Accounting Software for Self-Employed: Best Picks in 2024

Choose the best accounting software from our top picks

8 min. read

Updated on

Read our disclosure page to find out how can you help Windows Report sustain the editorial team Read more

Key notes

- We’ve got the best solutions for those interested in finding reliable accounting software tools for self-employed.

- If that’s your wish as well, then you should try our top picks.

- Learn everything there is to know about them by taking a look at our Accounting software section.

- Lastly, we encourage you to bookmark this Personal Finance Hub for finding more handy tips.

Filing tax is a crucial task that takes a pretty good time to be done correctly. It takes a lot of patience and an eye for detail to fill up all the required details.

Since not everyone has a personal accountant to take care of tax matters, a tax program comes to their rescue.

These tax programs are especially useful for self-employed individuals who earn income by contracting with a trade or business directly.

So, what’s the best tax software for self-employed? While there is a wide range of tax programs available, finding the suitable one is the key.

Moreover, the best accounting software programs for independent contractors should also be affordable. There’s one for everyone, and so is the case with the self-employed individuals.

These tax programs increase their annual savings, track their income, and file their expenses efficiently.

For those who are wondering what’s the best tax software for self-employed, here’s a list we have created.

What is the best tax software for the self-employed?

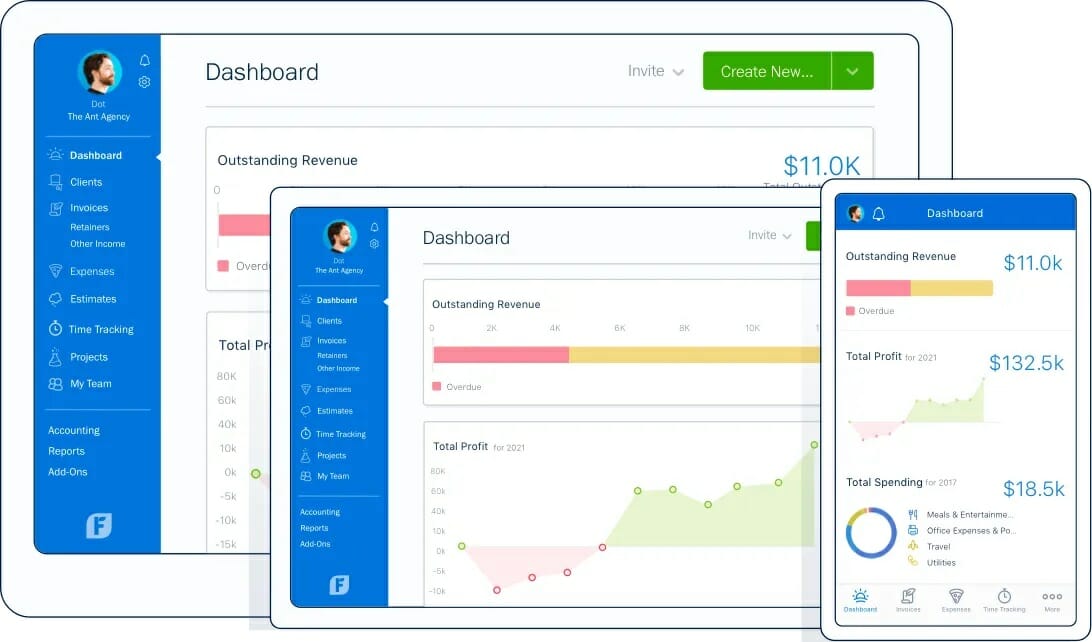

Freshbooks – Smart time-tracking tools

Track every dollar that goes in and out of your accounts and pay all the taxes on time using Freshbooks. It features a smart database of all expenses that can be updated in real-time with data from your payments.

Freshbooks keeps track of receipts, payments made through your bank account and does all the necessary calculus for accurate tax payments.

Since the platform was created to be intuitive, when tax time is closing in, just give access to your accountant and he will quickly find what he needs to do. Is that easy you can even do it yourself.

Thinking that some of the data is off? Easily create a customized report and find the issue with ease. Reports can be created for every type of data you provided Freshbooks.

Create professional invoices in seconds with clear details of the work done and the expenses. Also, remind clients that any payment is due with a smart reminder option.

Create faster payments by giving your clients options about the method used to pay. Simplifying the process and making it faster only boost your image.

