Download Moneydance for Windows 10

Paid, Free Demo / Version Moneydance 2021.1

1 min. read

Updated on

Read our disclosure page to find out how can you help Windows Report sustain the editorial team. Read more

Price: $49.99

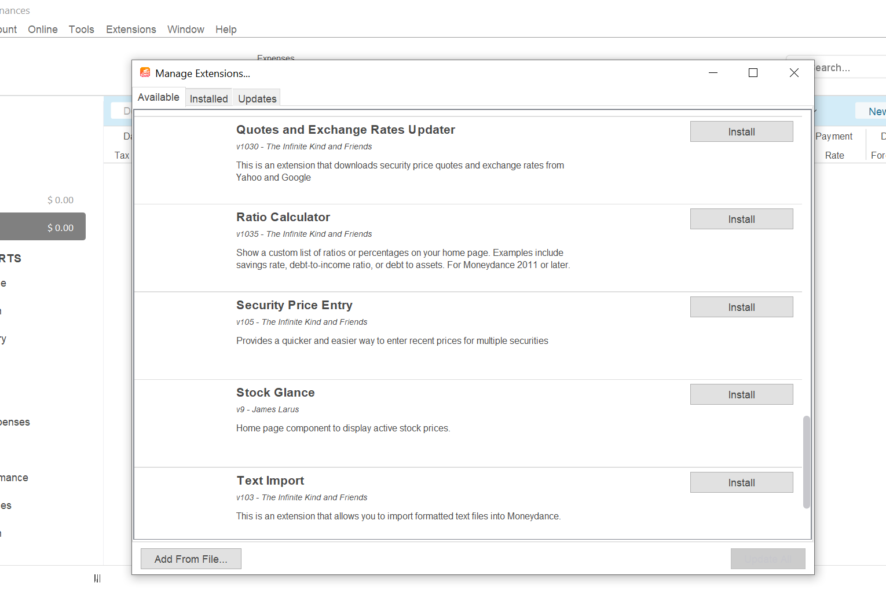

Download nowMoneydance is a personal finance software developed by The Infinite Kind. It is designed as an accessible tool, for regular, non-accountant users.

Money management software are very helpful tools meant to improve and manage personal finances. They are mainly used to keep track of spendings and to create budgets.

There is an impressive number of such tools on the market with various, constantly updating features. Below, we’ll focus on Moneydance and give a run-through of what it has to offer.

Moneydance’s System Requirements

In order to be able to run the latest version of Moneydance, your system has to meet the following minimum requirements:

- Processor: 2Ghz;

- RAM: 4GB;

- Hard Disk: 200MB;

- Video Card: Any;

- Operating System: Windows 10.

