Previewing Microsoft's Q3 earnings: OpenAI boosts its technology aspirations

Cloud services remains the most revenue generating segment

3 min. read

Published on

Read our disclosure page to find out how can you help Windows Report sustain the editorial team. Read more

Investors and stakeholders eagerly await Microsoft’s financial performance report as time approaches. The Redmond tech giant is set to unveil its third quarter (Q3) earnings on Friday, 26 April, at 6:05 a.m. AEST (GMT +10) after the market closes.

According to the latest Microsoft reports, cloud services remain the company’s most profitable segment, propelling Intelligent Cloud revenue to an impressive $25.88 billion in Q2, with a substantial 20% year-over-year increase.

They contribute to more than 40% of the group’s total revenue, and this positive trajectory is expected to continue in Q3 as well, with projected revenue of $26–$26.3 billion.

Revenue is anticipated at $60.86 billion in the current quarter, which is lower than the previous quarter’s $61.13 billion.

However, the EPS (Earnings per share) is estimated to grow to $2.84, which is higher than last quarter’s $2.77.

If we talk about Year-over-year performance, the anticipation of the revenue growth (year-over-year)is expected to be 19%, which is lower than the EPS growth (year-over-year), i.e., 27%.

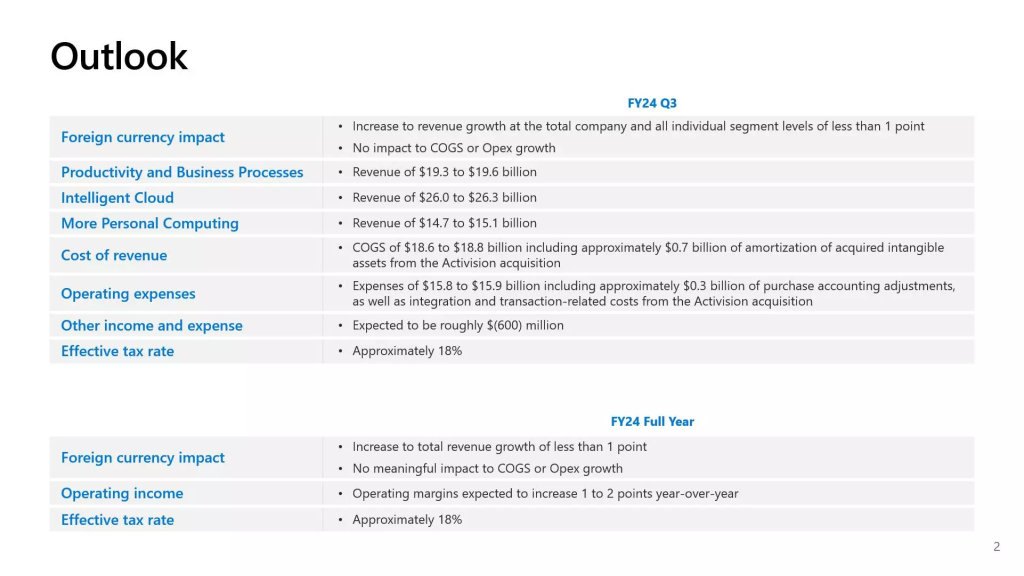

Fiscal outlook

Microsoft is expecting modest yet strategic growth in fiscal year 2024’s third quarter. If we talk about all operational segments, there is a projected increase of less than 1 percent point without significant changes to the current cost structure.

The aim of this strategy is to maintain stable operational expenses and the cost of goods sold (COGS)

The detailed financial projections are as follows:

- Revenue – Anticipated to be between $19.3 billion and $19.6 billion.

- Cost of Goods Sold (COGS) – Estimated to range from $18.6 billion to $18.8 billion. This also includes $0.7 billion attributed to amortization expenses related to acquiring intangible assets from Activision.

- Operating expenses – Expected to be approximately $15.8 billion to $15.9 billion. This includes costs related to purchase accounting adjustments, which are around $0.3 billion, and expenses from integrating and transacting with Activision.