Also, here are some key features of Freshbooks:

- Smart time tracking tools for tasks, projects and individuals

- Easy project management with real-time data for your clients

- Professional invoicing with smart payment options

- Reports for profitability, cash flow and finance health

- Smartphone integration

Freshbooks

Easy to use double-entry accounting for organic growth of your business.ZoHo Books – Client portal

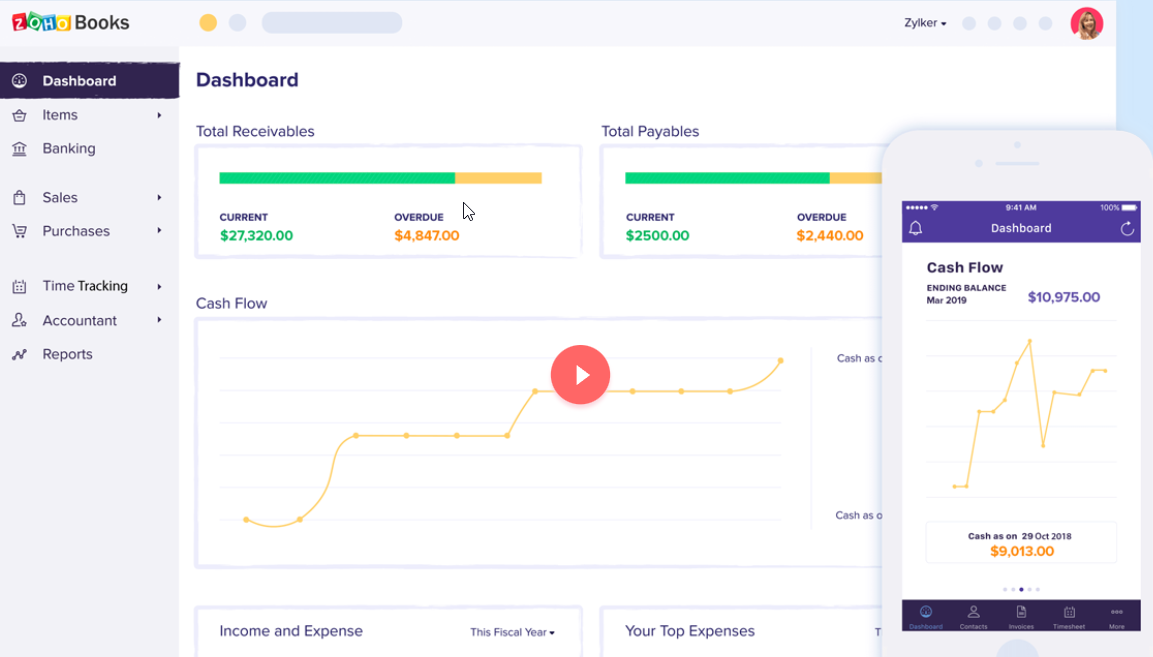

As a tool for taxes, ZoHo books excels in keeping all your expenses, upcoming payments and cash flow in order.

When tax time is close, don’t worry, ZoHo has everything under control. Get a smart overview of every amount of money you have using sophisticated reports with customizable data. If it’s kept in ZoHo, you can create a report about it.

When talking about expenses, ZoHo has a smart database that centralizes all payables. You can easily upload receipts, create and send purchase orders so you keep track with ease of every dollar in and out of your pocket.

To know when and where all your money is, ZoHo brings a bank integration, where you can import bank statements from your account, set categories for banking transactions and even do transaction reconciliation to stay tax season ready

Create invoices in seconds, send price estimates and follow up any late payment with reminders. On top of all this, get paid faster while giving your clients more payment options.

Apart from these, ZoHo’s key features also include:

