PayPal not Accepting Card? Fix It with These 4 Steps

3 min. read

Updated on

Read our disclosure page to find out how can you help Windows Report sustain the editorial team. Read more

Key notes

- PayPal is an extremely reliable online payment service, but issues can still appear.

- For example, we will be discussing what to do when PayPal doesn't accept a card.

- If you want to know more about this payment service, visit our dedicated PayPal Issues Hub.

- To check out additional info on online services, visit our Web Apps page.

To take the full potential of PayPal, you’ll need to link your bank or debit card. This allows you to transfer funds from PayPal to your bank account and vice versa.

Linking a debit card works great most of the time, and you should be set in a matter of minutes. However, PayPal is not accepting a card for some users. If you cannot link a debit card to your PayPal account, follow the steps below.

Why is PayPal not accepting my debit card?

1. Ensure that the card information is on point

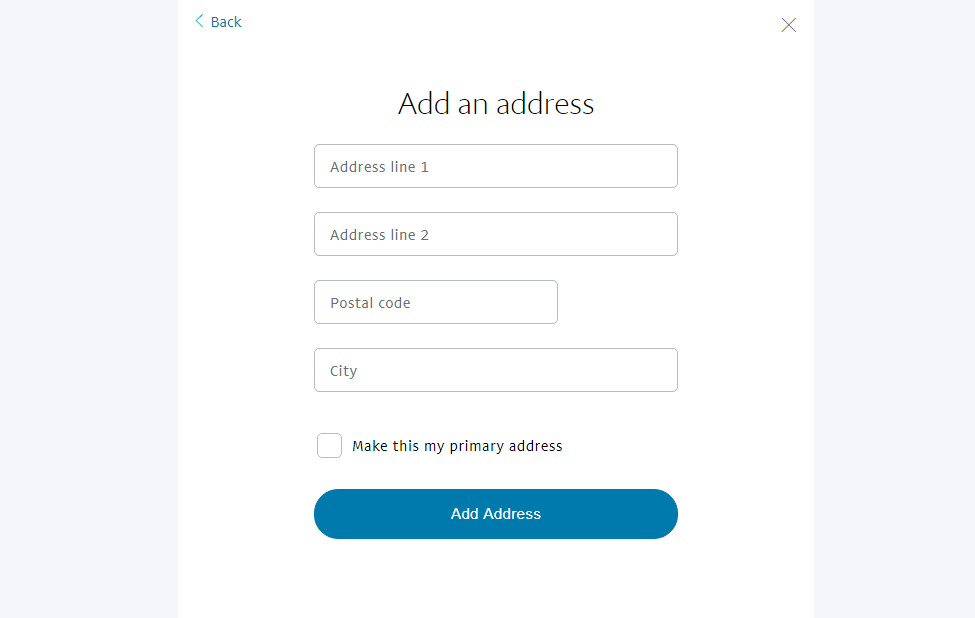

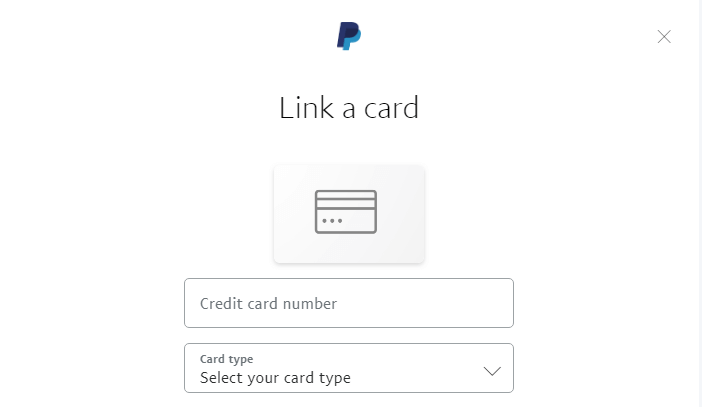

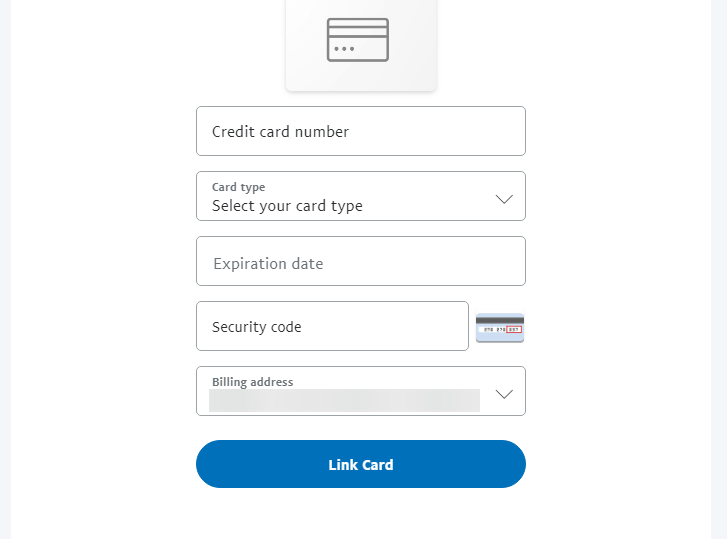

First, you must ensure that all the debit card information is on point. Ensure that the debit card is supported and that you set the right billing address, expiration date, and security code before moving on.

All the information must match the information from your bank. Remember to use only Visa, MasterCard, and American Express debit cards. Some Visa or MasterCard debit card iterations won’t work with PayPal if they only support the local currency.

2. Use a PayPal alternative

PayPal isn’t the only service of its kind on the market, so if using it is out of the question, at least you know all is not lost. However, if you choose to use a different service, you might as well use something that is as good or better than PayPal.

Other payment channels like Google Pay are often plagued by issues like error code U13 that bar transactions. Luckily, Payoneer fits the bill due to its flexible methods to get paid or fast transfer services between you and other clients.

With this payment manager option, you can benefit from fast online payments worldwide, local currency account bills, or low fees for your income. You’re able to make purchases online and in-store as well.

At the same time, your money can be managed efficiently with local currency transfers or withdrawals at any ATM worldwide.

3. Make sure that the debit card balance is at least 2 USD or EUR

This is really important. For PayPal to confirm that the debit card at hand is active, it’ll take 1 USD during the registration process. The sum will be returned to your bank balance once PayPal successfully links the debit card.

Therefore, ensure that you have at least 1 USD available, although due to exchange rates (if you have a different currency), we suggest having at least $2.

4. Remove the debit card from other accounts

If you have it linked, it is important to unlink the debit card from other PayPal accounts. PayPal allows for one card to be used on a single account solely.

Finally, you can contact the PayPal support team to discuss the issue. In our own experience, they tend to be quite helpful. You can reach them on the official support website.

Tell us the alternative solutions you used in the comments section below.

User forum

1 messages