9 Best Investment Portfolio Tracking Software in 2024

Check out the best stock tracking software on the market

7 min. read

Updated on

Read our disclosure page to find out how can you help Windows Report sustain the editorial team. Read more

Whether you’re managing stocks, real estate, or your monthly budget, the right investment tracking software will simplify the process, making it accessible to anyone, even if you’re no finance expert.

Let’s check out the top tools for managing your financial portfolio:

What’s the best financial investment tracking software?

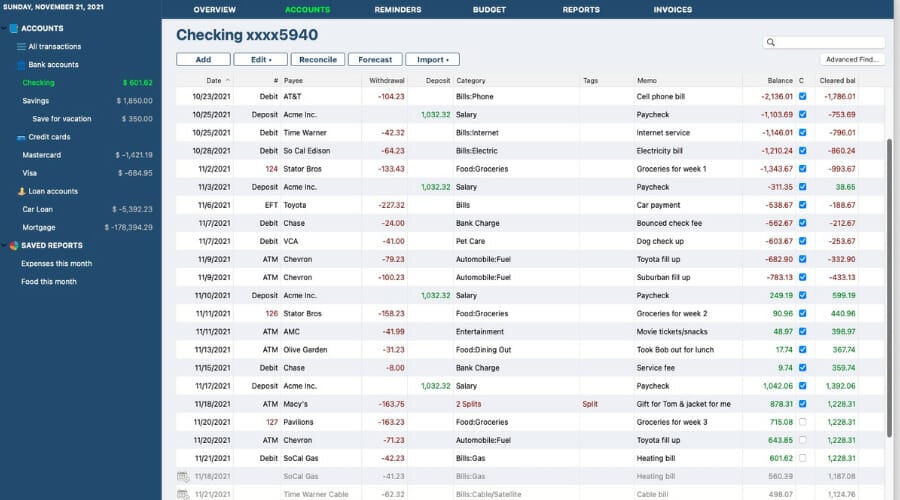

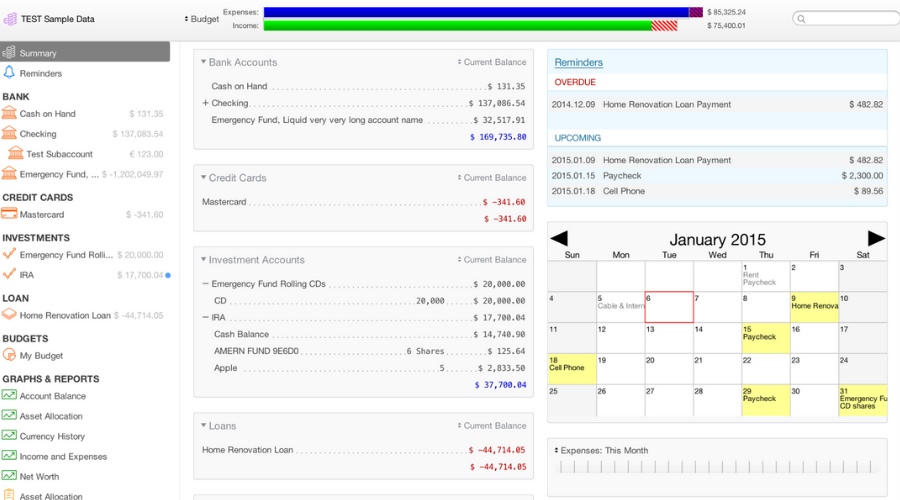

Moneyspire – Forecast future account balances

Moneyspire is a user-friendly software designed to consolidate your financial life in one place. It offers robust features like account tracking, detailed reports, budgeting, and bill reminders.

With encrypted local storage, your data stays private. Optional online banking makes transactions seamless, even without a direct bank connection.