- Time tracking tools for tasks, projects and yourself

- Unbilled hours and expenses tracking

- Client portal for easy communication

- Custom dashboard for business overview

- Inventory level tracking and low stock notifications

ZoHo Books

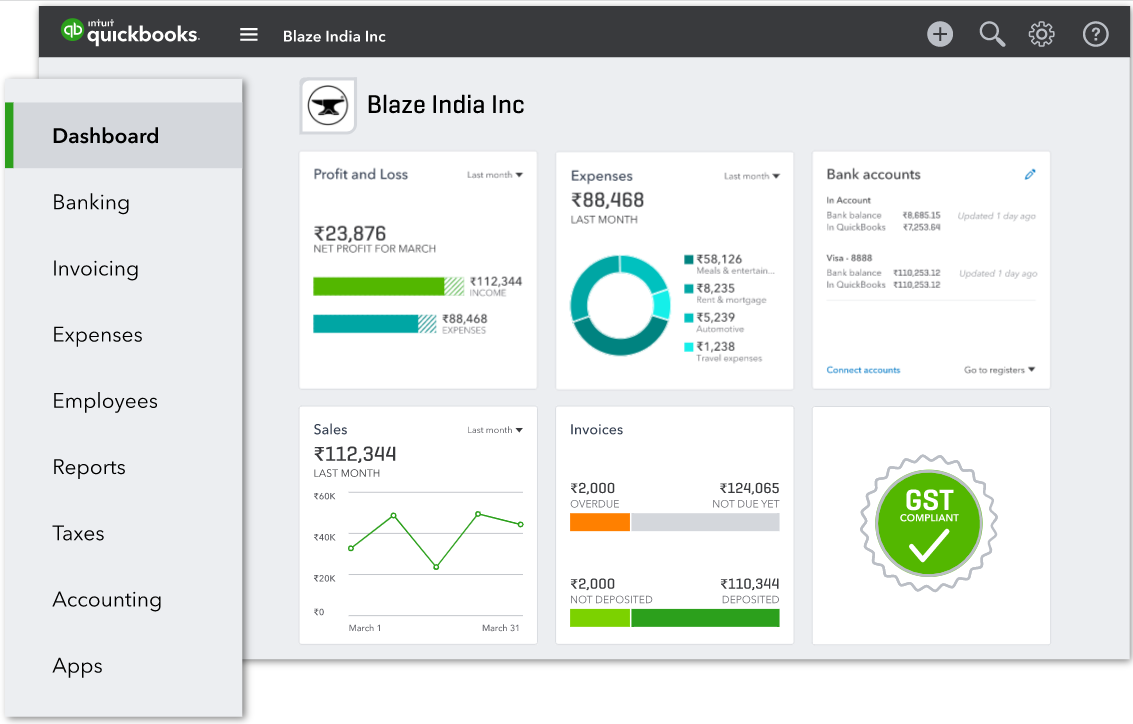

Manage your finances, taxes and automate workflow with this online accounting software.QuickBooks – Intuitive navigation

Currently known as the best accounting application for small businesses, QuickBooks Online is a top pick for self-employed as well.

With Automatic mileage tracking and the possibility to send invoices on the go, using it is intuitive and flexible.

You can also connect to your bank accounts, easily transfer info to TurboTax, and talk to real CPAs, among other features.

No note that there are three versions of QuickBooks to pick from, all of which work impeccable and offer a 30-day free trial for those who aren’t decided.

Key features that QuickBooks brings to the table:

- Intuitive navigation

- multilingual invoicing

- Useful add-ons and integrations

- Quarterly estimated taxes that are calculated automatically

- Helpful payroll support

QuickBooks

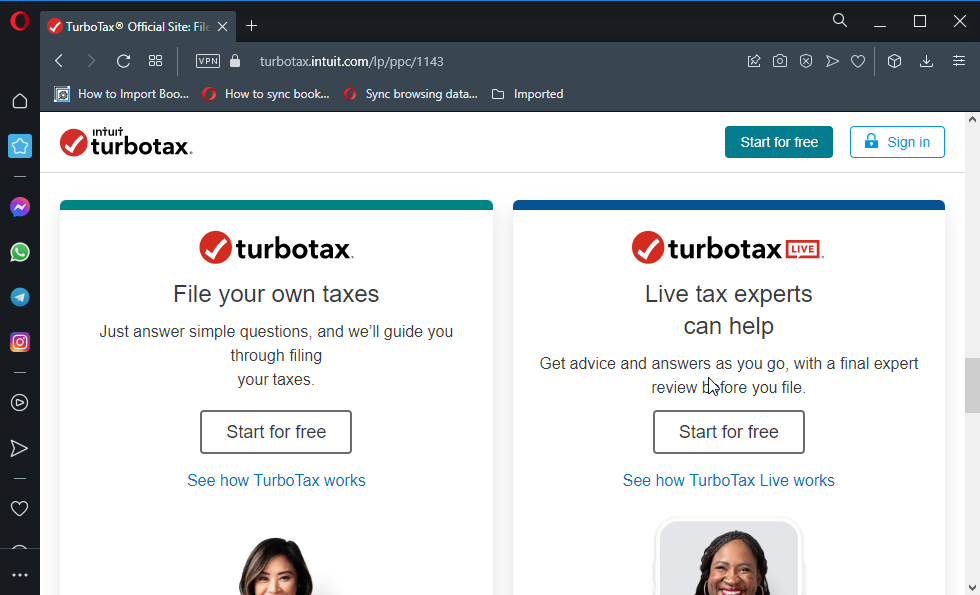

When you’re looking for the best accounting software for self-employed, you can’t go wrong with QuickBooks.Turbo Tax – Industry-specific deductions

Turbo Tax is one of the best tax software programs for self-employed that makes it faster and easier to file taxes, correctly.

