6 Best Free Cloud-Based Tax Software for Small Business

Get real-time reports of your business and try these solutions

9 min. read

Updated on

Read our disclosure page to find out how can you help Windows Report sustain the editorial team. Read more

Key notes

- Cloud accounting is an online service you can use to get reporting in real-time, as well as visibility in your business or company.

- A good, yet free cloud accounting software will offer functions such as reporting, inventory, invoicing, payroll, sales tax, job costing, and more.

- The options below cover various accounting tasks including invoice support, vendor records, VAT management, and more.

- Your privacy is also vital, so we made sure to select tools with up-to-date security features and encryption.

Cloud accounting is an online service you can use to get reporting in real-time, as well as visibility in your business or company.

This differs from traditional accounting because it is flexible.

You can access your accounting data from anywhere and any device instead of on-premise computers alone, plus the information is updated automatically for real time financial reporting.

Therefore, unlike the manual or traditional ways of keeping your books fresh, cloud accounting ensures your account balances are accurate.

And with fewer instances of errors from data entry, plus it can handle more transactions and currencies better.

Cloud accounting software thus steps in to make cloud accounting happen, and successfully at that.

What is the cloud accounting software infrastructure?

The software is hosted on remote servers and accounting data is sent to the cloud for processing, then returned to you, the user.

All applications and functions are done off-site, compared to traditional accounting which is done on your desktop.

And the software is accessed remotely, free from installations, and software maintenance hassles. Your team members can also access the same accounting data and software from wherever they are.

In addition to this, regardless of how big you expand your business, you don’t incur additional costs on maintenance and license control or management.

It is secure and comes with sharing options, plus you can access your accounting data even when other servers are down, as this is hosted in the cloud.

A good, yet free cloud accounting software will offer functions such as reporting, inventory, invoicing, payroll, sales tax, job costing, fixed asset tracking, banking, and other basic accounting features.

Here are our top picks for the best free cloud accounting software for 2020.

What are the best free cloud accounting tools for Windows PCs?