Impact of Microsoft and OpenAI’s partnership

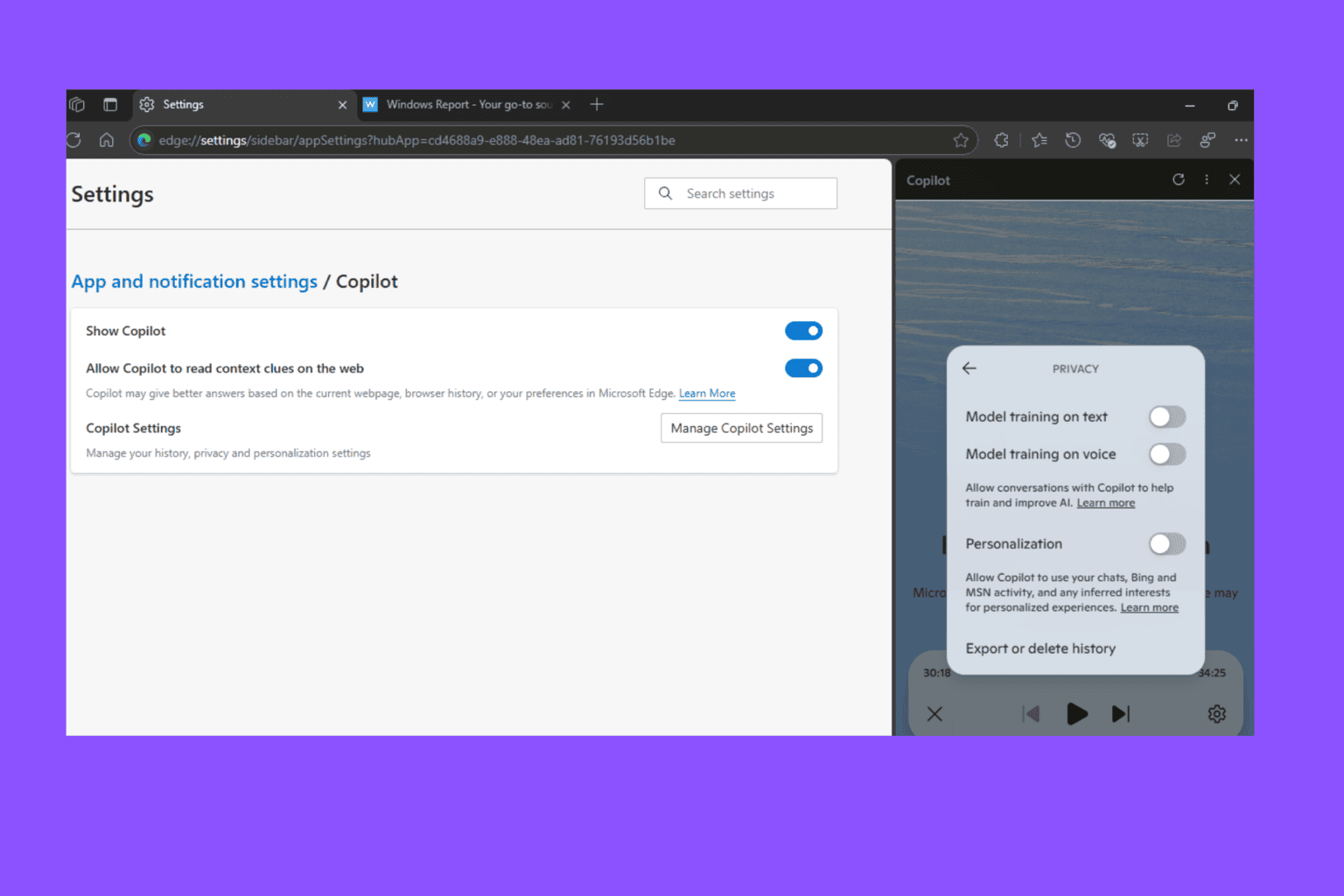

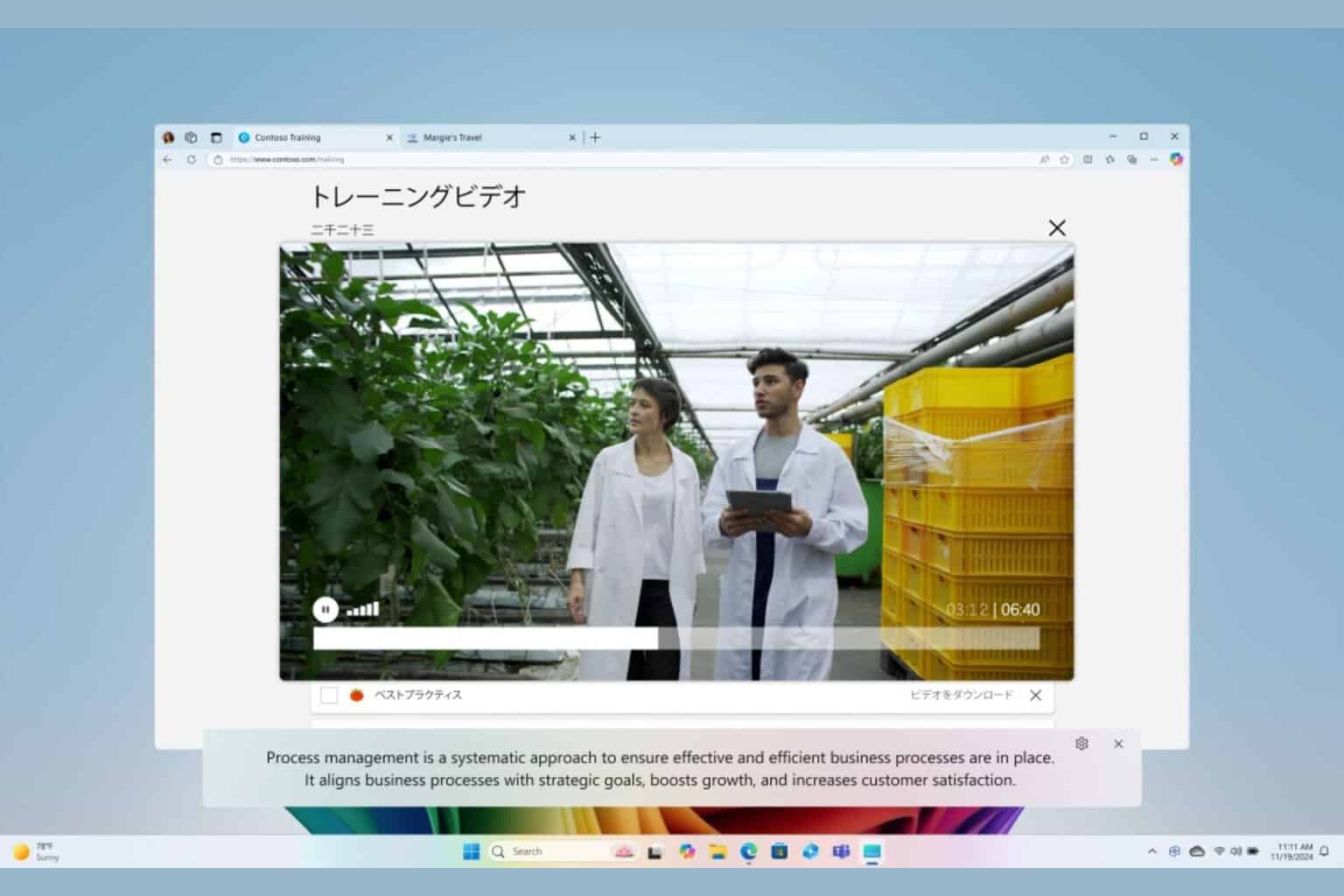

From the introduction of Copilot to the integration of the AI assistant into existing Microsoft products, the whole world is witnessing AI advancements by the tech giant.

With its substantial investment in OpenAI, Microsoft has strategically shifted towards integrating AI capabilities throughout its technological ecosystem.

As ChatGPT is gaining more traction, investors are optimistic about Microsoft’s future and ready to witness the further integration of AI and forthcoming strategic initiatives, given the company’s leverage in the AI domain.

Despite all the AI hype and revenue boost, other segments, like its devices and Office commercial products, saw declines of 9% and 17%, respectively, in the last quarter, and the weakened PC market is to blame.

However, as the PC shipments are surging back to pre-pandemic levels, you might see a bit of an increase in this quarter or the next one.

Microsoft’s shares

Due to prevailing risk-averse sentiment, Microsoft’s shares have encountered a setback since the start of Q2. This, in turn, has interrupted the upward trajectory that saw the company’s stock prices surge to 38% from October 23 to March 2024.

At the time of writing, Microsoft’s share price is between $406.78 and $412.47, which is low compared to its all-time high of $427.

To conclude, as Microsoft is preparing to reveal its third-quarter earnings in the middle of challenges and opportunities, the company’s trajectory remains under scrutiny.

What do you expect from Microsoft’s financial performance report for Q3? Share your thoughts with our readers in the comments section below.

User forum

0 messages