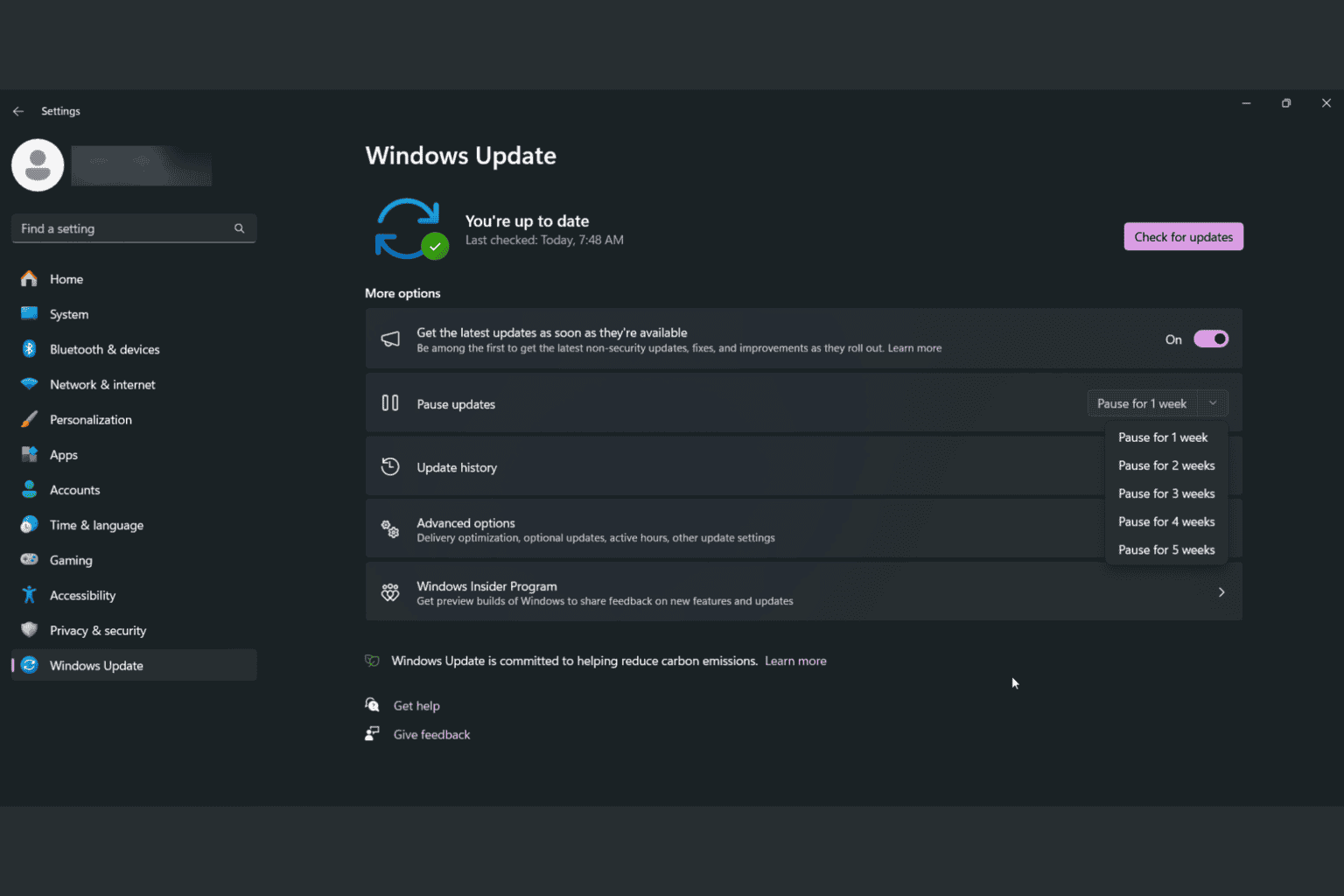

Screenshots

Our Review

- Pros

- Great security

- Supports multiple currencies and offers currency conversion

- Investment tracking

- Compatible with cryptocurrencies

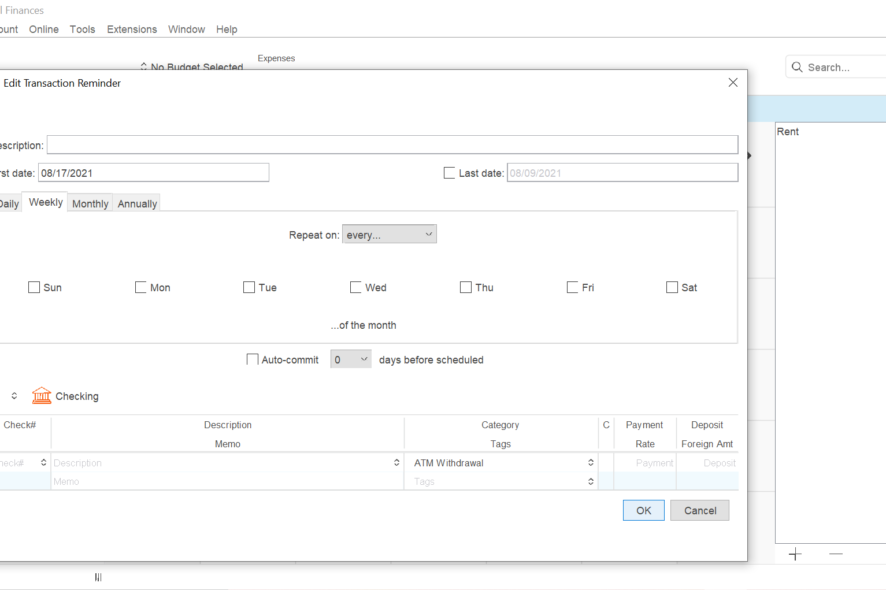

- Allows transaction scheduling

- Detailed activity graphs and reports

- Reasonable price & one-time fee

- Can be tested for free for the first 100 transactions

- Cons

- Mobile apps need improvement

- Customer support is done mostly by email and FAQ

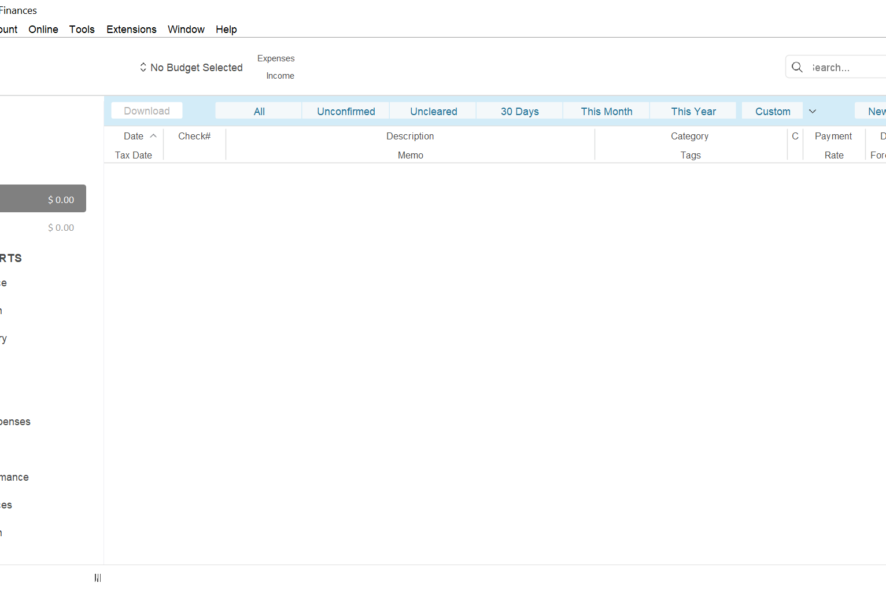

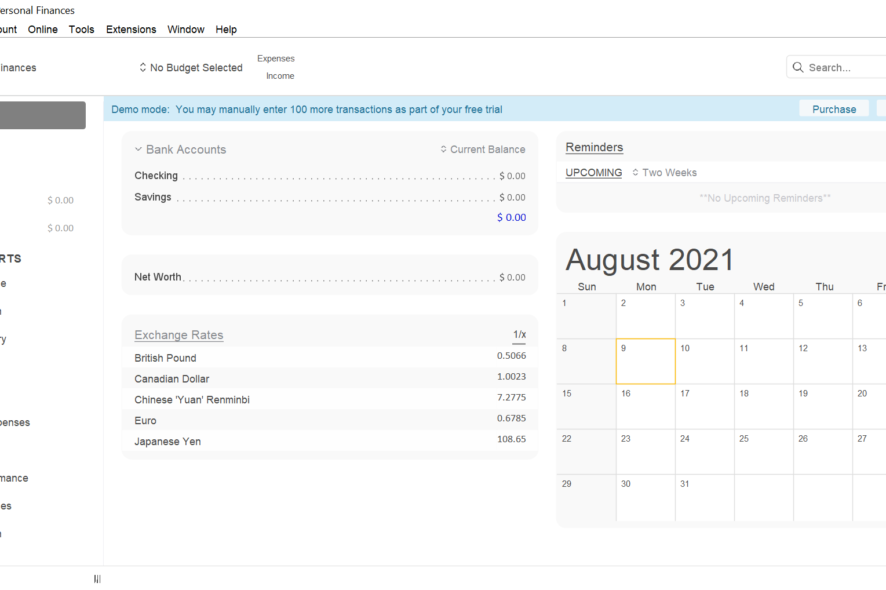

Online banking for multiple accounts

Moneydance allows the management of numerous accounts. The software is compatible with a large number of institutions, making it very likely that the user will be able to manage all their transactions in one place. You can check the official website to see all the banks the software supports.

You can download transaction data, send payments online and schedule all your transactions. The software automatically categorizes your transactions so you can easily access the information whenever you need it.

- Bank accounts

- Credit Card Accounts

- Investment Accounts

- Asset Accounts

- Liability Accounts

- Loan Accounts

When you want to connect whichever account type, you’ll just have to pick it from a pre-defined list and continue with filling your data.

