Net Wealth Worth Software: 9 Best to Use in 2024

14 min. read

Updated on

Read our disclosure page to find out how can you help Windows Report sustain the editorial team Read more

Key notes

- Keeping track of your income and expenses can help you get a better understanding of your financial habits and needs.

- Using financial tracking and managing software can help you save money, pay your bills in time, and see how you can increase your income.

- Find below our suggestions for some of the best financial management software that can calculate your net worth, help you set budgets, and more.

While creating a financial plan, your budget is the ultimate key to success. It allows you to take control of your financial future and be confident about your spending and investments.

However, another key factor to successfully managing your financial progress is using the best net worth tracker

By keeping track of your net worth with a financial app, you can measure your financial progress to determine your current debt and investment status.

Preparing a net worth statement is not just about tracking your finances but has more than one use.

For example, it can help you with the loan application, stay focused and motivated to achieve your financial goals and of course, know when you are ready to take retirement.

Tools to Track Net worth this year

A good number of people use Excel spreadsheets to keep track of their net worth by creating liability and assets columns. While it works, it is not the most efficient way of tracking net worth.

There are a good number of finance tracking tools that not only allow tracking net worth but also manage the budget, investment, and more.

In this article, we take a look at the net worth aggregator to make your personal finance management process simple and efficient.

What software should I use to track net worth?