Other key features of Moneyspire include:

- Budgeting setup

- Available for all regions and world currencies

- Compatible with all major operating systems

No less important, reporting of transactions, monthly comparison reports, and drag-and-drop import files are here included too

Moneyspire

Track your money securely with Moneyspire and simplify your financial life today.Empower – Robust financial planning

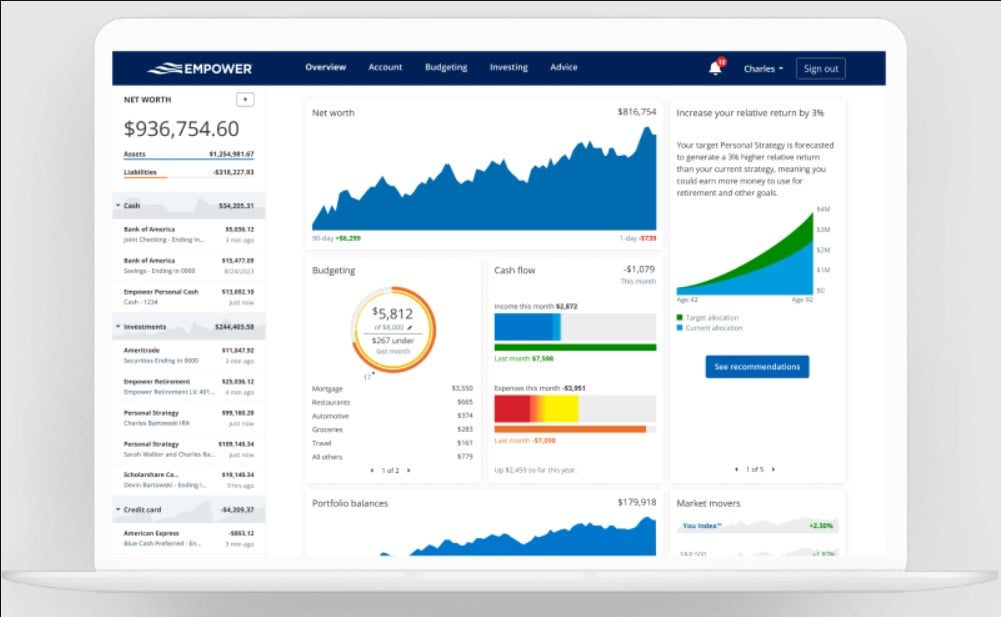

Empower offers a complete overview of your finances, with tools like Fee Analyzer and Investment Checkup to optimize your portfolio.

Its Retirement Planner and personalized advisor support make it ideal for long-term planning. Trusted by millions, Empower brings clarity to complex financial management.

Other key features of Empower include:

- Mobile and desktop applications

- Net worth calculator

- Newsroom

From your dashboard, you can view your net worth, cash flow, portfolio balances and allocations, top gainers and losers, reports, spending, investment returns, and not only.

Empower

That’s your chance to join investors around the world who already use this top finance software!BankTree – Real-time budget stats

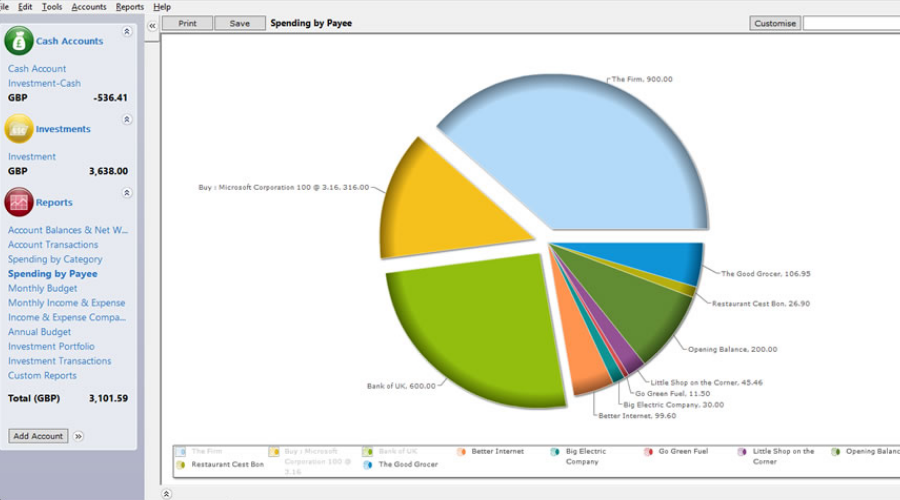

You can also take charge of your finances with BankTree. The online web application, desktop software tool, and intuitive mobile app are all part of a complete personal finance package.