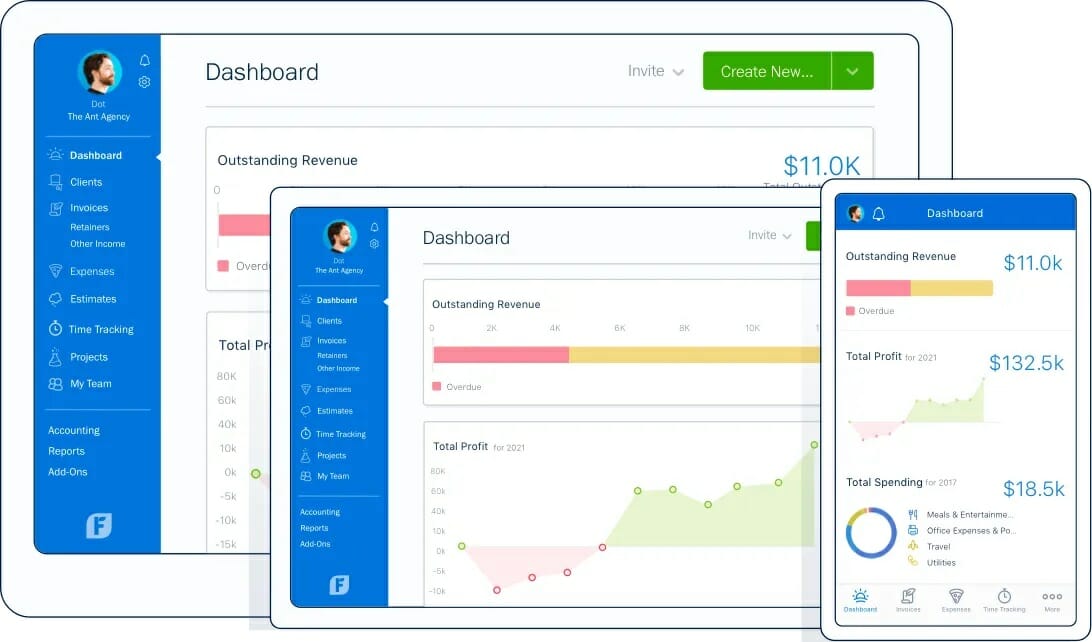

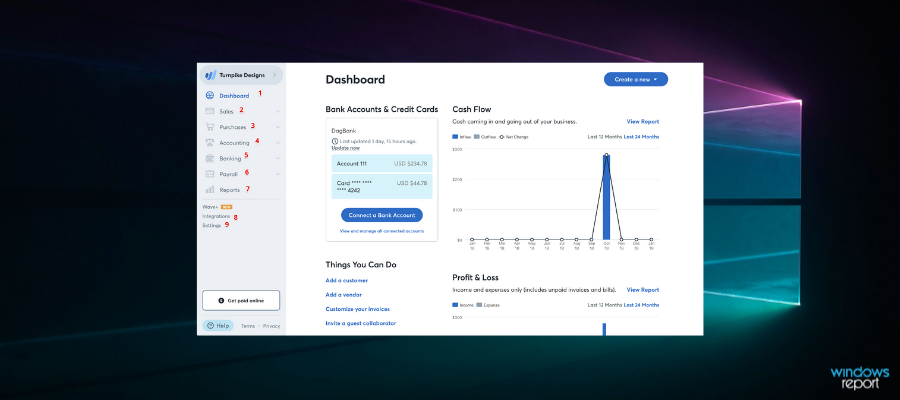

FreshBooks – Detailed bookkeeping

FreshBooks is the cloud accounting software you’re looking for when you plan to put your business on autopilot. It offers business owners an intuitive double-entry accounting experience that is integrated with the rest of its rich tools.

Be sure that you’re one hundred percent involved in the procedure of creating professional invoices, organizing expenses, and receiving payments.

To simplify the FreshBooks features:

- A solid Framework that provides detailed bookkeeping and effortless insights into your finances.

- A huge database that allows attaching receipts as well as the possibility to import expenses right from your bank accounts.

- Invoice creation in a few seconds with detailed reports on expenses, billed hours, and projects.

- The possibility to add billed hours automatically to invoices and send them right away, with the option to send reminders about late payments.

- Faster payments to you and your clients with its automatic deposit feature.

- A database where you have all your conversations, files, and work status, that also provides reports about anything with ease.

Thanks to its flexibility, it helps you save time from chasing your clients or worrying about numbers and dedicate it to growing your business instead.

FreshBooks

Cover everything from invoices to bookkeeping and save precious time with this accounting tool.Zoho Books – Payment reminders

