AML Software for Accounts: Best to Use in 2025

8 min. read

Updated on

Read our disclosure page to find out how can you help Windows Report sustain the editorial team. Read more

Key notes

- When it comes to financial fraud, any company can be a victim, therefore, actions need to be taken.

- Platforms that provide AML screening are the best solutions to validate the identity of your customers.

- For other related software and tools for your business, don't hesitate to visit our Accounting & Tax hub.

- If you need various applications for your company, find the best in our Business Software hub.

With the evolution of the internet and the services people and companies provide online, there is an increased risk of exposure to scammers, money launderers, and other third parties that don’t have the best interest of your company at heart.

Because of these risks, being able to store information about your clients and verifying their validity, is very important. Activities that include market manipulation, trade of illegal goods, corruption of public funds, tax evasion, etc. are covered by AML regulations.

In the past, the process of finding possible money launderers was a painstakingly slow process that included manually searching through tons of papers and folders. Even after the searching process would be done, you would still have issues when it comes to gathering objective and exact information.

Fortunately, you can now use specialized software that allows you to easily streamline the research process of possible money launderers. Read on to find out more details.

What are the best AML software?

Shufti Pro

Shufti Pro is a top software in the financial industry that offers Identity Verification services with the help of KYC & AML Screening solutions.

It is a great tool for worldwide medium to large businesses because it scans over 3,000 documents written in more than 150 languages from around 230 countries and territories. Thus, Shufti Pro can guarantee up to 98.67% accurate identification results.

The platform offers access to 1700+ datasets acquired from international sources including OFAC, EU, HMT, UN, DFAT, and others. Furthermore, the AML data bank is updated every 15 minutes.

Unfortunately, fraud is very common, thus, to avoid being a victim, performing regular AML checks will help to don’t lose money and your company’s reputation. Also, it is a simple way to verify and validate your customer’s transactions.

Shufti Pro’s AML engine works intelligently to reduce false positives. Global AML verifications are done in real-time to enable organizations to mitigate the financial risk associated with high-risk customers.

Most important features of Shufti Pro:

- Quick and Accurate Verification Processing

- Seamless API integration for service automation and higher flexibility

- Comprehensive Global Coverage

- Two-Fold Technology, AI (Artificial Intelligence) and HI (Human Intelligence)

- It can be used as web-based, desktop software, Android or iOS application

- PCI DSS and GDPR compliant

Shufti Pro

One of the best AML software, Shufti Pro identify high-risk entities with robust AML screening solutions.Encompass

Encompass is a great AML software that allows you to fully manage your company by storing data in an accessible and safe location and can also automate different aspects of the monotonous-type tasks of your practice.

The automation process is done using CDD (Customer Due Diligence) and EDD (Enhanced Due Diligence) processes.

Stream-lining these aspects of your practice is extremely useful, as it allows you to focus on more sensitive topics while also taking the time to analyze your data results. This type of software offers detailed information by connecting to various clients databases focused on the task at hand.

Encompass has a very intuitive user interface that offers you quick access to all the automation features, data sources, searches, and can even monitor ongoing data streams in real time.

This software offers optimal protection from risks posed by regulations, including the ability to simultaneously verify customer information, discover the previous beneficial owners, screen for issues, and can even perform media checks.

You can use Encompass to see an all stored data regarding specific customers in one simple file. This allows you to assess the risk involved with each customer, apply risk ratings,and also compare the risks to AML/CTF compliance. The Encompass API can be easily integrated with your AML system and it allows you to easily automate any process.

Notable features of Encompass include:

- Access to global corporate registries

- Electronic identity verification

- Automated discovery of UBOs

- Automated screening of individuals compared to your PEP sanctions data

- Can automatically store negative results checks and uses AI to show you results quickly