This financial investment tracking software has a comprehensive interface, so you’ll find it easy to record income/expenditure and gain complete control over your investment tracking.

Those who use BankTree not only get easy-to-understand reports access but they can even pay bills in time by using the robust bill reminder calendar, as well.

First-class investment features of BankTree include:

- 2048-bit secure connection

- Incredibly easy dashboard navigation

- Real-time budget stats

- Customizable interactive reports with intuitive charts

- Up-to-date market values for all your investments

- BankTree Mobile app data easily synced with the desktop platform

- Comprehensive video tutorials

Therefore, it seems to be the winning combination for all those looking for a personal and business all-in-one application.

BankTree

There’s one place to manage all your finances with ease! Use BankTree and you won’t regret your choice!Quicken – Great at planning your investments

Quicken goes beyond basic tracking, offering over 30 customizable reports and powerful portfolio tools.

It adapts as your investments grow, providing robust features for advanced stock tracking.

With bank-grade security and a 30-day money-back guarantee, Quicken is a reliable choice for all investors.

Here are some more key features this software offers:

- Automatic download of all transactions

- Automatic categorization of income & expenses and define custom rules

- Track complete portfolio across financial institutions

- See change in portfolio value over time

- Customize your portfolio view to meet your investment needs

Quicken

Manage growing investments confidently with Quicken’s secure and scalable tools.With a strong privacy policy, no ads, and bank-grade security, you can rest assured that all your stock trading information and accounts are safe with Quicken

Moneydance – Very easy to use

Moneydance simplifies personal finance with an easy-to-navigate interface. It tracks investments, supports multiple currencies, and syncs with banks for online payments.

For the investment part, this software offers support for stocks, bonds, CDs, mutual funds, and more. You can view the total value of your investment or just check the individual performance.

Here are some more features of Moneydance:

- Online banking and bill payment

- Supports multiple currencies, including cryptocurrencies

- Add-on extensions are available

- Mobile support

From detailed reports to portfolio analysis, it’s a versatile choice for users seeking functionality without complexity.

