estate among other investments.

We checked out the most popular options you may want to consider when deciding on the best you can use today.

What’s the best financial investment tracking software?

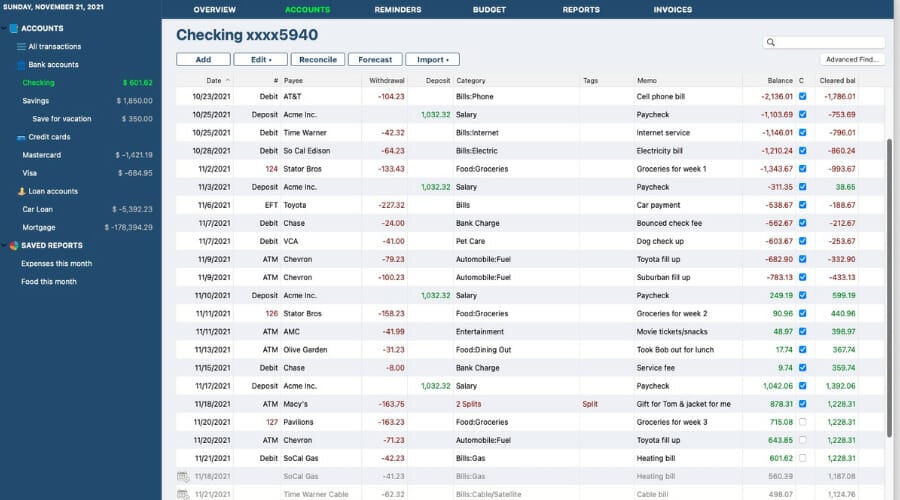

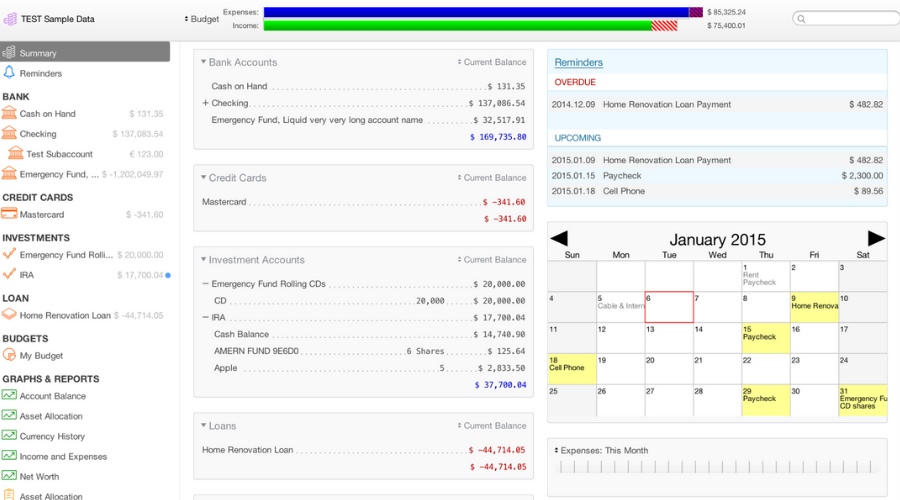

Moneyspire – Forecast future account balances

This is a simple and easy-to-use, yet powerful financial investment tracking software that brings your financial life together in one place, without costly subscriptions or forced upgrades.

You can easily move from other finance applications, and you don’t have to put your data online.

With Moneyspire, feel free to fulfill tasks such as tracking your accounts and balances and getting expenditure and income reports.

You may also enjoy reminders for bills and deposits or upcoming payments, generate detailed reports and charts to see where your money is going plus ease the filing of tax returns.

Therefore, set budgets, forecast future account balances, reconcile banking statements, and use the mobile app to stay on top of your investments and finances anywhere from any device.

Moneyspire’s optional online banking functionality allows you to directly connect to your bank and automatically download transactions and pay bills.

If your bank doesn’t support this direct connection, Moneyspire Connect will come in handy.

Your data is stored encrypted on your hard drive and is never transmitted, plus you can optionally store your data in the cloud and work on your finances from anywhere.

The latest version has an improved user interface that’s more attractive and easier to read, new tags feature for enhanced categorization.

Other key features of Moneyspire include:

- Budgeting setup

- Available for all regions and world currencies

- Compatible with all major operating systems

No less important, reporting of transactions, monthly comparison reports, and drag-and-drop import files are here included too.

