7 Best Social Trading Platforms With No Fees

4 min. read

Updated on

Read our disclosure page to find out how can you help Windows Report sustain the editorial team. Read more

Looking to trade without paying fees? These zero-fee social trading platforms make it possible. With access to stocks, crypto, ETFs, and more, you can start trading without commissions.

Check out our list of the best platforms to get started.

What are the best trading platforms with no commission?

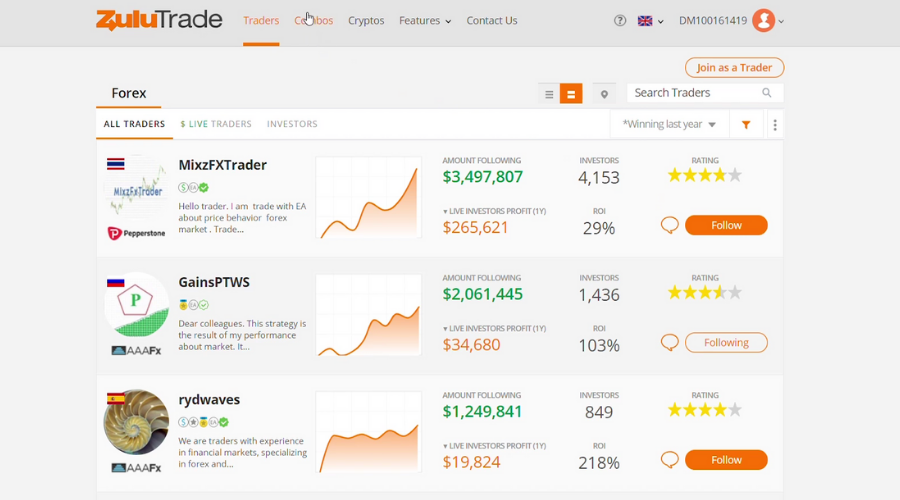

ZuluTrade

✅Pros

- Easy to learn and start trading

- Excellent collection of tools for beginners

- Mobile trading options

❌ Cons

- One trading account per user

ZuluTrade is a top choice for social trading with zero fees and a low $1 minimum. Perfect for beginners, it offers mobile trading, powerful tools, and an easy learning curve.

You can choose from a wide range of assets, including crypto. However, it only allows one account per user and requires an MT4 account.

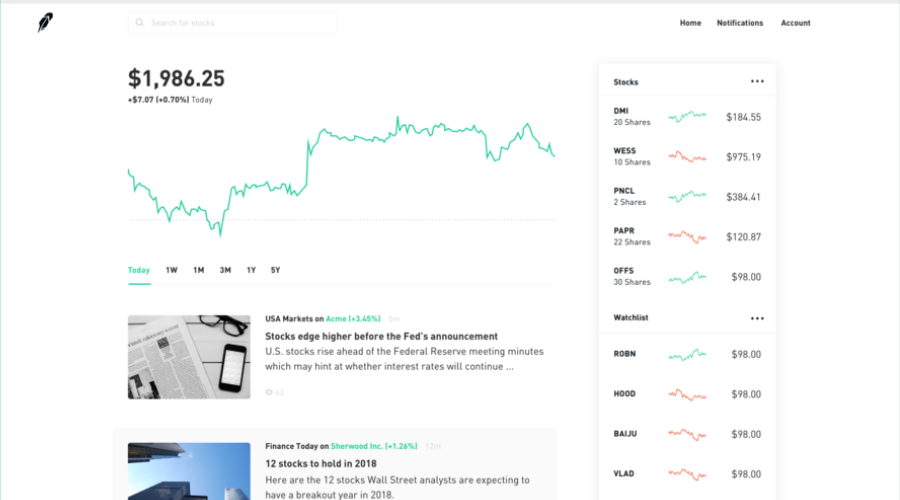

Robinhood

✅ Pros:

- No trading fees

- No account minimum

- Very accessible user interface

❌ Cons:

- No mutual funds or bonds

Robinhood is a commission-free trading platform, perfect for beginners. With no trading fees and a simple interface, it makes it easy to trade stocks, ETFs, and crypto.

Available on both web and mobile, your account stays synced across devices. Robinhood uses historical data and prediction stats to help you time trades for the best prices.

Plus, it offers educational tools to guide new traders. Overall, Robinhood is an easy, affordable way to start trading without needing a huge investment.

