3 best tax software deals for no stress

4 min. read

Updated on

Read our disclosure page to find out how can you help Windows Report sustain the editorial team Read more

Here are our top 3 picks for tax software deals

TurboTax

From developer Intuit, TurboTax is one of the most popular tax preparation software solutions in the US. Available both as an online and offline product, it gives American citizens the possibility to effortlessly file taxes, as well as print and email them.

TurboTax comes in four flavors for Black Friday 2019: Basic, Deluxe, Premier, and Home & Business. Each one comes with more features than the last.

For instance, TurboTax Basic ensures a maximum tax refund and a user-friendly graphical interface for preparing, printing and emailing your taxes.

It assists you every step of the way and makes sure there are no errors on your side. Tax data from the previous year can be imported from TurboTax or other tax software.

The Deluxe version allows you to download 1 state and get help with over 350 tax deductions and credits. If you have donated any objects, you can track them for the entire year, get a clear idea of their value, and import them into TurboTax with the help of ItsDeductible (for iOS).

Meanwhile, TurboTax Premier offers a service that evaluates your tax return after filing it. Plus, it gives you personalized advice for the following year.

More professional assistance is readily available with employee stock plans, bonds, mutual funds, royalties, refinancing, income for rental property, general expenses, and retirement tax using an IRA tool.

Lastly, the Home & Business edition of TurboTax is specially created for small businesses and self-employed individuals, like freelancers or consultants.

In this edition, you receive extra guidance for successfully managing your tax deductions, including office supplies and home bills, as well as for finding out tax deductions for startups.

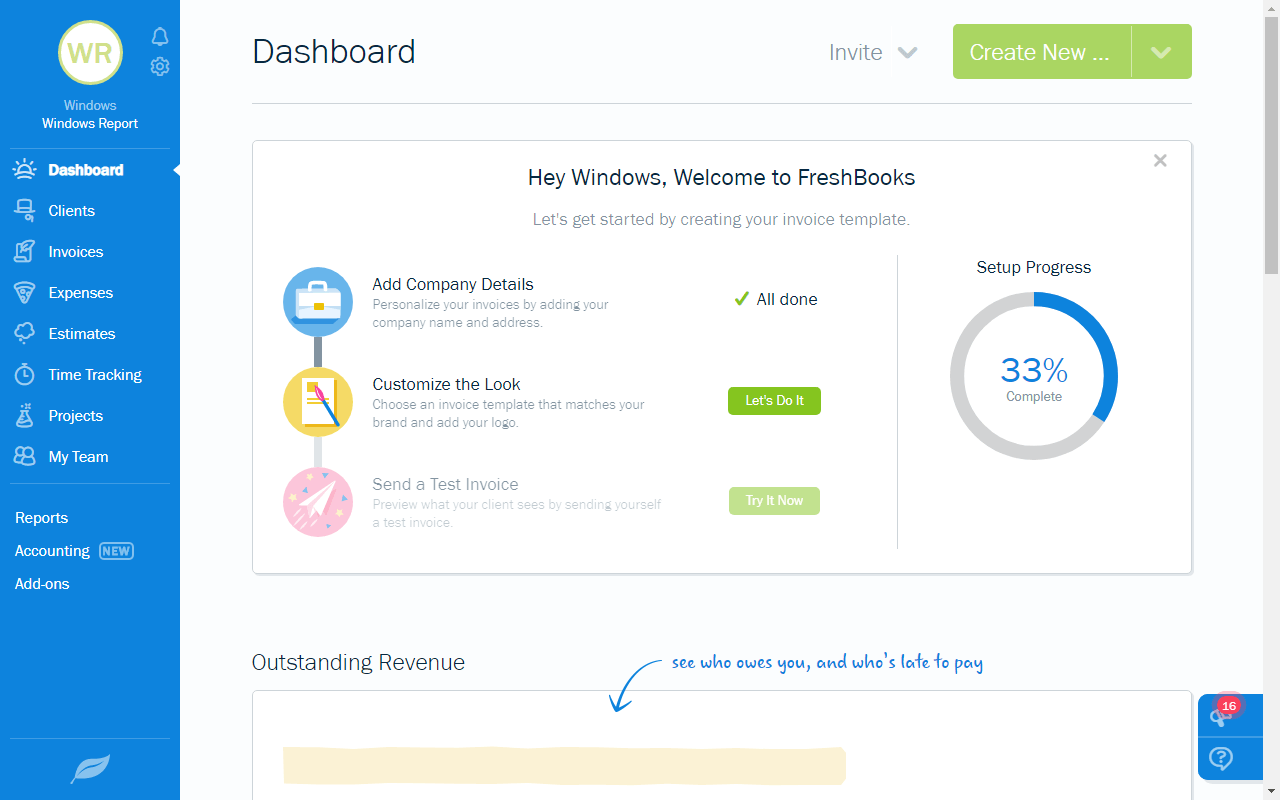

FreshBooks

FreshBooks is a cloud-based accounting and invoice software solution oriented toward small businesses, both entrepreneurs and teams.

It’s wrapped in an incredibly intuitive interface, making it possible to manage your company’s financial affairs with minimal effort. And, by inviting team members, such as employees, contractors and accountants, you can efficiently work together.