- Continuous monitoring of your customer’s profiles

- Ability to build a complete audit trail for every action performed

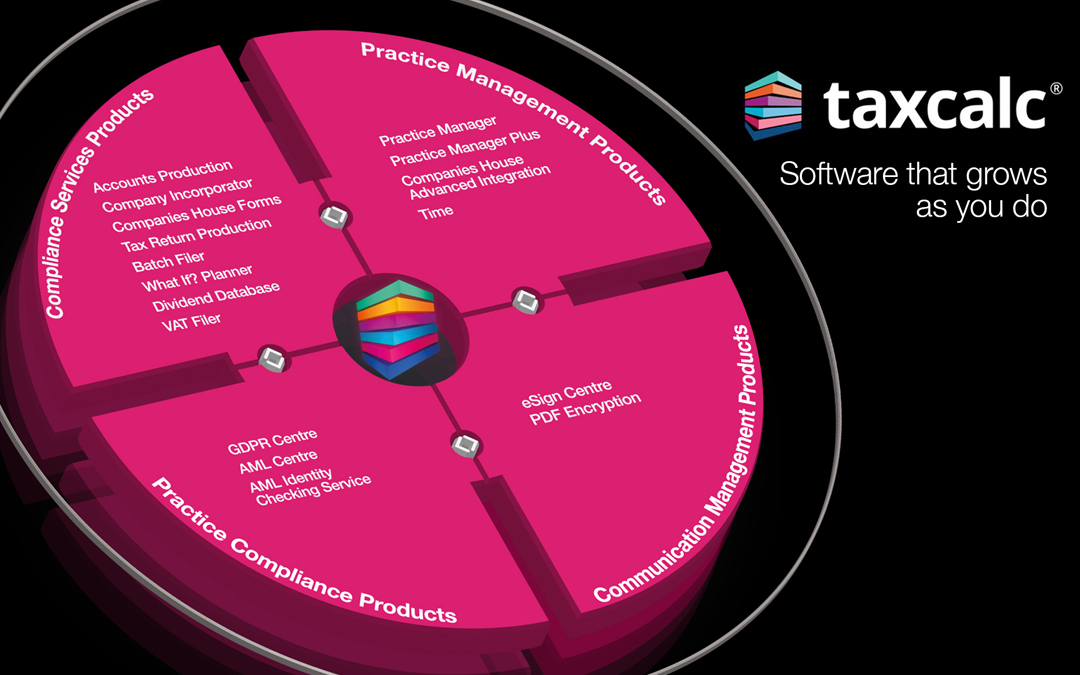

Taxcalc AML

Taxcalc is another great software options that was designed to help your accountant prevent, and deal with any AML issues encountered.

This software was launched in 2009, and since then, Taxcalc has become a partner with the global leader in identity and credit information, called Equifax. This feature allows you to rest assured that all the information you get regarding your customers is true and objective.

All you need to do in order to acquire customer information is to simply enter the name and address of your possible client. This will show you all known data regarding your client’s purchase history, outstanding payments, etc., so you can make a better informed decision.

Because of it’s powerful yet simple to use features, Taxcalc AML can be used in accountancy practices, by auditors, bookkeepers, and tax and payroll advisors as well.

Key features of Taxcalc AML include:

- Pass and Refer results – after the identity check is completed, the system allows you to choose if the candidate was accepted on not and add notes relating to your decision

- Built in Anti-Money Laundering Identity Checking Service

You can get Taxcalc AML with a basic licence that allows you to perform searches and verify registration for 15 people. As your business evolves, you have the possibility to buy more ‘personal searches’ packs, depending on the number of customers you need to verify.

AMLCC

AMLCC is a powerful AML software designed for use in different industries, but it is greatly optimized for use in accountant practices. This easy-to-use tool will help you deal with all the responsibilities dictated by law.

This software can guide you through all the steps needed in order to successfully train your staff and offers you the possibility to create a full range of reports, both automated and manual.

Your data is always securely stored in the cloud, eliminating the risk of possible issues with data corruption or the loss of files and data folders. You can easily access all AMLCC data from anywhere in the world.

The AMLCC Recording System makes it easier than ever to create, manage, and store records, and also offer other features such as:

- Risk assessments

- Can verify client identities

- Database with clients reported to the NCA

- Residency checks

- Ability to analyze ‘risk’ factors – politically exposed persons

One of the best features of AMLCC is the fact that it offers a comprehensive Training Module that contains two parts :

- MLRO training – Money Laundering Reporting Officer

- Training for all client-facing staff – receptionists, sales people, etc.

Both parts of the training module include a multiple-choice questions test that allow you to evaluate yourself.

Iris AML

This AML software from Iris is a very powerful tool for accountants, solicitors, etc., that allows you to manage every aspect of your company’s compliance recording.

You can use this app to produce a risk-based assessment of your customer’s database, that can give you an all-encompassing overview of your practice. The compliance features found in Iris ensures you are up to date with the latest legislation and also has regular updates.

Key features found in Iris AML:

- KYC information – client risk and documentation

- Ability to track staff training

- Automatically identifies non-compliant clients

- Unlimited electronic ID verification system

- Download and search treasury sanctions list

- Can import customer records from any existing database

- AML compliance technical reference manual by SWAT UK Limited

Oracle Financial Services AML

Oracle Financial Services Anti Money Laundering is a great AML software that has a good range of features. You can use this AML software to easily identify, examine, and directly report any people that might be interested to engage in money laundering.

This offers you the possibility to streamline processes and focus your energy on other aspects of your practice.

This AML software from Oracle has a wide range of pre-configured AML scenarios, stored in libraries. These scenarios can simplify the process of data processing and collection and also keep up with rules imposed by laws.

Main features include:

- Can monitor, investigate and report on any incredulous activities

- Library of comprehensive behavior detection

- Can customize your risk scoring and thresholds

- Robust case management

- Full compliance with national & international regulations

- Detect, investigate & report suspected money laundering

- Alert suppression

- Trusted pairing

- Threshold analytics

- Create and manage workflows

⇒ Get Oracle Financial Services AML

In this article, we explored some of the best software options on the market that allow you to easily collect, manage and create a wide range of reports, and also protect your company against hidden money-laundering practices.

The features included in the above list cover a wide range of accounting and data collection tools that will surely help run your practice even more efficiently than before.

Please let us know in the comment section below what software did you choose from the list, and why.

User forum

0 messages