It’s easy to use and convenient software that’s suitable even for beginners. Moreover, it offers added security to your tax details.

This program is especially recommended to those who use QuickBooks to maintain their books. It basically speeds up the entire process of tax preparation.

The best part is that it can import data from QuickBooks and checks for any errors meticulously. On top of that, there’s the ng customer support that helps clients with their queries at any time.

Key features you are about to enjoy:

- Ideal for both personal and business income and expenses

- Looks for industry-specific deductions

- Covers a variety of industries

- Easy 1099-MISC import with just a snap from your smartphone

- One-on-one help for answers from a TurboTax specialist

Turbotax

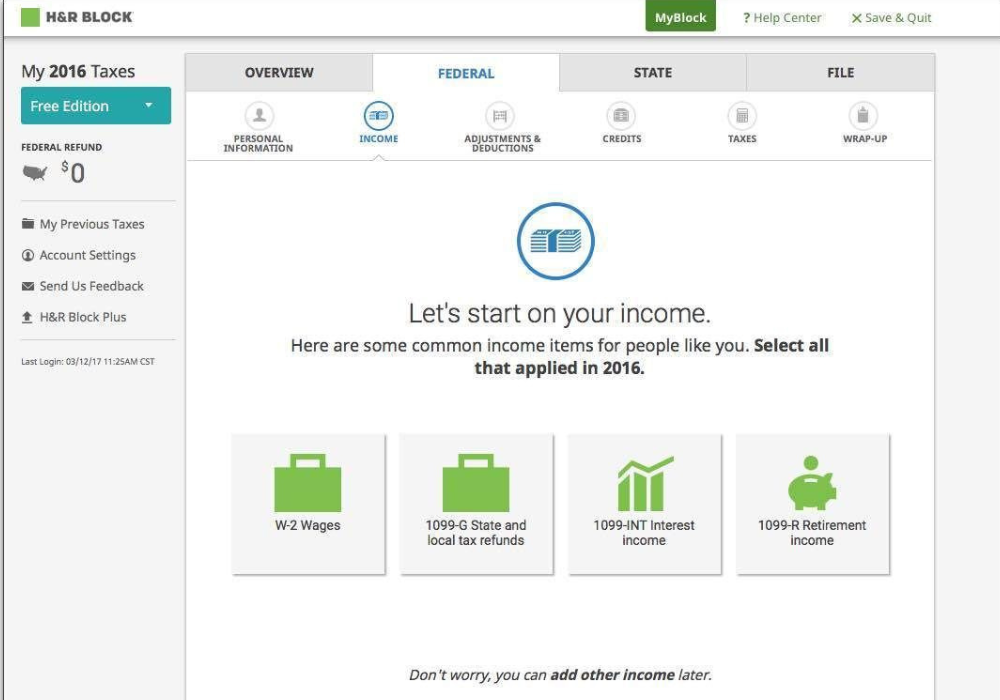

With Turbotax, your accounting plans are safe. Start for free and pay only when you file!<br>H&R Block – Unlimited live customer support

H&R Block is another great tax program for the self-employed that offers real pricing. It offers professional guidance from the experts in person or online.

This easy to use program comes with three chief guarantees. It helps users to achieve a maximum refund for their employment requirements considering the deductions based on the industry and expenses.

The software allows users to file payroll taxes returns 940 and 941, and also process yearly forms such as the 1099 MISC and W-2 for those having employees or 1099 contractors.

It also allows users to import data from QuickBooks and TurboTax into it.

From unlimited access to live customer support to personal tax consultation, the program offers unparalleled guidance at no extra cost.

Best of all, users can also avail of its audit facility in-person for no extra fees for its desktop edition.