With the help of FreshBooks, it’s possible to organize clients and billings, retainers and other income, keep track of your expenses, connect with your bank, and rebill clients. Further, you can set up estimates and turn them into invoices with one click, as well as create proposals for clients.

- Download FreshBooks (free trial)

Projects can be tracked, shared and billed in a single place, thanks to collaboration tools. Plus, you can generate a wide range of reports, such as accounts aging, collected payments, bank reconciliation summary, or item sales.

When it comes to Black Friday 2019, you can check out tax software details for FreshBooks in four models: Lite (5 billable clients), Plus (50 billable clients), Premium (500 billable clients) and Select (over 500 billable clients). Each model unlocks more features than the last.

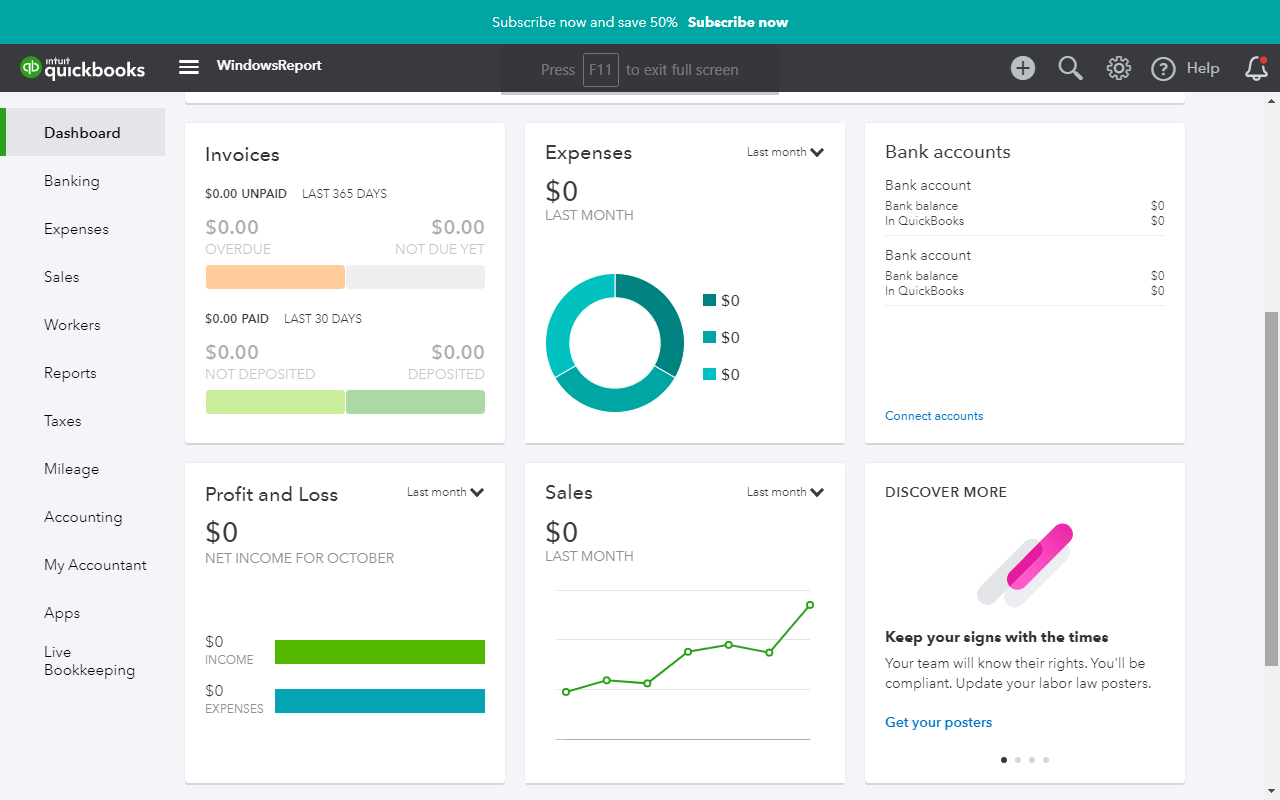

QuickBooks

QuickBooks is another accounting software solution designed for small and medium-sized businesses. It can be accessed from a web browser or downloaded to your computer, whether you are the business owner, a simple employee, an accountant,the bookkeeper, or have another role.

Using this program, you can send and track invoices and bills, monitor your sales tax and retail sales, organize your inventory and expenses, as well as oversee your working hours with time-tracking tools.

It is possible to create automated tasks for income and expense tracking, define rules for each transaction, add and use receipts, monitor your contractors easily, or pay your employees and file taxes.

- Download QuickBooks (30 days free trial)

QuickBooks can also generate various reports, log your trips to set up mileage deductions, show your chart of accounts, and put a real-life accountant at your disposal.

There are multiple five subscription plans available for the QuickBooks tax software, which you can check out on Black Friday 2019: Self-Employed, Simple Start, Essentials, Plus, and Advanced. Each edition comes with more tools than the previous one.

Conclusion

Managing your taxes shouldn’t be overwhelming, not with the right software solution at hand. Don’t hesitate to get a tax software deal at a reasonable price on Black Friday 2019 and put your mind at ease.