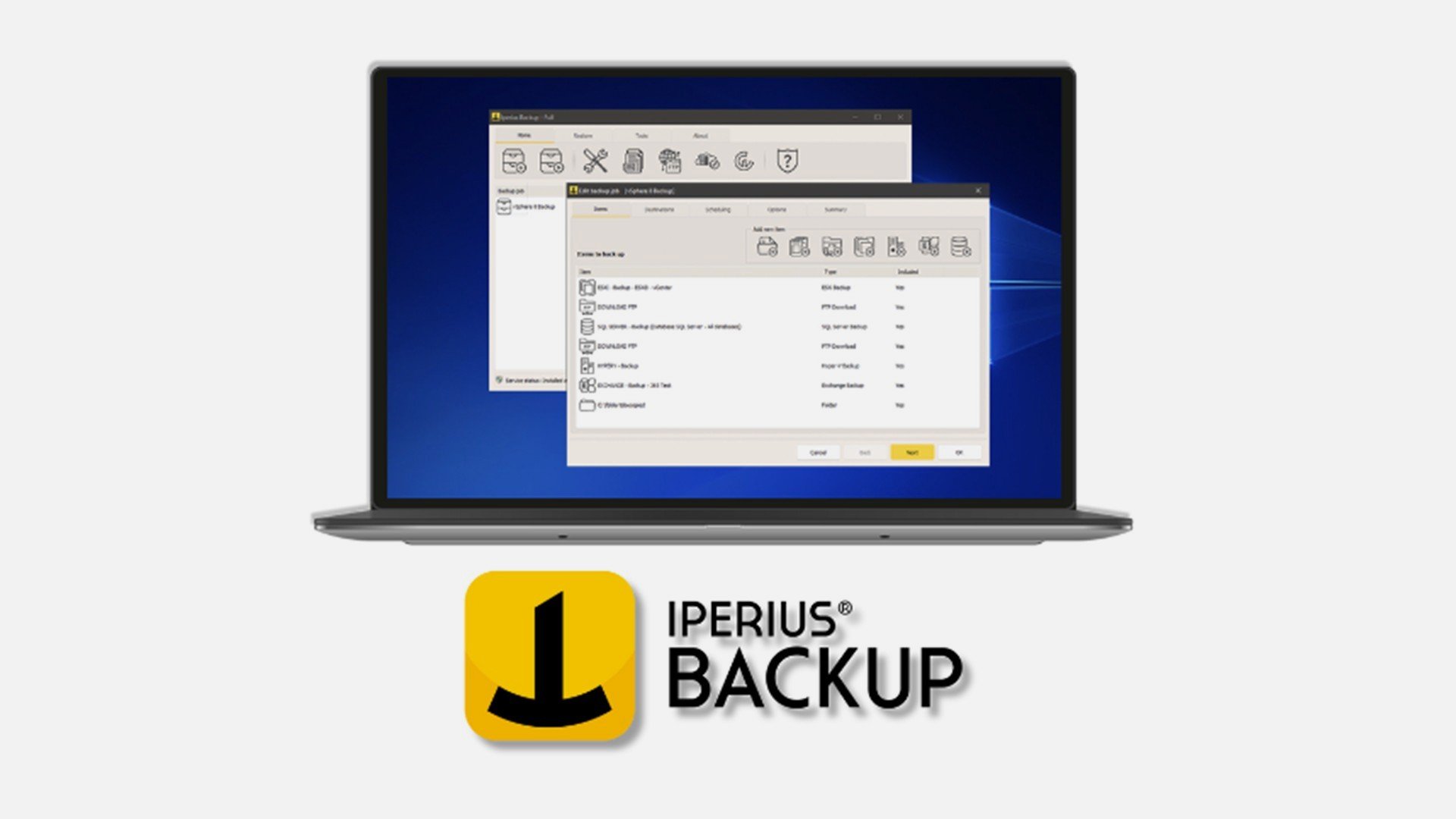

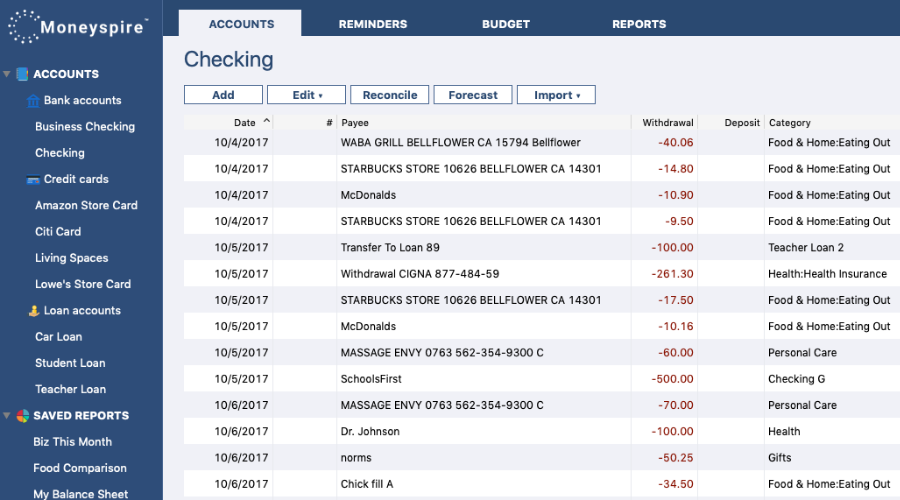

Moneyspire – Best overall

When it comes to financial management software that offers the tools necessary to review net worth, track all your accounts, and handle loans, bills, budgets, and investments, Moneyspire is definitely a first-class option.

With Moneyspire you can manage either your personal finances, your business’s, or both. The tool is fully customizable to your own needs, so while it has a ton of features, it does not get overwhelming.

The tool is pretty easy to use and set up. When you first install it, you will have to fill in some information about your accounts, choose your currencies, and add your accounts.

If you have used financial software before, you can import the data into Moneyspire. It supports QIF, WMTF, OFX, QFX, and CSV files.

This is one of the top software used in finance because it supports all the currencies of the world, so regardless of what type of account you have and in what currency, Moneyspire can help you manage it.

It also supports all major types of accounts, including bank, credit card, cash, investment, other asset, and other liability.

The tool makes it easy to keep track of all aspects of your financial life. You can use it to create budgets, check your balance, and see reports on how much you spend and how you can adjust that to reach your budgeting goals.

The app can also help you handle taxes. It generates detailed reports on expenses that already contain your tax deductions.

Other key features of Moneyspire include:

- Manage small business finance with income and expense reports, track customer invoices, and more

- Unlimited number of accounts

- Track bill payments with automatic reminders

- Print check

- Create your own invoices

- Fully customizable user interface with categories, data locations,

All these features are included in the premium version. You can try them for free during the 30-day trial period.

The app also has a completely free version, but that’s a bit limited because it only lets you manage one account.

Moneyspire

Keep track of your net worth and handle your finances with this reliable tool that supports all currencies.Empower – Best for budgeting and planning