Moneyspire

Stay well informed about the status of your investments with detailed reports, charts, reminders, and more.Empower – Robust financial planning

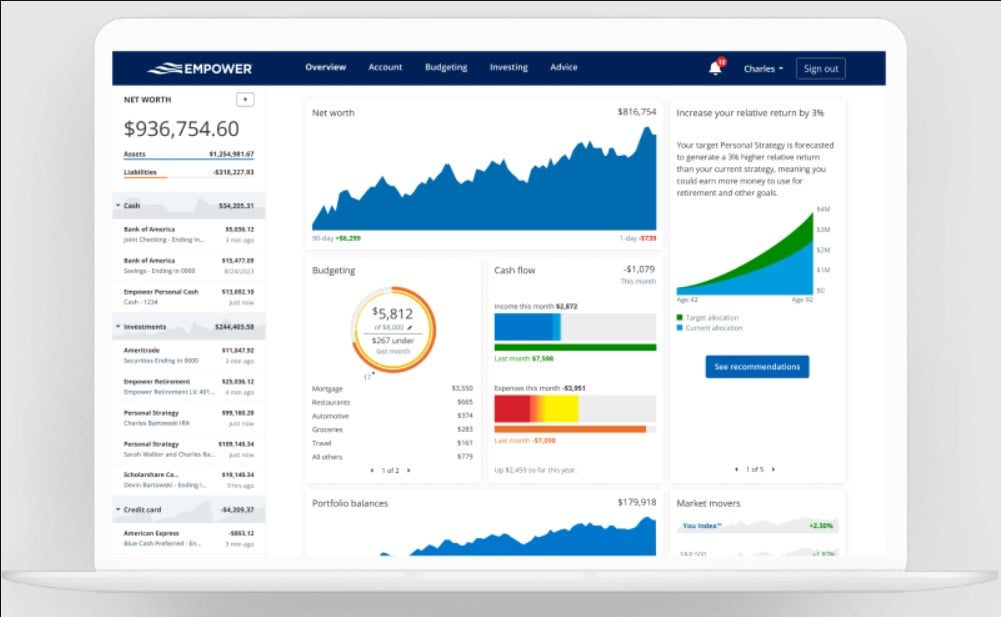

This financial investment tracking software is the best among its rival brands and is the most popular software you can use to track investments.

With over 1 million users, and tracking assets worth more than 226 billion dollars, it makes it easy to manage your entire financial life in one platform.

Empower lets you link all your accounts to the dashboard so you can see your net worth and assess the health of your current portfolio with the Fee Analyzer or Investment Checkup tools.

You may even plan your future using the Retirement Planner or meet an advisor to discuss your investing strategy.

One of the benefits of using this software over having a broker is that your broker could be costing you thousands of cash from retirement savings in hidden costs, preventing you from retiring earlier.

The Fee Analyzer helps you spot such hidden fees in your accounts and funds.

For investors who need a long-term plan or high net-worth private clients who want a robust financial plan and personalized services, it offers data-driven portfolio management.

Other key features of Empower include:

- Mobile and desktop applications

- Net worth calculator

- Newsroom

From your dashboard, you can view your net worth, cash flow, portfolio balances and allocations, top gainers and losers, reports, spending, investment returns, and not only.

Empower

That’s your chance to join investors around the world who already use this top finance software!BankTree – Real-time budget stats

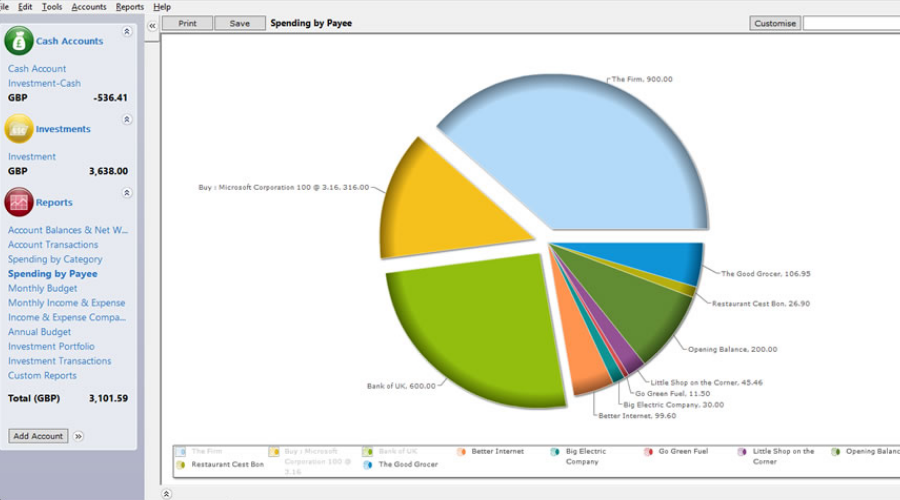

You can also take charge of your finances with BankTree. The online web application, desktop software tool, and intuitive mobile app are all part of a complete personal finance package.

