Best Tax Software for Tax Preparers [No EFIN Required]

It's possible to file taxes without EFIN, with certain limitations

7 min. read

Updated on

Read our disclosure page to find out how can you help Windows Report sustain the editorial team Read more

Key notes

- All these applications will help you file your taxes, and many offer great support.

- For continued use, we suggest that you register your EFIN, since it's completely free.

Filing your taxes isn’t always simple, but there is tax software that works with no EFIN required. However, this isn’t the most reliable solution in the long run.

Before we cover some of these applications, we’ll briefly explain what EFIN is and what limitations these applications have if you’re not using it.

Can I prepare taxes without an EFIN?

Electronic Filing Identification Number is required if you want to file your taxes.

It’s possible to prepare taxes with EFIN, but if you want to do it without any limitations, you must register an EFIN.

How many returns can I file without EFIN?

You can file up to 5 returns electronically, but if you want to submit more, you’ll need to use an EFIN.

What is the best tax preparation software with no EFIN?

TurboTax – Best tax manager

TurboTax is a great user-friendly tax software that allows you to streamline the process of applying for your tax return, and it works without an EFIN code.

You can gain access to TurboTax either by downloading software or by accessing the online tax portal.

The advantage of downloading the software is that you can access all your stored documents even if not connected to the internet, and all your files are stored locally.

If you don’t have enough space on your hard drive or don’t want to download anything, you can use the online TurboTax. The advantage of this method is that it allows you to access your files from anywhere in the world easily.

One of the best features found in TurboTax is its ability to help you through every step of applying your online papers.

As you go through the steps required to apply for taxes, you will be guided by a small banner on the side of your screen. This lets you know what you need to type and saves you time.

Because of the chat-line structure of TurboTax, it almost feels like an interview while completing all the data required.

Even though the free version of this software offers you access to file 1040 Forms, allows you to claim the child tax credit, earned an income tax credit, and is designed for those of you who don’t need to claim any deductions or credits other than the standard deductions.

If you need the software to process more complicated papers, try one of the premium versions.

Here is a small summary of the premium editions of TurboTax:

- TurboTax Free Edition – you can file your taxes for free, covering your W-2 income, EIC, and child tax credits.

- Deluxe – you get everything already in the Free Edition and 350 + tax deductions and credits along with maximizations of tax deductions and credits.

- Premier – contains all the features found in the Deluxe version and adds the ability to report both investments and rental income

- Self-Employed – contains all the features found in the Premier version and adds deduction help, expense-tracking, and independent contractors features

Turbotax

Handle all your taxes efficiently with this tool and a guarantee for a maximum refund!We have a separate guide on TurboTax covering all the good and bad about the software; read this to know more.