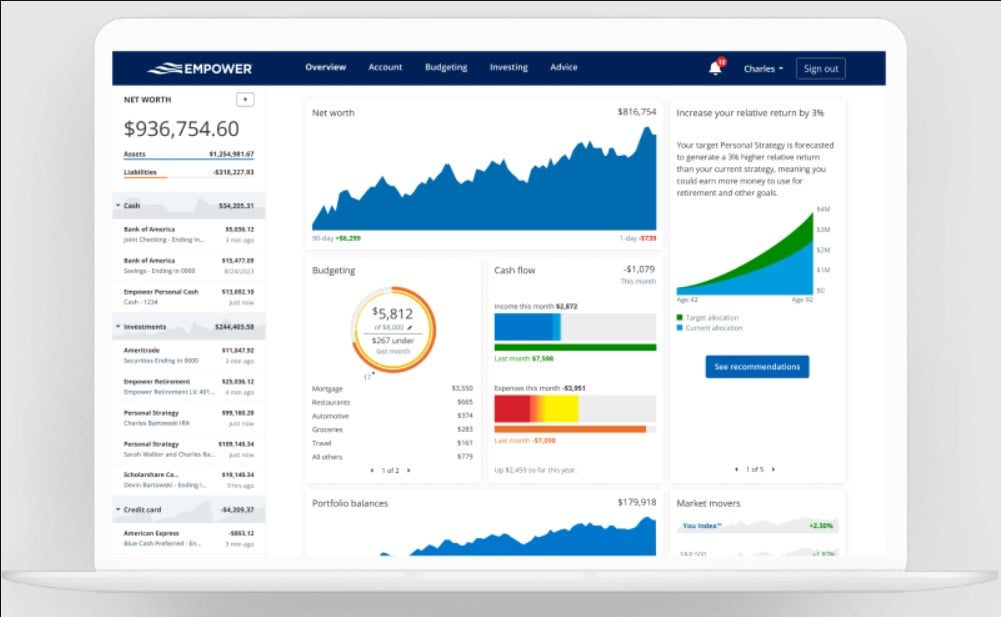

With over $8 Billion in assets under management and a 1.9+ Million user base, Empower is a one-stop destination to keep a tab on your finances and manage them.

Empower offers a free finance management dashboard to the user that tracks your investments and automatically updates your net worth periodically. You can also download the app on your Android and iOS devices for easier access.

Empwer has two plans on offer. The free plan is for everyone who wants to track their net worth and acts as an investment aggregator. If you want Empower to manage your finances and investment, you can opt for the premium plan.

The dashboard gives you access to all your linked accounts in one place and gets a real-time view to manage your entire financial life.

The fee Analyzer feature can save you from the hidden mutual fund fees to save money. You can compare your portfolio allocation to the ideal target location using the Investment Checkup tool.

Other key features of Empower include:

- Investment checkup

- Budgeting assistance

- Fee analyzer

- Education expenses planner

Last but not the least, the Retirement Planner makes it easy to build, manage and predict your retirement all from one place.

Empower

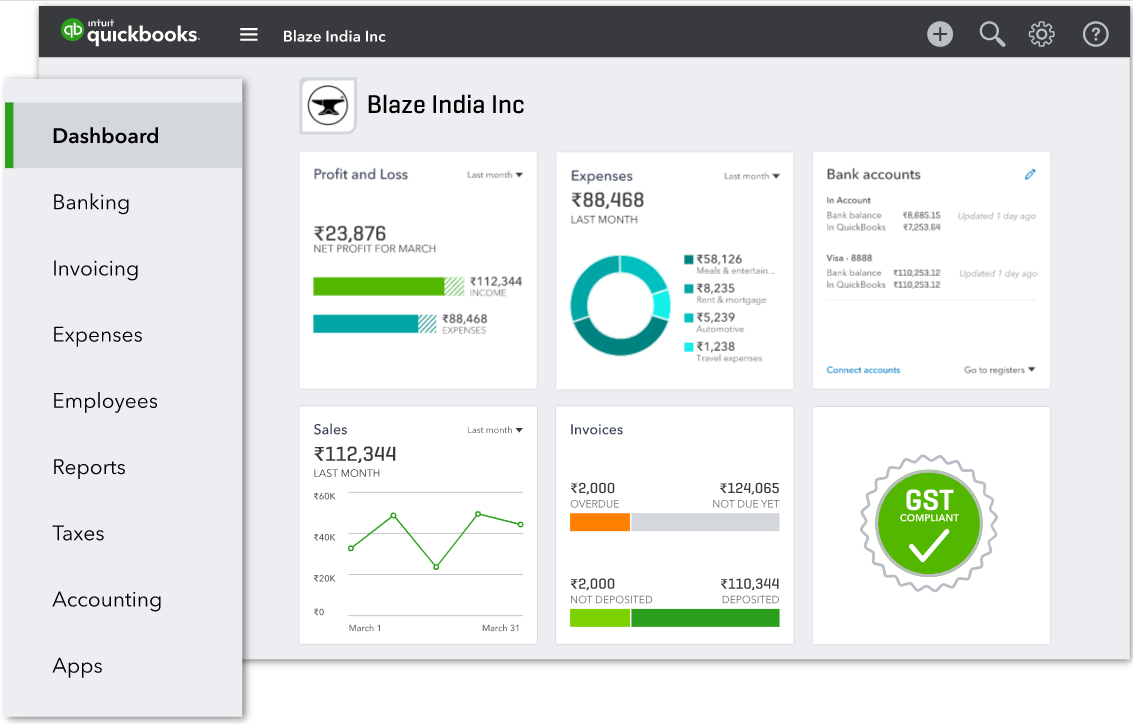

Keep track of all your income and expenses with this simple app for PC and mobile.QuickBooks – Complete financial solution

QuickBooks is a well-known suite that helps professionals all over the world in all things related to finance.