Moneydance

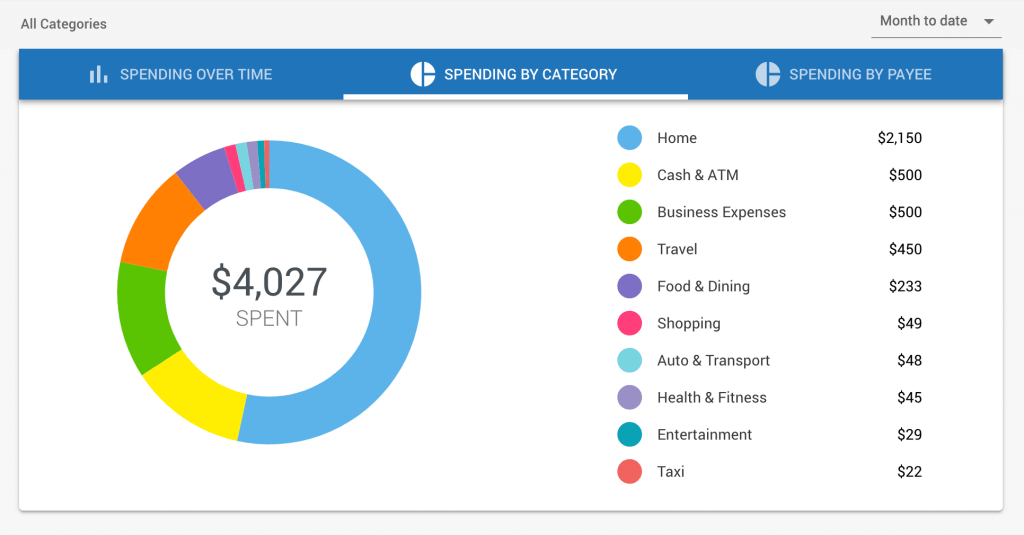

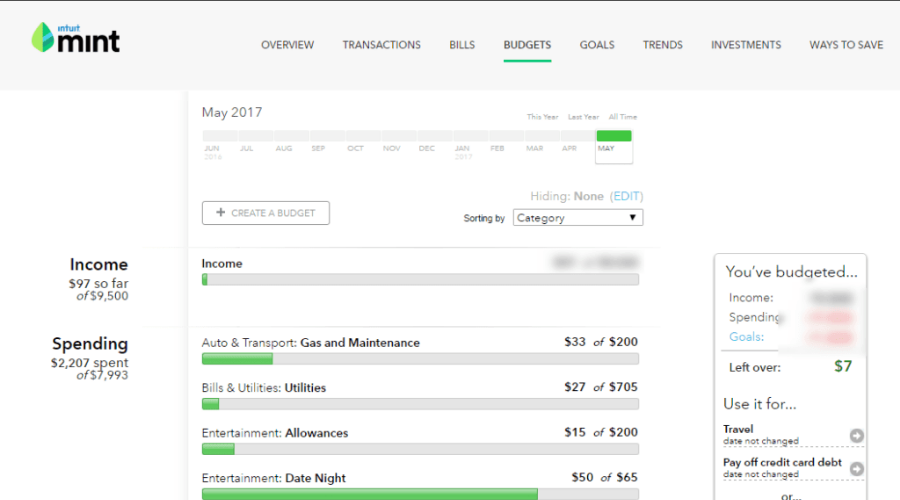

Online banking and investment tracking in a single app.Mint – Compare portfolio to market benchmarks

Mint provides a free way to track and manage finances. It compares your portfolio to market benchmarks and highlights unnecessary fees.

With strong security features and tools to set spending goals, Mint is perfect for users seeking financial insights without extra costs.

Other key features of Mint include:

- Mintsights automatically ffins savings you missed

- Custom spending habits goals

- Bill negotiation feature

Touch ID is available if you prefer it, and if your device gets lost or stolen, you can delete all your account info remotely.

⇒ Get Mint

SigFig – Rebalances automatically

SigFig streamlines investment tracking with features like automatic rebalancing and tailored portfolio recommendations.

Designed for transparency and efficiency, it uses advanced strategies to reduce fees and optimize returns. A mobile app keeps you connected on the go.

Even more, you can share your investment goals in a simple questionnaire that lets the team get to know you and what you want to achieve.

your smartphone, you can check on your investments from wherever you are.

Other key features of Sigfig include:

- Interactive user experience with personalized tips and recommendations

- Intutive financial management platform

- Compatible with financial institutions around the world

If you wish to speak to a human advisor, they’re also a phone call away.