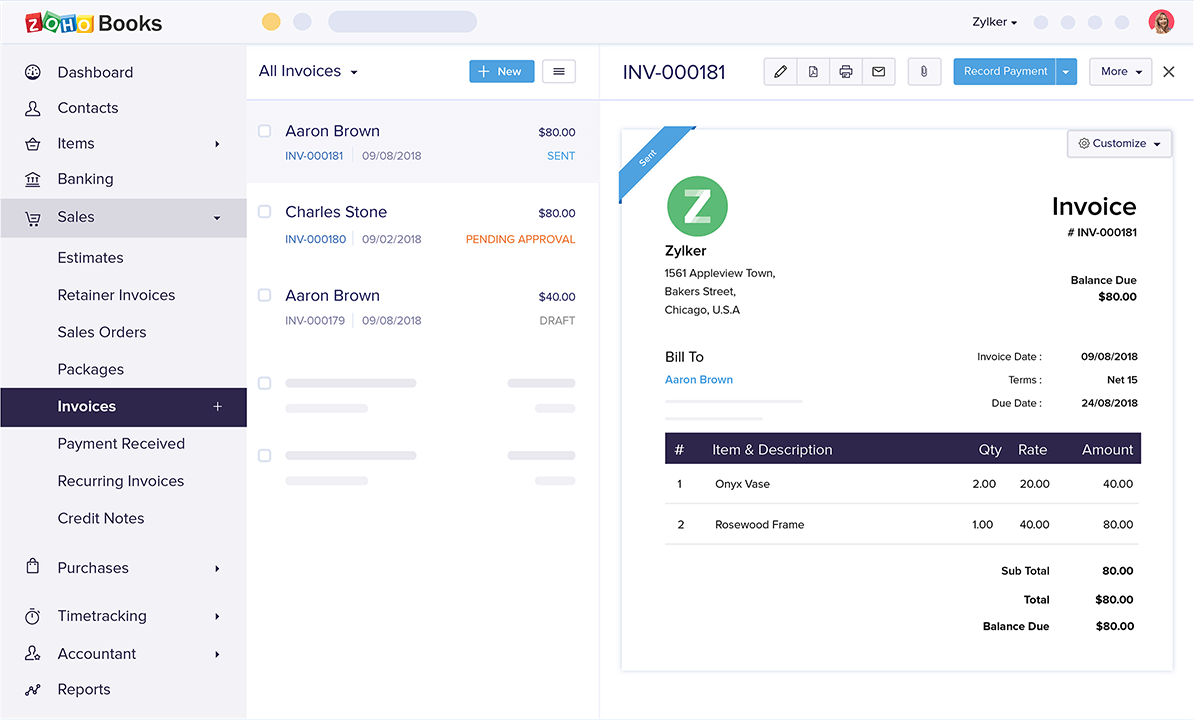

Zoho Books is a free-to-use cloud-based software that offers a full package when it comes to taxing, accounting and invoices. Offering a smart way to save and keep track of every cent, this software allows you to upload every receipt and import expenses right from bank accounts.

With an amazing overview of all expenses, you can easily create custom reports about any data you need, time management, billed hours, upcoming payments, expenses, and many others.

As your clients and employees are your main focus, ZoHo provides a client portal as well as a secure way to store client payment information. As for employees, keep them close to Slack integration and never miss a beat.

What are the pros and cons of Zoho Books?

Pros:

- Wide range of features for every type of business

- High-security measures for its features

- Time tracker for tasks and projects

- Payment reminders

- Integrations with Slack, Office, and DropBox

- Scaling possibilities for freelancers and companies

- Free with affordable upgrade options

Cons:

- No fixed asset management

- Annual invoice limit of 5000

Created to offer everything a business needs to reach the top results in no time. Productivity and efficiency are the top priority for Zoho Books.