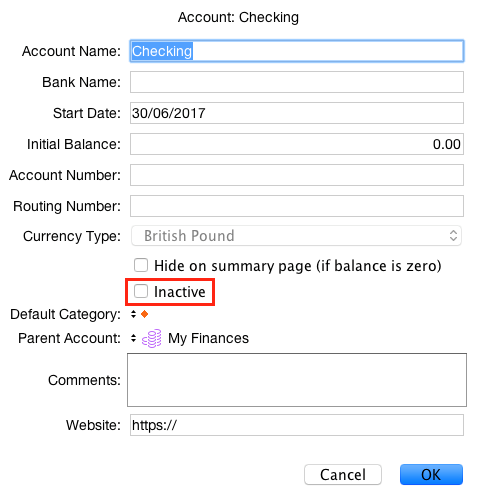

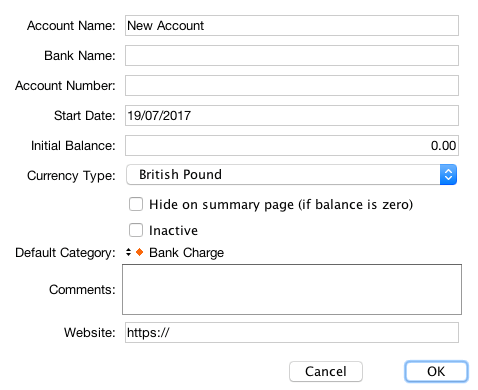

You can easily change the name, currency, and other details regarding your accounts, all in one place: Edit Accounts (see picture below).

If you don’t use an account anymore but want to keep the data in case you need the information or if you plan to use it in the future, you can hide it from the main dropdown list by listing it as inactive.

To mark an account as inactive go to Account, Edit Account, and check the Inactive box.

Automatic Registers

With the Account registers feature, you can enter, edit and delete transactions. It is meant to resemble the experience of a paper checkbook register, but the processes of sorting the transactions and calculating balances are done automatically.

It has an auto-complete feature that helps you enter and categorize transactions more efficiently.

Moneydance uses a double-entry principle to keep track of your accounts. That simply means that every financial transaction has effects in at least two different accounts.

You can make transactions between a financial account and an expense or income category, or between two financial accounts.

Create and follow Investments

Moneydance allows its users to create and manage various types of investment accounts like stocks, mutual funds, savings, or precious metals.

To create an Investment account, select Account and then New. Select Investments as the type of account and click Next.

Enter all the necessary details regarding your account and you’re all set. You can now view a summary of your investments, investment securities, and performance data.

The Portfolio View is a summary of your accounts. You can see details such as price, number of shares, and current value for one Investment account at a time.

If your account contains multiple types of securities (stocks, bonds, etc), Moneydance will generate a graph in the Portfolio View. The graph shows the distribution of value across all your different types of securities.

The Bank Register view assists you in doing standard bank-type transactions with your Investments accounts.

The Securities Detail view gives information about specific investment securities in the account. You can see a transaction list, security information with the number of shares owned, current price, value, cost basis, and more.

You can also access security functions that allow you to record a stock split, to add or edit your securities. The Securities Detail view is also the section where you can delete your securities.