This financial investment tracking software has a comprehensive interface, so you’ll find it easy to record income/expenditure and gain complete control over your investment tracking.

Those who use BankTree not only get easy-to-understand reports access but they can even pay bills in time by using the robust bill reminder calendar, as well.

First-class investment features of BankTree include:

- 2048-bit secure connection

- Incredibly easy dashboard navigation

- Real-time budget stats

- Customizable interactive reports with intuitive charts

- Up-to-date market values for all your investments

- BankTree Mobile app data easily synced with the desktop platform

- Comprehensive video tutorials

Therefore, it seems to be the winning combination for all those looking for a personal and business all-in-one application.

BankTree

There’s one place to manage all your finances with ease! Use BankTree and you won’t regret your choice!Quicken – Great at planning your investments

Quicken is another great software when it comes to all things financial. It can help you create budgets, pay bills and of course track your investments.

This software is way more powerful than normal spreadsheets, you can track all your accounts from a single dashboard and action where it is needed with few clicks.

Quicken offers over 30 report types already built-in but moreover, you can further customize those reports in order to better track your stock portfolio, for example.

Another great thing, especially for stock tracking, Quicken will adapt to your needs as your finances increase. The software will provide more complex features that will help you manage your increasing stock.

With a strong privacy policy, no ads, and bank-grade security, you can rest assured that all your stock trading information and accounts are safe with Quicken

You can even try this software, basically for free, due to its 30-day money-back guarantee.

Here are some more key features this software offers:

- Automatic download of all transactions

- Automatic categorization of income & expenses and define custom rules

- Track complete portfolio across financial institutions

- See change in portfolio value over time

- Customize your portfolio view to meet your investment needs

Quicken

Track your stock portfolio easily and securely with Quicken.Moneydance – Very easy to use

Moneydance is a very easy-to-use, fully-featured, personal finance management software that of course includes investment tracking.

This software doesn’t compromise its security. Your data is private, encrypted, and never shared, which is essential when talking about stock investment.

Moneydance can make every task easy, it comes with features that help with budgeting, and investment tracking as well as detailed graphs and reports.

You can also use Moneydance as an online banking app as it can automatically download transactions and send payments online from hundreds of financial institutions.

For the investment part, this software offers support for stocks, bonds, CDs, mutual funds, and more. You can view the total value of your investment or just check the individual performance.

Here are some more features of Moneydance:

