Personal Bank Account Reconciliation Software: Best of 2025

8 min. read

Updated on

Read our disclosure page to find out how can you help Windows Report sustain the editorial team. Read more

Key notes

- Bank reconciliation software is a dream come true to anyone running a small business.

- As always, there is more than one option on the market and this might generate some confusion.

- But we’re here to help! Check out these best reconciliation tools that you can use to improve your workflows.

- From automated reconciliation software to accounting services, you’ll find your productivity booster for sure here.

Manual reconciliation is a tried-and-tested method and more than half of the companies in the US still take this approach. However, this it’s prone to human errors, unlike bank reconciliation software.

What’s more, automated reconciliation will take one of the most time-consuming tasks in the accounting department and make it faster and more efficient.

But, not every company is ready to make the switch yet. The prime reasons being the costs and the time it will take for the employees to get familiar with the new technology.

One way to know if your business would benefit from reconciliation tools is to start assessing your business needs.

Once done, evaluate the available software options and then focus on the training part as the rollout of the new automated system begins.

There are many reconciliation tools available on the market today. So which should you choose for your business? That’s where we step in.

This article will help you find the best bank reconciliation software to modernize your finance and accounting areas and boost your productivity.

What is the best bank reconciliation software?

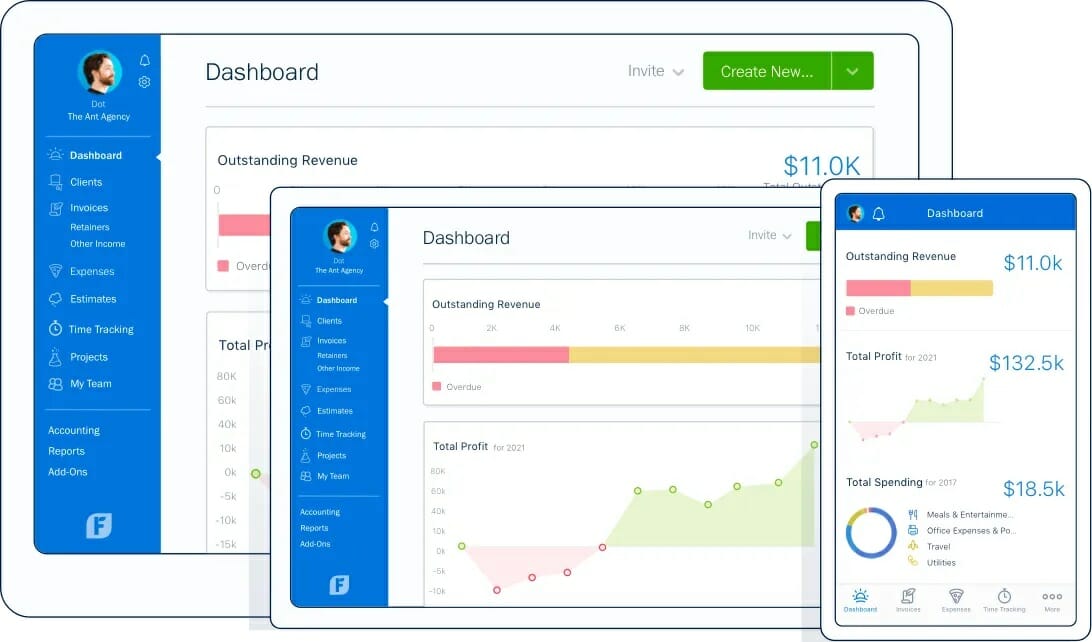

Freshbooks

Bank reconciliations are just one aspect of a much broader spectrum known as finance and accounting. Luckily enough, FreshBooks is a cloud-based software that will take care of every part of accounting, reconciliations included.

It doesn’t matter if you own a small company or a multinational enterprise, Freshbooks was built to be an easy-to-use, intuitive, efficient helper to increase your business productivity.

Double-entry accounting tools provide great help when it’s time to do a bank reconciliation. Since you can track all receipts, invoices and payables in one app, you will get it done in no time.

One key aspect of this bank reconciliation software is that it is simple and intuitive. Thus, you’ll spend less time on paperwork and impress your clients with how professional your invoices look.

Automate part of your business with a smart invoice system, with professional templates that will clearly show expenses and work done. Also, it comes with more payment options and automated late payment reminders.

Out of town? Have all features included within the mobile app, send invoices, check balances and real-time updates on projects from anywhere.

Other key features of Freshbooks are:

- Time tracking tools for all employees and projects

- Automatically add billed hours to invoices

- Multi-project management with real-time data

- Customizable reports with data filtering options

FreshBooks

See your company grow with bank reconciliations at a glance away.QuickBooks

When it comes to balancing checks, creating invoices, reconciliations, or pretty much any other accounting action, few tools can come close to this bank reconciliation software.

Just like balancing your checkbook, you need to review your accounts in QuickBooks to make sure they match your real-life bank and credit card statements.

Admittedly, unlike some of the other entries on our list, this service does not feature automated reconciliation software.

However, one great thing about QuickBooks is the added documentation that will teach you how to do pretty much anything. This includes guides that will teach you how to reconcile your accounts so they match your bank and credit card statements.

Here’s how to use QuickBooks:

- Get your bank or credit card statements.