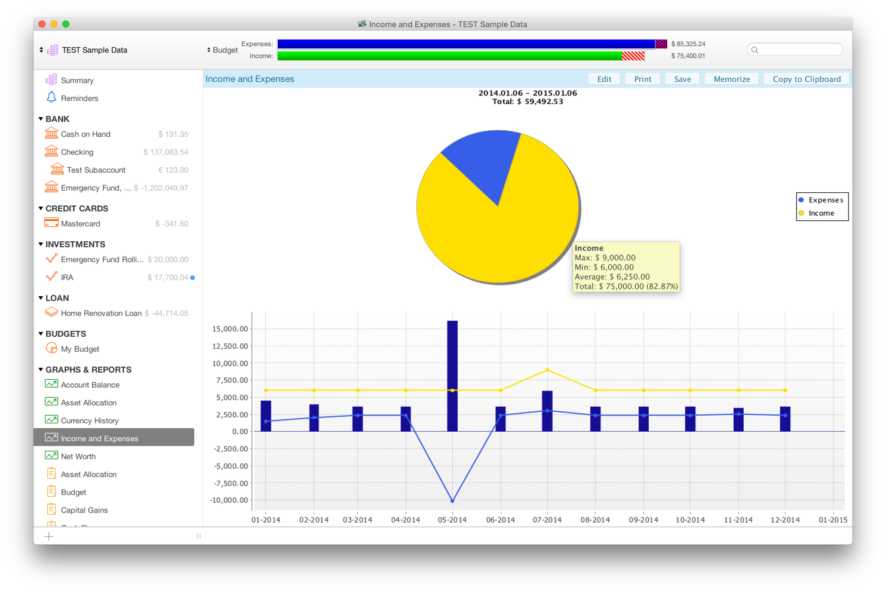

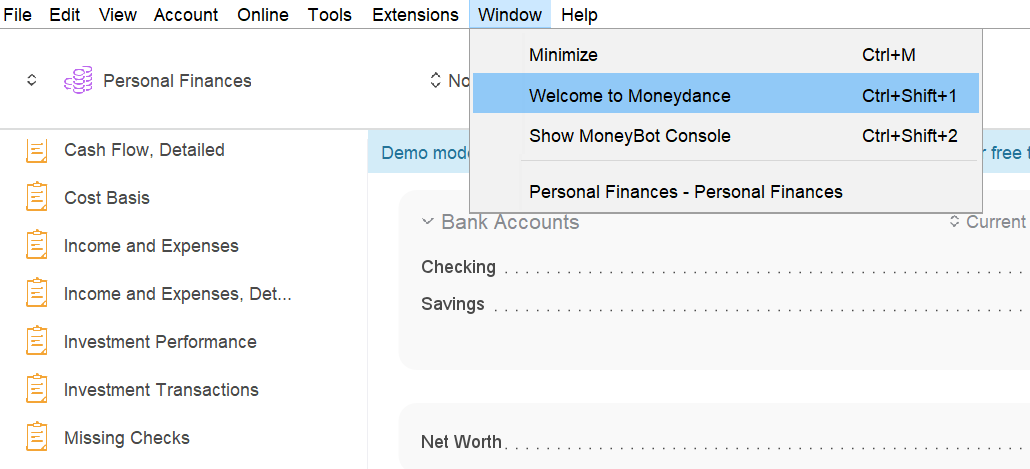

Graphs/ Reports

Moneydance generates detailed reports of your financial activity which can be further used to analyze and improve your money management behavior. All reports can be downloaded and printed.

Moneydance can generate several types of graphs and reports. You get Account Balance graphs and reports in which you can include or exclude sub-accounts. You can get Balance reports and graphs on a specified period like a day, a week, a month, or a year.You also get reports and graphs about your Expenses where you get an overview of your expense categories and their values over a specific period of time. You can also get a comparative graph of your Income and Expenses.

Other types of reports and graphs provided by Moneydance include:

- Asset Allocation: graphs and reports regarding the division of your assets

- Budget reports

- Investment Performance Reports

- Net Worth reports and graphs

- Transfers

If you decide to use Moneydance, you can get more in depth information about the graphs and reports and how to use them by checking the instructions provided online by the creators of the software, on the Infinite Kind website, in the Knowledge Base section.

Collaborate by Syncing your data

If you need to collaborate on a specific financial management activity, or if you want to share your data with an accountant to get professional expertise, you can easily do that with Moneydance.

To safely share financial data with Moneydance:

1. Open the file you want to share

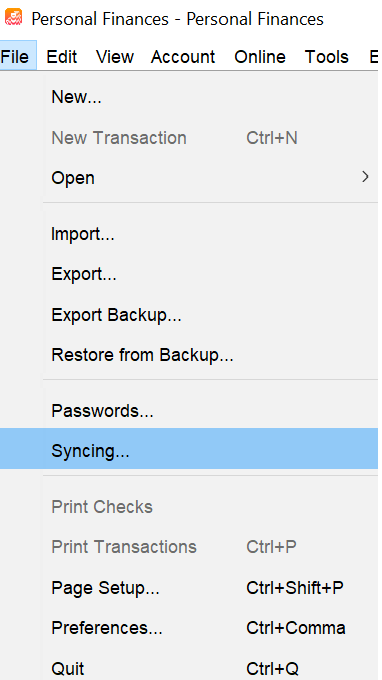

2. Go to File and select Syncing

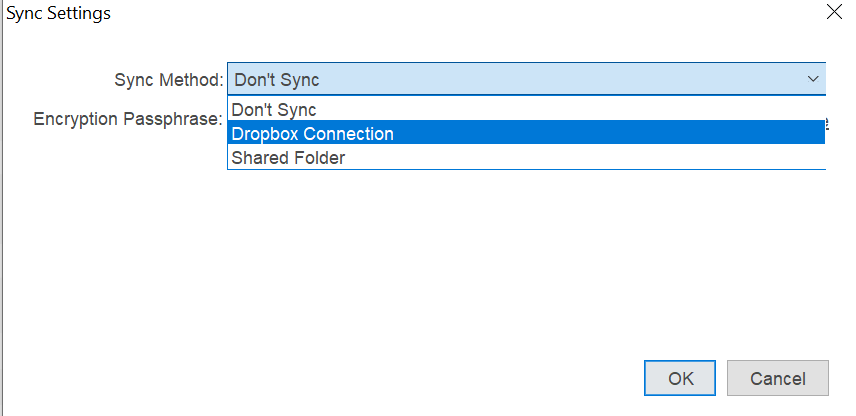

3. Choose your preferred option: Dropbox Folder, Dropbox Connection, or Shared Folder

4. Create an encryption password

Now, on the computer you want to open the shared information:

2. Select Open Synced File

3. You will need to enter the same encryption password

4. Open the file

Organize and manage your finances

Moneydance allows you to set budgets by adding spending targets per month/week or any other interval. Check your budget status in the app’s toolbar or in Graphs & reports.

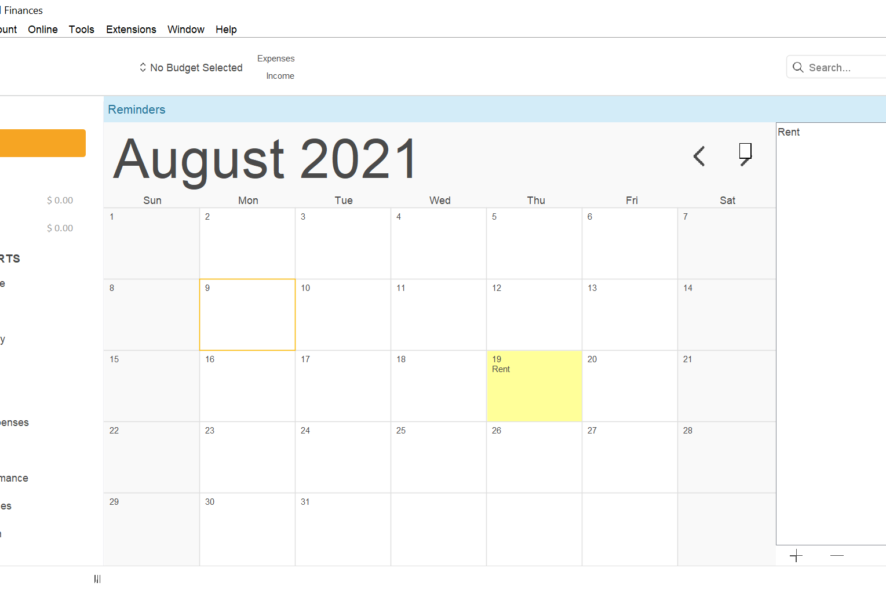

You can also set reminders for upcoming transactions to make sure you never miss a payment.

Another useful feature that keeps all your information in one place is the attachments option. You can attach images or documents to your transactions with drag-and-drop.

Moneydance has two budget formats, the Mixed Interval Budget and the Monthly Budget. The monthly budget is used to create budgets with consistent intervals whereas the Mixed Interval Budget is great when you want to include different time intervals within your budget.

Is it worth it?

In a nutshell, Moneydance is a trustworthy money management tool. It has been on the market for quite some time, but it provides new, up-to-standard features and great security. Anyone can use it, accounting skills are not necessary.

Its greatest assets are the fact that it is compatible with a big number of institutions and account types, you can do it all in one place.

In terms of costs, the price of Moneydance is similar to those of similar services, it’s not expensive, yet not the cheapest out there. Considering the extensive toolset it provides, the price is justified.

Full Specifications

- Software Version

- Moneydance 2021.1

- License

- Paid, Free Demo

- Release Notes

- •Added Security Price History report

• Added Progress indicators of import processes

•Improved handling of quoted fields

• Updated report viewer

• Added Brazilian-Portuguese translations

•Updated report viewer

• Embedded browser compatibility with some of the banking sites

•New calculation method

User forum

0 messages