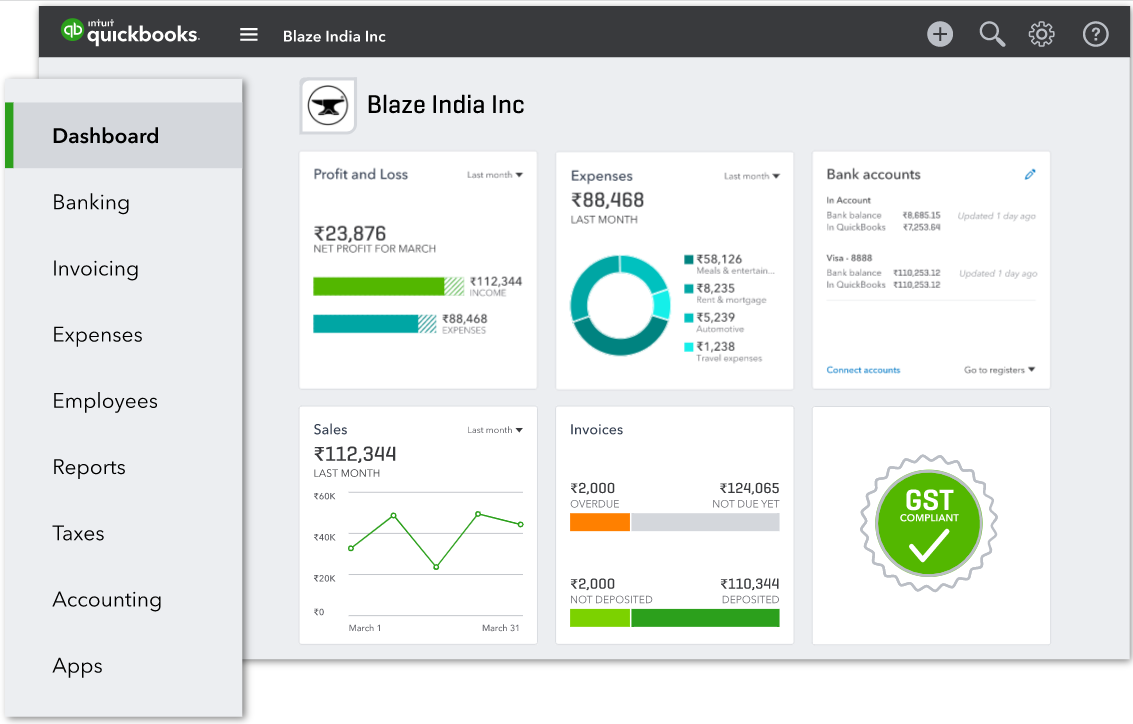

QuickBooks – Extremely versatile

If you’re looking for a quick and easy solution to pay taxes, look no further than QuickBooks. With this service, you can connect to your bank directly and configure bank feeds, credit cards, and online payment processors such as PayPal.

This will eliminate the chance of any errors since all transactions will go through QuickBooks. Doing so lets you track and manage bank transactions, import revenue and expenses, and report on all transactions.

The service allows you to create custom invoices and track payments in real-time, so it’s perfect if you’re running a business. Speaking of businesses, the service allows you to analyze costs and income on multiple projects.

QuickBooks also supports commonly used tax rates; you can create your own if needed. The service is available online on any device or platform, so you can use it without limitations.

Other great features:

- Automatic backup.

- Supports over 500 additional apps.

- Dedicated mobile apps.

- Support for custom reports.

- Cutting-edge security and privacy.

QuickBooks

With its extensive functionality, QuickBooks is perfect tax software for home users and professionals alike.TaxSlayer – Offers outstanding assistance

TaxSlayer allows you to prepare your federal and state tax returns online, while the service will help you claim all the available tax breaks and refunds.

All income types are supported, and you can file your 1040 with ease. The service can also autofill your income and wages simply by importing W-2s and 1099s. It’s important to mention that IRS inquiry assistance is available, so you can rest assured that your data is always correct.

TaxSlayer also supports reminders, so you won’t miss submitting your taxes. In case of an audit, you can also get assistance from an IRS enrolled again.

This excellent service should help you pay your taxes quickly, and with superb assistance, you can rest assured that all your information will always be 100% correct.

Other great features:

- Ability to complete federal and state tax returns online

- The service can help you claim tax breaks

- Supports 1040 with all income types

- Ability to autofill income using your W-2 and 1099

- Offers IRS inquiry assistance

H&R Block – Offers great protection features

This is another great service that allows you to file your taxes, and it offers step-by-step guidance and help from experts while filing taxes.

The service offers great security and privacy with Tax Identity Shield, allowing you to monitor your tax info. A second look feature is also available, allowing experts to review your old returns and ensure everything is in order.

In case of any problems, there’s protection from audits and multiple layers of protection, thus ensuring that all your data is safe. Before filing your taxes, the software will also scan and ensure everything is correct.

This is an excellent and professional service, so don’t hesitate to try it.

Other great features:

- Accuracy review that ensures your information is correct every time.

- Ability to work with TurboTax files.

- Enhanced protection.

- Great support.

AccuTax – Complete federal tax line

AccuTax is another incredibly useful tax software that allows you to prepare your taxes, whether you want to do it for an individual or a business.

This software allows you to file papers electronically, refund settlement products, etc.

Even though this software doesn’t require an EFIN account to perform tax returns and many other operations, it is worth mentioning that the team at AccuTax can also help you get an EFIN in a shorter time.

AccuTax was released in various versions, each catering to the different needs of users so that it will be suitable for all your needs.

Other great features:

- Compatible with data from Lacerte, Intuit/ProSeries, Tax Slayer, and other services.

- Provides several different pricing models.

- Easy to use.

- Doesn’t require EFIN.

Can I get an EFIN online?

Yes, you can get EFIN online for free by doing the following:

- Create your IRS service account.

- Next, you need to file your e-File application online.

- Once the application is approved, you’ll get EFIN number from the IRS.

The process can take up to 45 days, and during it, you’ll need to pass a suitability and tax compliance check, along with other checks.

Because not all of us know how to file taxes, what steps we need to take for tax returns, and all the other complicated ways to deal with taxes, using specialized software greatly helps.

The software options we presented in this article contain all the tools you need to easily sort out your taxes each year and allow you to file papers without an EFIN code, no matter how many operations you need to do.

Yes, it is possible to get an EFIN if you have bad credit. While bad credit is taken into consideration, it is not always a barrier when trying to get an EFIN.

If you need additional functionality, consider using accounting software for self-employed, or tax filling software for small businesses.

The comment section below lets us know how these software options work.