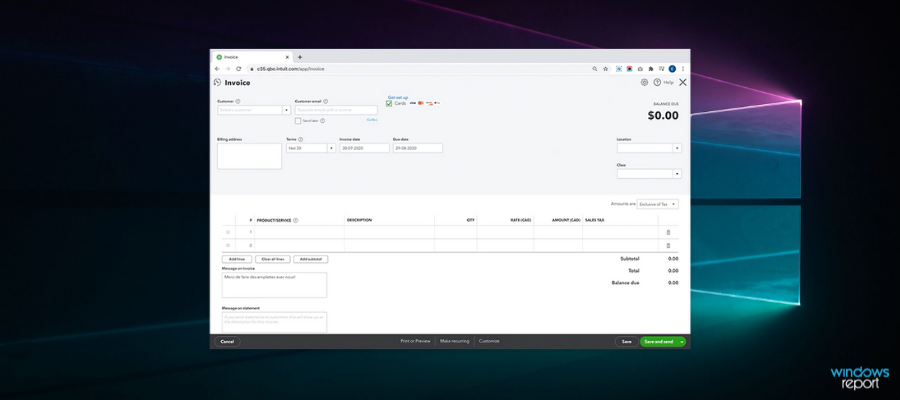

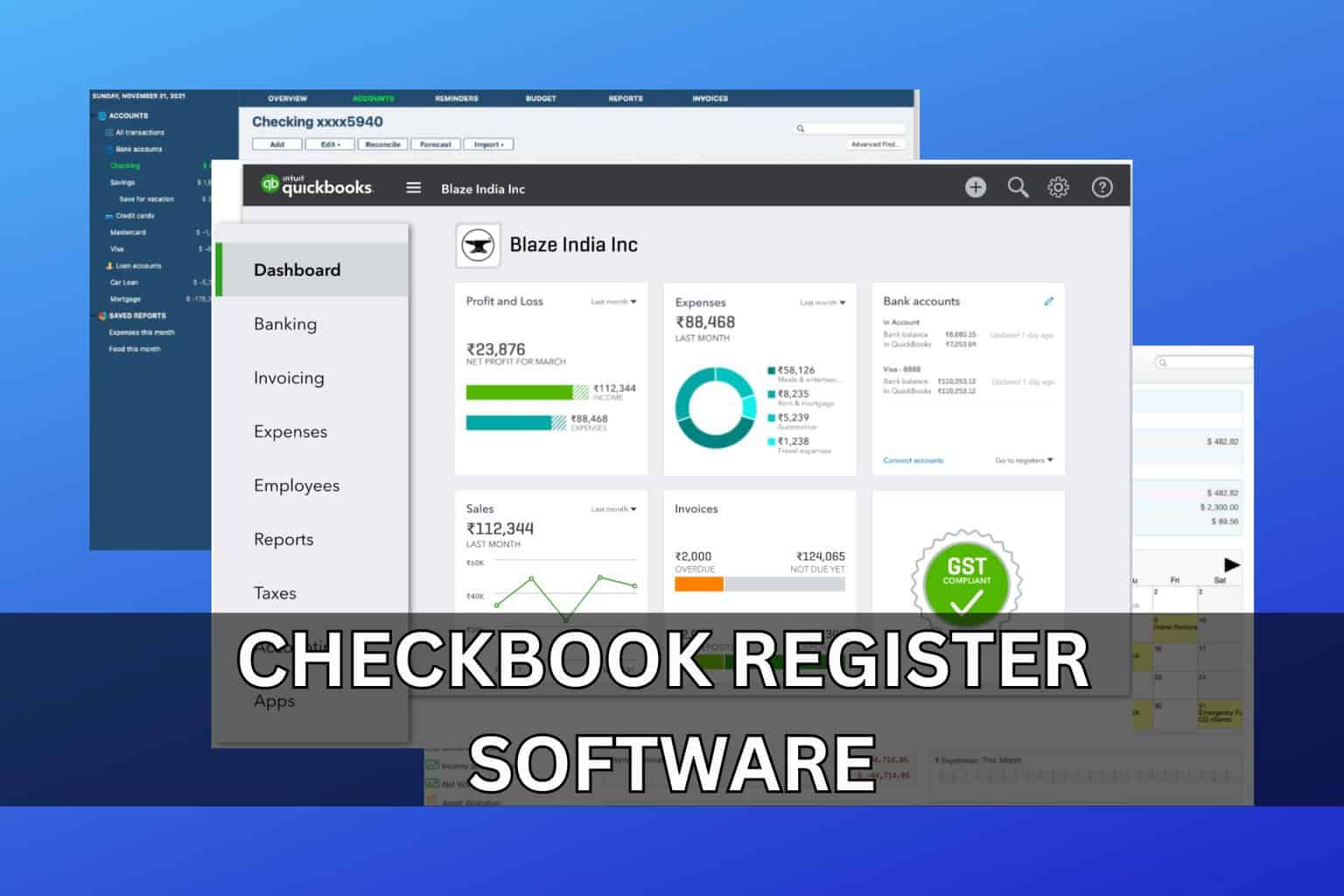

QuickBooks – Easy to use

QuickBooks is an exceptionally robust cloud accounting software that manages small business finances and ensures all your decisions are based on actual business data and accurate insights.

To help you manage your business finances in a smart way, QuickBooks assures that your data is stored in the cloud.

You may enjoy easy remote access to your account data from any location and keep the workflow going from PC, Mac, phone, or tablet. This isn’t the only advantage you should expect to get from QuickBooks.

A set of comprehensive financial tools walk you through all processes starting from importing your data all the way to sending custom quotes and invoices to get paid faster than ever before or calculating project profitability.

What are the pros and cons of QuickBooks?

Pros:

- Easy to use and learn

- Amazing accounting reports

- Multilingual invoicing featuring receipt tracking

- Can be accessed from any device

- Easy to look up customer information

- Affordable

Cons:

- Created for small businesses, using limitations on users/number of transactions

- Lacks reports outside of accounting

QuickBooks makes sure you always know where your business stands, yet it’s both intuitive and easy to operate. All these make it appealing to small businesses, so choose the plan that works better for your business right away.

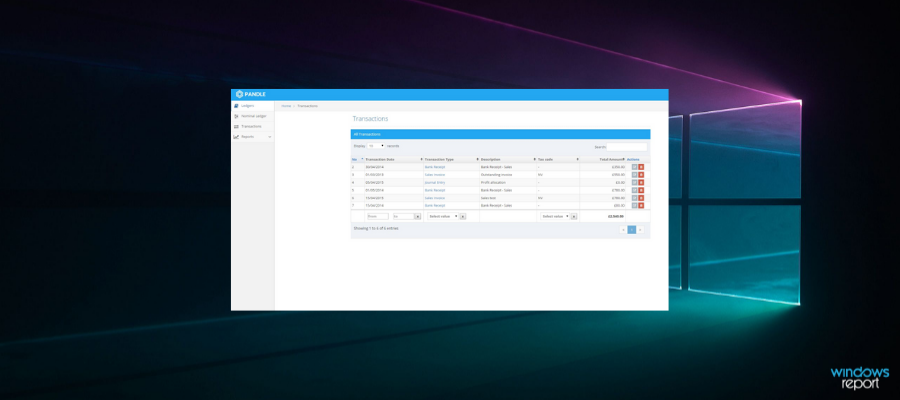

Pandle – Great customer support

If you want free cloud accounting software that will last with you until the end of time, Pandle is your best bet because it is free forever!