- Online banking and bill payment

- Supports multiple currencies, including cryptocurrencies

- Add-on extensions are available

- Mobile support

Moneydance

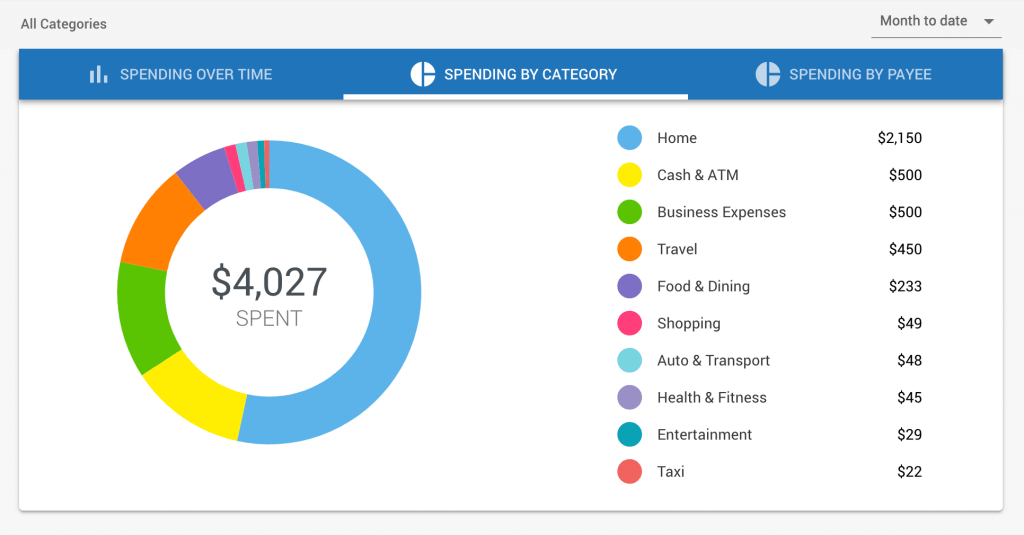

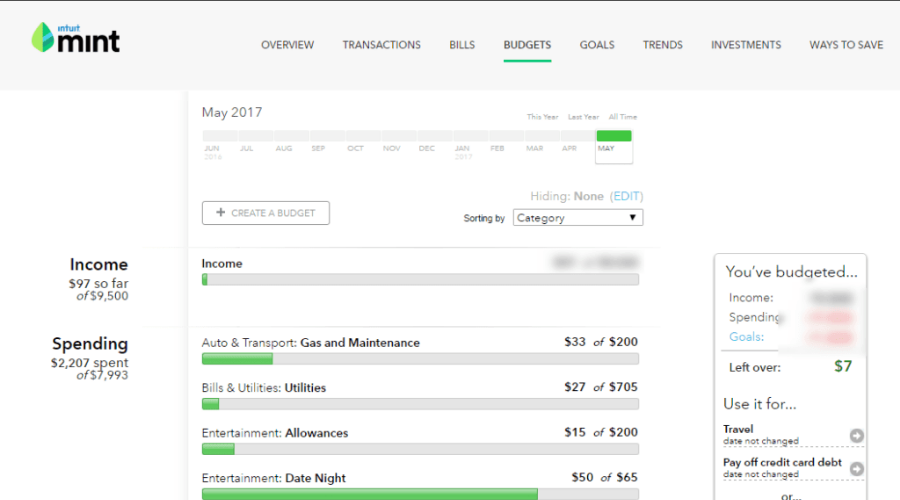

Online banking and investment tracking in a single app.Mint – Compare portfolio to market benchmarks

This usually comes as another popular financial investment tracking software. You can sign up for free and use it to track and manage your financials all from one single screen.

Mint lets you compare your portfolio and finances to market benchmarks, and instantly see your asset allocation across investment accounts.

This includes 401(k), mutual funds, brokerage accounts, and IRAs. It also gives you advice and tips so you can know your investment style with the right tools.

To be more precise, it helps you identify unnecessary fees like those from investment advisors, brokerages and 401(k) providers, which reduce your investments’ long-term growth.

Once you sign up and sync your bank account, you’re only seconds away from financial freedom.

In terms of security, Mint puts your mind at ease first because it comes from the makers of TurboTax and QuickBooks.

These are trusted household names in the finance sector, plus it uses VeriSign to scan and ensure security for sensitive data transfer.

Another security feature is its multi-factor authentication designed to help you protect access to your account.

It does so by using a 4-digit code which only you can use to view your account, instead of just a login and password, plus you’re notified of account changes.

Other key features of Mint include:

- Mintsights automatically ffins savings you missed

- Custom spending habits goals

- Bill negotiation feature

Touch ID is available if you prefer it, and if your device gets lost or stolen, you can delete all your account info remotely.

⇒ Get Mint

SigFig – Rebalances automatically

This is a fairly new name in the financial investment tracking software industry, but it is a clever software tool that guides you towards better investment decisions.

With SigFig, you get complete transparency, summary reports, regular updates, a thoughtful transition of your assets with cutting-edge fees, and tax-efficient strategies to reduce commissions and taxes.

Even more, you can share your investment goals in a simple questionnaire that lets the team get to know you and what you want to achieve.

You can also review your recommended investment portfolio that is tailored to you based on your goals and risk preferences.

SigFig also monitors your investments daily, rebalances automatically whenever you have extra dividends or interest or even cash.

On top of all these, it designs an optimal portfolio allocation to maintain diversification benefits across multiple asset classes, while considering tax implications.

With the mobile app built natively for your smartphone, you can check on your investments from wherever you are.

Other key features of Sigfig include:

- Interactive user experience with personalized tips and recommendations

- Intutive financial management platform

- Compatible with financial institutions around the world

If you wish to speak to a human advisor, they’re also a phone call away.