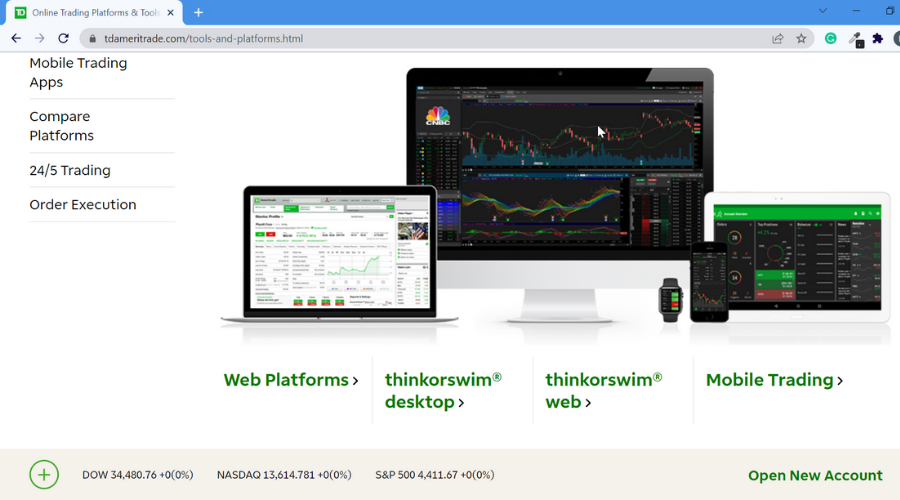

TD Ameritrade

✅ Pros:

- Free access to lots of trading platforms

- Tons of educational resources

- Mobile friendly

- Free research

- 24/7 specialized support

❌ Cons:

- Some platforms require a learning curve and may be intimidating for beginners

- No fractional shares

- Pretty high margin rates

TD Ameritrade is a powerful trading platform offering access to various assets with $0 commission on stock, ETF, and options trades.

It provides free access to multiple trading platforms and mobile apps, making it easy to manage your investments.

The platform also offers educational resources tailored to different investment types and powerful research tools for market analysis.

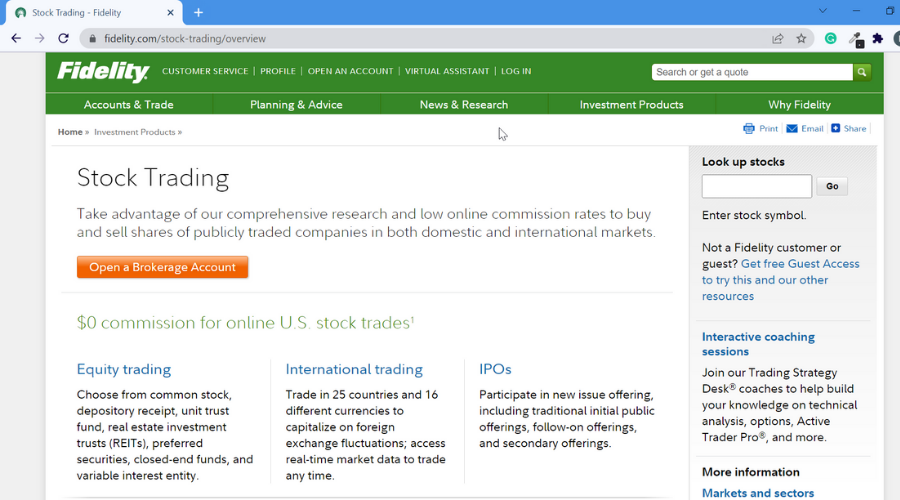

Fidelity

✅ Pros:

- no fee for stock, ETF and option trades

- Specialized team of financial advisors

- Mobile application

- Resourceful research options

- Easy transfers between your Fidelity account and your bank

❌ Cons:

- No crypto trading

- No forex trading

Fidelity is a reliable, zero-fee platform with no commission on trades for ETFs, stocks, penny stocks, and options.

With two main account packages, Fidelity tailors investment strategies to meet individual goals, with professional management.

The key difference is that the Fidelity Personalized Planning and Advice plan includes unlimited one-on-one advisor calls, while the Fidelity Go plan charges fees for specialized advice.

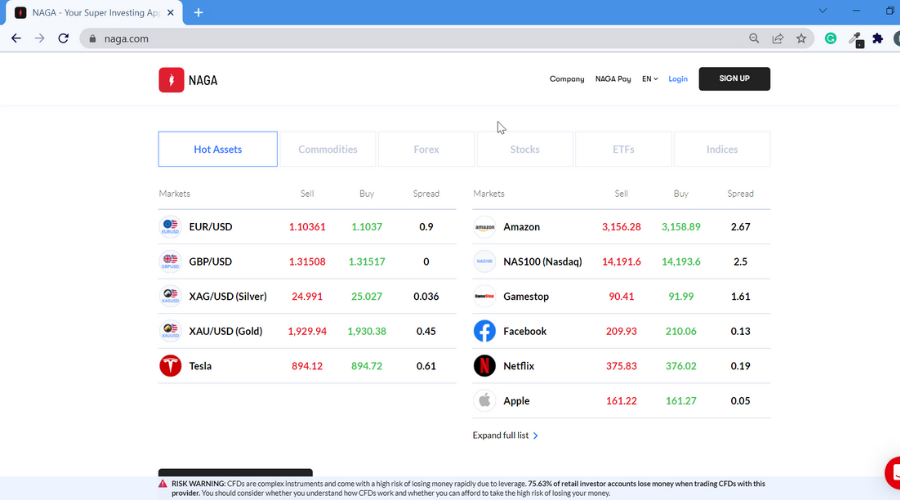

NAGA Trader

✅ Pros

- No minimum deposit

- Proprietary web-based social trading platform

- Good customer support

❌ Cons

- Spreads are comparatively high

- Hidden costs

NAGA Trader, once known as SwipeStox, is a social trading platform with over 750 assets like stocks, commodities, and crypto.