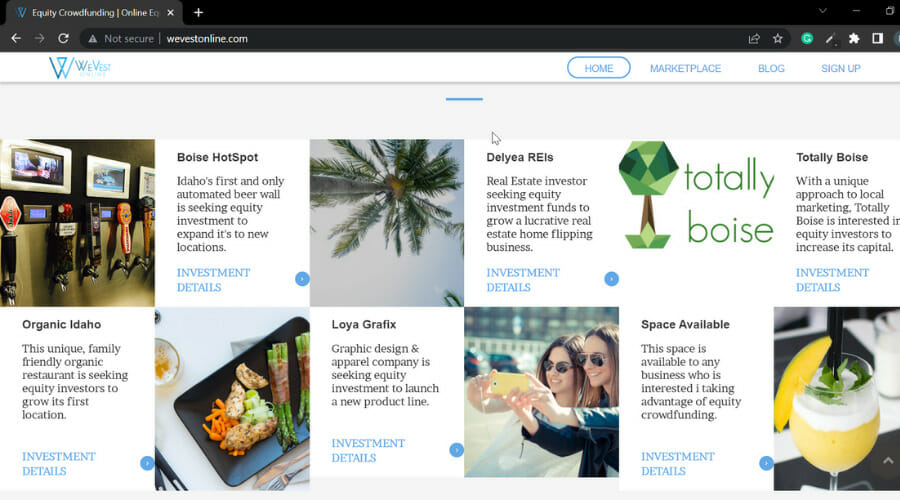

WeVest – Business equity crowdfunding

WeVest helps you set and achieve financial goals with tailored recommendations. Track your net worth, forecast future finances, and secure savings plans.

Its encrypted platform ensures privacy while empowering users to make smarter financial decisions.

WeVest is safe and secure with 256-bit SSL encryption and AES-256 database encryption, plus they don’t store your address, credit card, or social security number.

They don’t even need your real name. When you join WeVest, you’ll learn how your net worth stacks up compared to other people like you.

Other key features of Wevest include:

- Support for business equity crowdfunding

- Marketplace to list your business

- Informative online community

Investment accounts can be hard to compare and prioritize but WeVest focuses on net worth benefits and practicality of your different account options so you can make the right choices.

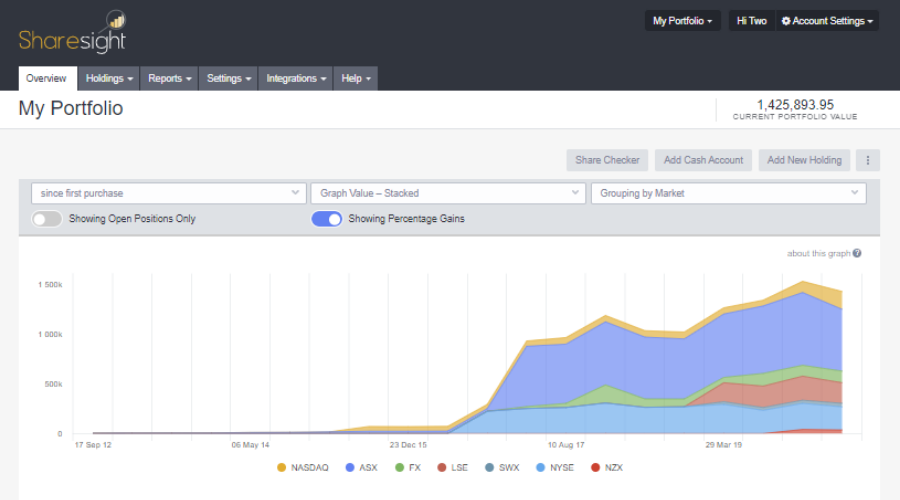

Sharesight – Import your trading history

Sharesight simplifies investment management with automatic tax and performance reports. Import your trading history, monitor corporate actions, and receive price alerts.

The free plan includes one portfolio, while advanced features are available with premium plans.

If you want to get access to more advanced features and get full reports, you’ll need to purchase a monthly subscription.

Overview:

- Automatic Dividends & Adjustments

- Email alerts

- Mobile app

- Broker email imports

- Record unlisted investments

- Portfolio sharing

Overall, Sharesight is a great tool if you want to monitor your finances, so you might want to try it out.

So, which one of these financial investment tracking software sounds good for your investments? Or do you have one you’re currently using that’s not listed here?

Share your opinion with us by dropping your comment in the section below.

Tracking several accounts is not an impossible mission. Just use our Financial management section and learn to master this challenging task.

Bookmark our Accounting & Tax Software Hub too and become an experienced investor.

User forum

0 messages