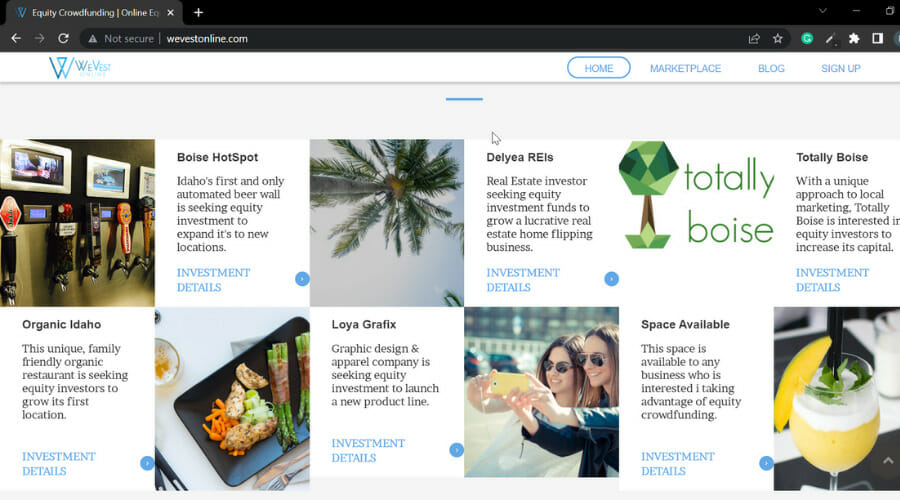

WeVest – Business equity crowdfunding

WeVest is a financial investment tracking software that brings all your accounts together and forecasts your entire financial future.

You can track your net worth, get your finances in order, optimize your savings, and own your financial goals such as retirement planning, or buying a house.

Do so by simply telling WeVest what you want and they’ll tell you how to get there.

WeVest is safe and secure with 256-bit SSL encryption and AES-256 database encryption, plus they don’t store your address, credit card, or social security number.

They don’t even need your real name. When you join WeVest, you’ll learn how your net worth stacks up compared to other people like you.

You’ll also become better at allocating your money to maximize your future net worth and meet your financial goals.

Your net worth will grow based on default recommendations or the custom plan you build yourself.

Other key features of Wevest include:

- Support for business equity crowdfunding

- Marketplace to list your business

- Informative online community

Investment accounts can be hard to compare and prioritize but WeVest focuses on net worth benefits and practicality of your different account options so you can make the right choices.

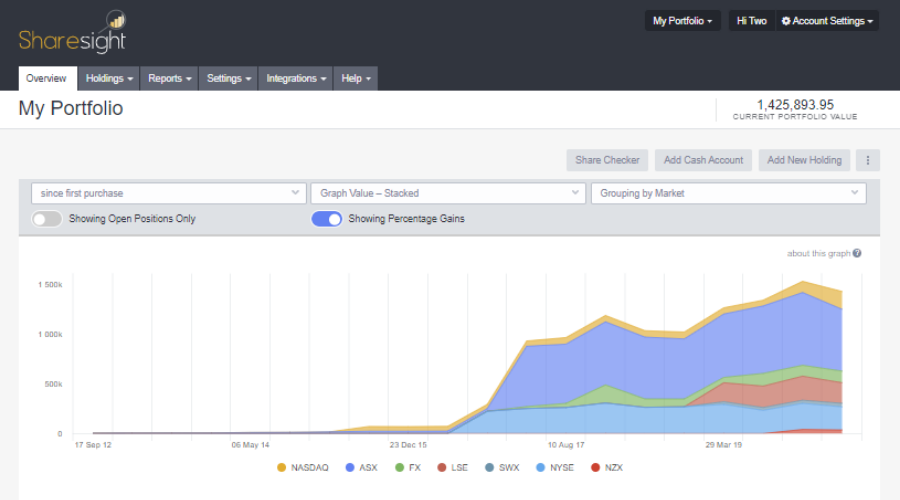

Sharesight – Import your trading history

If you’re looking for a good financial investment tracking tool, perhaps you’ll be interested in Sharesight.

This is an online tool, and it provides automatic and comprehensive tax and performance reports. It is incredibly simple to use, so you should be able to find the desired data without any issues.

Sharesight allows you to import your trading history, so you can easily monitor corporate actions.

In order to keep a close eye on your investments, there are daily price and currency updates along with detailed reports.

If needed, you can also receive email alerts in order to keep a close eye on your stocks. It’s worth mentioning that this tool supports sharing, so you can easily share your tax reports with others.

This is great if you need to quickly share your information with your accountant for example.

Sharesight comes in several packages, and the Free plan gives you access to 1 portfolio and 10 holdings.

This package comes with automatic dividends and price alerts and it offers limited reporting.

If you want to get access to more advanced features and get full reports, you’ll need to purchase a monthly subscription.

Overview:

- Automatic Dividends & Adjustments

- Email alerts

- Mobile app

- Broker email imports

- Record unlisted investments

- Portfolio sharing

Overall, Sharesight is a great tool if you want to monitor your finances, so you might want to try it out.

So, which one of these financial investment tracking software sounds good for your investments? Or do you have one you’re currently using that’s not listed here?

Share your opinion with us by dropping your comment in the section below.

Tracking several accounts is not an impossible mission. Just use our Financial management section and learn to master this challenging task.

Bookmark our Accounting & Tax Software Hub too and become an experienced investor.