- Use the Reconcile option in Tools, then choose the account you’re aiming at.

- Examine your transactions in the dashboard to compare whatever you had on the paper with what you already have in the tool.

Quickbooks shows, under the same screen, the type of transaction, the date, the amount, and the account. Pre-approved transactions from the bank appear as already checked by QuickBooks.

TurboTax

TurboTax focuses mainly on filing tax returns for small businesses. One of the best things about it is that it’s free to use for certain operations.

These include filing your federal and state taxes, importing your return from a previous year from similar tax software, or offering guidance in case of an audit.

This is not automated reconciliation software. Nevertheless, it’s very easy to use. To reconcile your accounts, you have a dedicated Balance Sheet option under the Federal Taxes menu.

Here you have to manually update existing accounts or enter new ones and make sure the entries match the amounts in your books.

Another advantage is that you can use TurboTax together with QuickBooks and import your balance sheet from there. Here’s one powerful combo that will produce the ultimate bank reconciliation software.

BlackLine Account Reconciliations

BlackLine is an automated reconciliation software that will allow you to control and streamline this challenging process. It is a cloud-based solution with an intuitive interface specifically designed for performing account reconciliation.

The reconciliation tools it offers include standardized templates, approval, and reviews, procedures, policies, and workflows for preparation. What’s more, the integration option allows you to store supporting documents on the cloud.

This bank reconciliation software maintains proper segregation of duties. In return, this reduces the possibility of human error in a paper-based manual spreadsheet. T

The users can see the details of account reconciliation, add text fields and upload supporting documentation. You can also follow up on the completion status in the dashboard or in a quick preview.

ReconArt Reconciliation Solutions

ReconArt combines bank reconciliation software with a management suite. It is a cloud-based solution that helps to streamline your finance and accounting reconciliation process. And it does so while increasing productivity.

When it comes to reconciliation tools, ReconArt’s solution is one that definitely pops out. And there a good reason for this. Its powerful functionalities allow you to operate at new levels of efficiency.

You can automate routine and high volume scenarios, or schedule activities and actions. It can also automate data mapping, imports, extraction, and enrichment process. Furthermore, it allocates codes for automated reconciliation status, adds item exceptions, sends alerts and notifications, and more.

Other benefits of this automated reconciliation software include the ability to recapture and redirect team bandwidth, reduce time-to-complete windows, increase accuracy and decrease risk.

Xero

Xero is ideal for Startups, small and medium-sized enterprises (SMEs). The cloud-based account management solution can also be used on smartphones via the app or through a web client.

Xero is more than just an automated reconciliation software. It offers the tools to process invoices and quotes, manage inventory, purchase orders, bills, and expenses, and more. Plus, you can import data from your other management solutions via third-party app integration.

Thus, you can further customize the Xero experience by integrating it with services like PayPal, Shopify, Expensify, Deputy, Gusto, Squarespace and more for point-of-sale, time tracking, e-commerce and so on.

The online dashboard allows you to monitor cash flow with charts and graphs, customize reports, see details about your bank accounts and credit card, follow up on outstanding invoices, monitor your sales and specific parts of the business.

For the reconciliation process, Xero automatically imports bank transactions every working day, sets up rules to automatically match bank transactions to invoices, creates routines, groups similar transactions, and more.

But there is more to Xero than a suite of reconciliation tools. You can also track project times and spendings, create and check inventory items, pay bills, and run unlimited payroll across all states using Gusto.

⇒ Get Xero

Statement Matching

Statement Matching is a cloud-based automated reconciliation software solution available for Windows computers. It is ideal for startups, SMEs, agencies, and enterprises.

Statement Matching comes equipped with reconciliation tools, it can keep track of credit notes, payment dues, miss-posting, and send notifications and alerts.

Unlike other bank reconciliation software that require you to upload suppliers’ documents, Statement Matching takes it one step further. Thus, it allows suppliers to access and reconcile their own statements, view the status of the invoices, and leave comments via the online portal.

The software reconciles the statements by company and vendor using the invoice date, number, amount, and currency details. You can also use it with cross-company and cross-vendor in case the supplier has multiple accounts on your system.

Bank Rec (Treasury Software)

Bank Rec is an automated reconciliation software that allows you to perform high-speed automated matching with predefined rules. For each account, you can select matching rules such as issue-to-issue, check-to-check, and user-defined.

The Reconciliation Wizard offers reconciliation reports that satisfy the Sarbanes-Oxley 404 act. It can also generate period-sensitive reconciliation reports that include historical data. Everything can be exported to Excel if necessary.

Using exception reporting, you can identify why a record didn’t match with your ledger. Furthermore, you can track unmatched items and resolve the problem using the Point and Click option.

Bank Rec uses Type Classes as an attribute during matching to achieve the highest possible rate. You can import Excel and CSV files or simply copy and paste them for easier imports. It also supports BAI files, SQL insertion, and QuickBooks integration.

Bank Rec is an offline software that can free your employees from the time-consuming manual reconciliation task and allow them to focus only on exceptions.

Automated reconciliation software can help you with data availability, different data formats, lack of transparency, data matching issues, and data complexity, that often create problems during transactional matching.

These reconciliation tools will surely help you improve your workflows and make your staff more efficient with fewer human errors.

User forum

0 messages