Microsoft’s long-term stock evaluation looks very sunny for investors

3 min. read

Published on

Read our disclosure page to find out how can you help Windows Report sustain the editorial team. Read more

Over the past seven years, Microsoft CEO Satya Nadella has preceded over a cloud services division that’s effectively printing money for the company, and the folks over at The Motley Fool believe that ATM machine will continue to rain revenue and profit gains for investors for years to come.

Microsoft’s stock has seen a quantified resurgence since its president of servers and tools ascended to the CEO spot and ushered in a very profitable pivot to a cloud services era for the company.

From 1998 to November 2016, Microsoft’s stock hovered between lows of $19 to highs of $52 a share, but once its cloud services shift was in full swing, early investors have enjoyed a three hundred dollar increase on their returns and according to analysts over the Motley Fool cloud service diversity is what will keep the Redmond-based company a worthwhile investment despite its increased buy in over the years.

At over 11 times annual sales, shares have become more expensive compared to the start of the year when they were trading at below 9 times sales.

You can own individual companies that each compete in a small portion of Microsoft’s territory for much cheaper. The cybersecurity expert Palo Alto Networks trades at 10 times sales, for example, and video game giant Electronic Arts is valued at 4 times sales.

But Microsoft delivers exposure to these niches and a half-dozen more, all wrapped up under a single brand. That diversity makes it an obvious choice for most enterprises seeking comprehensive tech services. It also makes it an attractive stock to have in your portfolio. As a result, owning Microsoft stock over the next several years will likely have a positive impact on your portfolio, despite its high price today.

Providing cloud platforms, services, and securities has become an increasingly competitive market with Amazon still leading the charge, but Microsoft has nestled into the second spot and utilized its position as a hybrid solutions business to chip away at AWS lead in the market.

While competitors such as Google Cloud, Alibaba Cloud, Oracle, IBM’s Kyndryl, Tecent and OVHcloud vie for users, investors feel confident in Microsoft leveraging its established enterprise business offerings to continue to bolster Azure.

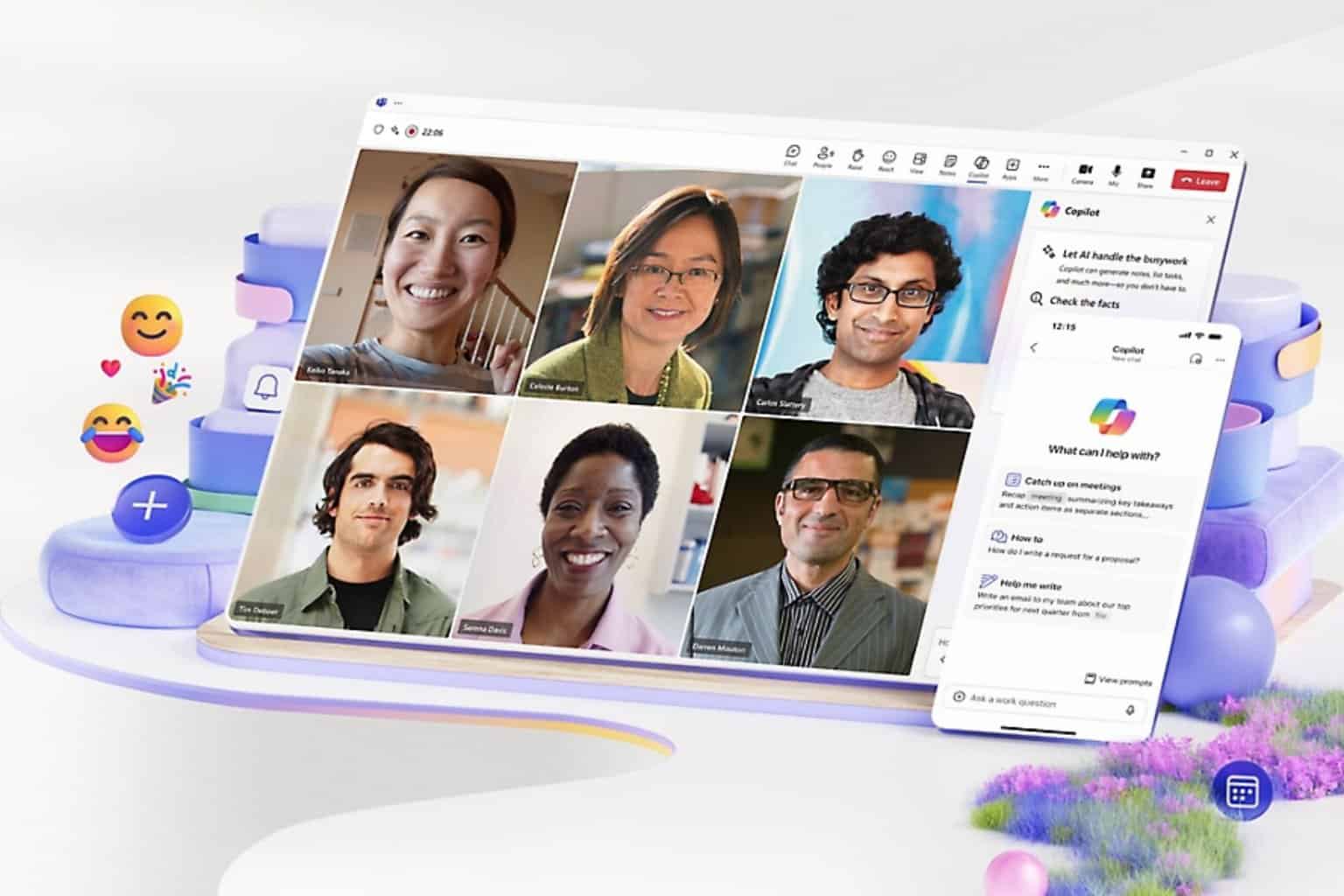

In accordance with its shift from licensing Windows to licensing its cloud services and platforms, Microsoft investors are recognizing another bet from the company in the way of AI that can help to generate revenue during the ebbs and flows of the cloud market.

While Microsoft currently sits at a comfortable second place to AWS in the cloud market the year over year gains for the business have come down from quarters of leaps and bounds to a more moderate churning of revenue, however, Microsoft is now juicing its cloud business with artificial intelligence, and investors should see additional returns thanks to some very strategic partnership that net the company profit as enterprise adopts AI, LLMs, and GPT models across its stack.

Microsoft Azure is available in sixty regions with 116 available zones compared to AWS at 26 regions and 84 zones or Google 32 regions and 103 zones. Combine Azure’s accessible footprint and historic compliance records with Microsoft also leading a public charge of artificially intelligent and generative pre-trained infused systems and services into areas such as LinkedIn, Dynamics 365, GitHub, Azure SQL, and Office 365 the company has a myriad of diversification options to continue to suck up cloud revenue for investors despite a contentious market.

User forum

0 messages