Pandle provides full VAT management with support for cash accounting and FRS, cash flow forecasting, multiple currency control, and access to your accounts from the mobile app.

It also includes an interactive help center filled with guides and videos plus an FAQ section for all your queries, daily backups, bulk transaction editing, tax estimations, and reminders.

What are the pros and cons of Pandle?

Pros:

- Simple, intuitive, easy to use, yet very sophisticated

- Automatically pull transactions from your bank account

- Premium templates for invoice sending

- Payment reminders with multiple currencies

- Great customer support

Cons:

- No PDF support

- No customizable invoices

When it comes to security, it offers data encryption with 128-bit SSL just like what is used by banks. Pandle comes as a simple and quick cloud-based software for all small businesses.

Wave – High Security

This is one of the best free cloud accounting software and online resources for small businesses.

Some of the benefits you can enjoy by using Wave include a professional image, faster payments, better organization of your transactions and books of account, easy payroll processing with guaranteed accuracy, and it is 100% free of charge.

You can use the invoicing, accounting, receipt scanning, payroll, and other tools all for free, with zero limits, and zero charges, for as long as you want.

It is easy, intuitive, and can be used by anyone, not just accountants, and you can start in seconds as soon as you sign up.

The platform is organized and customizes software instantly so no need for technical configurations, plus you can work from any computer or device, at any time.

What are the pros and cons of Wave?

Pros:

- Unlimited income and expense tracking

- No invoice limit with customizable templates and payment terms

- Unlimited numbers of users

- Live chat support for all software

- High security with 256-bit SSL encryption

Cons:

- No Upgrade plans for better functionalities

- No phone support

Other features include double-entry accounting software, automatic reports, and simple and instant collaboration with other people you trust to manage your books with controlled access.

Get all your invoicing, receipt scanning, payroll, and other accounting needs in one place on the cloud with professional, customizable, easy, unlimited, and free cloud accounting software.

⇒ Get Wave

TaxSlayer – Smart document managament

Tax Slayer is a service that provides expert-level assistance in tax refunds. They gear towards different types of customers, from individuals that need help with their personal taxes, to big and small businesses. They even offer support for tuition fees.

Getting started with Tax Slayer is easy. It has highly responsive agent customer support via email and phone. They take you through the whole process and explain everything along the way.

You can upload your W-2 form and Tax Slayer automatically uses all necessary information for incoming forms and documents.

What are the pros and cons of Tax Slayer?

Pros:

- User-friendly interface

- Supports both federal taxes and state taxes

- Smart document management and e-filing support

- Easy to use right from your phone

Cons:

- Professional support is limited

- Free package is not recommended for high earners

Tax Slayer promises high accuracy in helping with your taxes. They ensure that their team carefully calculates and researches credits and deductions. They promise reimbursement for any federal or state penalties.

Tax Slayer targets all types of tax-paying customers, so they have various subscription plans that offer specific services depending on your needs.

Why do you need a cloud accounting software?

Each of these free cloud accounting software tools comes with distinct features but there are a few things they all have in common including:

- User-friendly interface compared to traditional accounting software.

- Free subscription and longevity

- Simple accounting language

- Ease of use for both accountants and non-accountants

- Built for mobile so you can access it from your smartphone or tablet

- Interactive pages and dashboards

If you want to know which free cloud accounting software is suitable for you, or your business, you may not find one that exactly matches your specs.

But you can tell from the software’s interface, navigation, abilities to import your data, do actual bookkeeping tasks, support for data access, your team size, plus whether the software is customizable and scalable.

User support is also important because you may have questions or troubleshooting issues so you need assistance.

Does any of these six free cloud accounting software match your needs?

Tell us which one you like the most, or if you have used any of these before, share with us your experience in the comments section below.

If you want to learn more about accounting software, don’t be surprised to find more information in our Accounting Software section.

If you’re in for a more broad approach, check out our Business Software Hub.

User forum

0 messages