No trading fees, but there are withdrawal fees. It’s powered by TradingView and lets you connect MetaTrader 4 and 5.

For newbies, the platform has solid tutorials and regular webinars to help you level up.

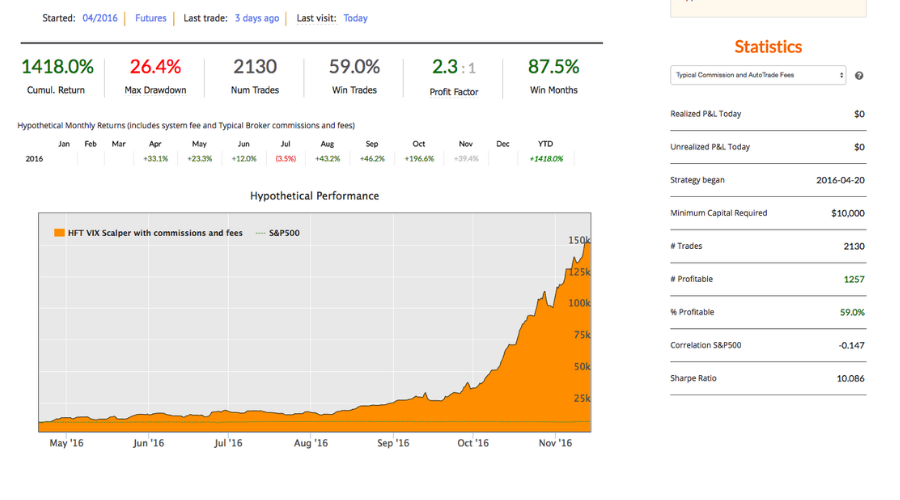

Collective2

✅ Pros

- Automated trade copying

- Multi-broker AutoTrade feature

- Social communication features

❌ Cons

- No demo accounts

- Not the best commission system

- Now own broke solution

Collective2 has been around since 2012, offering social trading with no commissions—just a monthly subscription. No extra fees unless you’re paying for a pro strategy from a broker.

The Portfolio Plus plan gives you unlimited strategies, but it’s not cheap. You can trade whatever system you want, with unlimited trade size, and it supports Forex, options, futures, and stocks.

It’s a solid option if you’re looking to copy trade without extra costs, but be prepared to spend a bit more for the perks.

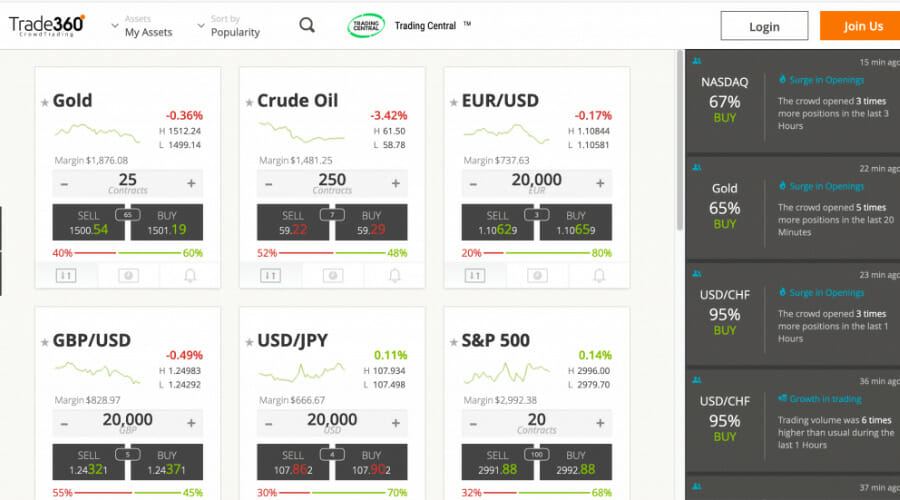

Trade 360

✅ Pros

- CySEC regulated

- Commission-free trading available

- Can trade multiple assets class

❌ Cons

- Lacks market analysis

Trade 360, founded in 2013 and regulated by CySEC, is another solid social trading platform. You can start with as little as $1, and there are no withdrawal fees.

It offers six commission-free accounts, though the pricing structure can be pricier than competitors.

While deposits and withdrawals are free, Trade 360 doesn’t disclose third-party costs, which could be a downside.

So, these are the five best social trading platforms and networks that you can use to start social trade.

Consider bookmarking our Business Software Hub for more resources. Do check out our Trading Software section as we have some up-to-date and detailed resources for online traders.

Make sure to check out all services, and go through user reviews on Trustpilot before locking on a network that you think will serve you better.

User forum

0 messages