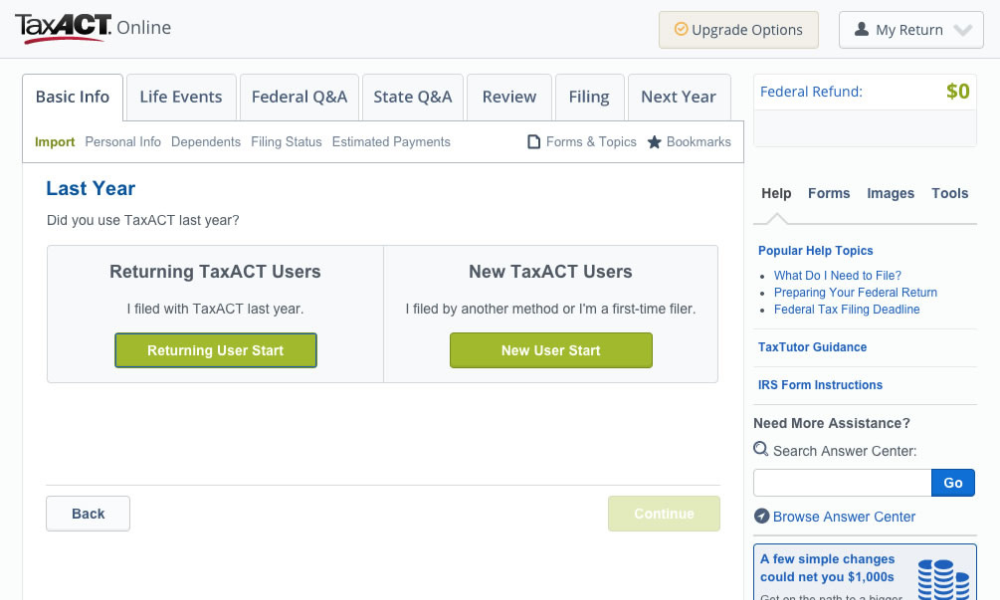

TaxAct – Suitable for self-employed people

TaxAct is suitable for the self-employed, especially for freelancers. It costs less than its competitors and allows users to file a single federal tax return.

The best part is, it comes with a price-lock guarantee and so, unlike its competitors, it offers its users the same price despite how long it takes to finish filing returns.

Whether it’s income through self-employment or investments, it offers support for all.

Life Events is a feature that applies to any possible changes in the filers’ tax situation from the previous year to the current one.

To help serve the filers better it offers 19 options related to different tax situations that might be relevant to the filer currently.

All the users need to do is to click on the respective link for added guidance, information, and tips.

Live customer support is another great advantage along with hyperlinked words and phrases offering detailed information.

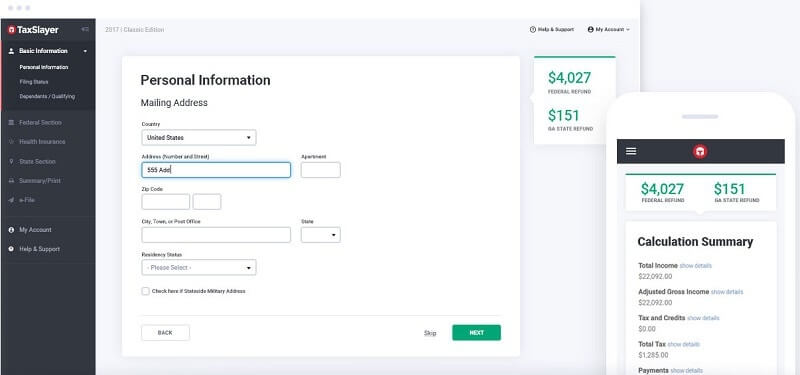

TaxSlayer – 100% accurate calculcations

TaxSlayer is especially suitable for those business owners who want to file Schedule C. It allows the tax filers to make their own 1040 and Schedule C forms. It’s known for its ease of use and maximizes refunds.

The program offers assured maximized refunds that the users are entitled to or they promise to refund the suitable price paid.

Users also have the facility to get their TaxSlayer filing charges to be deducted straight from the federal tax refund.

Best of all, it also guarantees 100% accurate calculations or they refund the customer any of the federal or state fees along with interest charges.

Credit Karma – Searchable guide

Yes, Credit Karma is also known for its services in the tax category. This premium software is available for free for all users, for both state and federal taxes.

The program provides 100% assurance for accurate calculations. Additionally, it covers individuals with free Audit Defense for those who get audited.

They also provide 100% assurance to users that they will receive the refund they are entitled to. Best of all, there are no hidden charges and no sudden fees.

It helps users manage all chief IRS schedules and forms that include related complex tax situations. Users can also import last year’s returns completed by any other software previously.

As a bonus, the interface offers a searchable guide.

If you’re self-employed, then you must be extra careful when choosing a tax software tool because that’s what should help you manage taxes efficiently.

Overall, the software can help import your data, optimize your tax deductions, checks for any mistakes, and offer unparalleled customer support.

So, for those who are wondering what’s the best tax software for self-employed, this should be your ultimate list.