Naturally, this software will also be one of the best to keep track of your net worth, due to its long list of financial features that will help you manage your business, expenses, accounting, and many more.

QuickaBooks support multi-currency, meaning you won’t have to use different software if your accounts are split into different currencies.

This tool is also great because you can get bank feeds directly in the app if you connect it to your bank accounts.

The QuickBooks suite also comes with a mobile app from which you can access the most important features so you can always be on top of what is going on within your estate.

Here are some other key features of QuickBooks:

- Insights and reports

- Inventory management

- Capture & organize receipts

- Very easy to switch to

- Lots of other apps integration

QuickBooks

Keep track and manage your net worth with this amazing complete financial solution.Quicken – In-depth tracking

If you want something more sophisticated and a personal finance management app that allows you to manage your expenses, and track your bills as well as investment, Quicken offers the tools that cater to the needs of starter to advanced users.

You can link all of your bank accounts, credit cards, assets, retirement plans, liabilities, and investments to the software.

Quicken is available for both Windows and Mac users which means it is offline software. The software covers the essential features of a financial management tool including budgeting, bill payment, and investment tracking functionalities.

The latest version of Quicken comes with a Bill Alert feature that notifies of any pending due and makes a payment as well.

The dashboard provides a quick preview of your financial status. You can see what’s coming in and what’s going out. Check balance and receive alerts on the same.

Other features in Quicken include the ability to review your portfolio, monitor performance, create a budget, manage to spend and manage your property.

Unlike other personal finance tools, Quicken offers multiple plans. Users have the possibility to select the features included and thus not pay extra for what they won’t use.

Other key features of Quicken include:

- Short and long term planning

- Tracks all transactions

- Remote accessibility

- Clear and secure data protection

Quicken may not sound attractive to an average user looking for personal finance software, but someone requiring tools to fix their complex finance routines will appreciate the depth and feature it has on offer.

Quicken

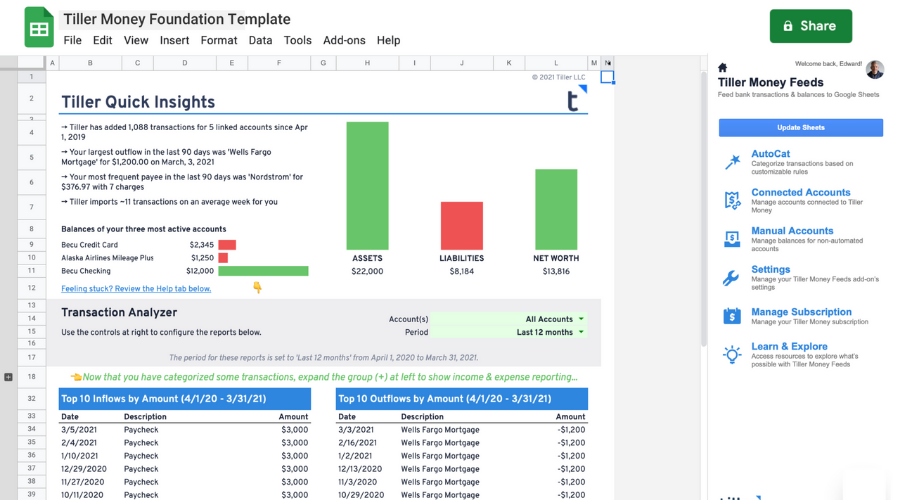

Monitor your income and take care of your expenses as well as investments with this advanced financial management app.Tiller – Best for collaboration

Tiller Money is a personal finance platform based on spreadsheets that you can integrate into your Microsoft Excel and Google Sheets spreadsheets.

With this tool you can link all your recurring expenses such as subscription plans and bills and the application will automatically fill your spreadsheets with this information.

You can link all your financial accounts and keep track of your whole income information.

Tiller creates specific sheets for different types of financial actions. For your transactions, it will include information regarding the date, category, amount spent, the account that paid for the said transaction, and more.

This keeps you very well organized, offering you a quick but detailed view of all your expenses.

The tool also creates a separate sheet for your balances where you can see daily information about all the accounts linked.

This includes net worth, assets, banking, liabilities, and credit cards. You will be able to see real-time information as well as historical data that can help you better manage your money over time.

Tiller has several pre-made templates for more advanced budgeting and spending goals. For example, it includes a pre-made retirement planner, a foundation template, and more.

Other key features of Tiller include:

- Strict privacy policy with powerful 256-bit AES encryption

- Powerful auto-categorization rules

- Mail notifications about your transactions and balances

- Responsive customer support

- Easy to share and collaborate on your spreadsheets

Tiller is a paid service, but you can try it out for free with a limited trial.

Tiller

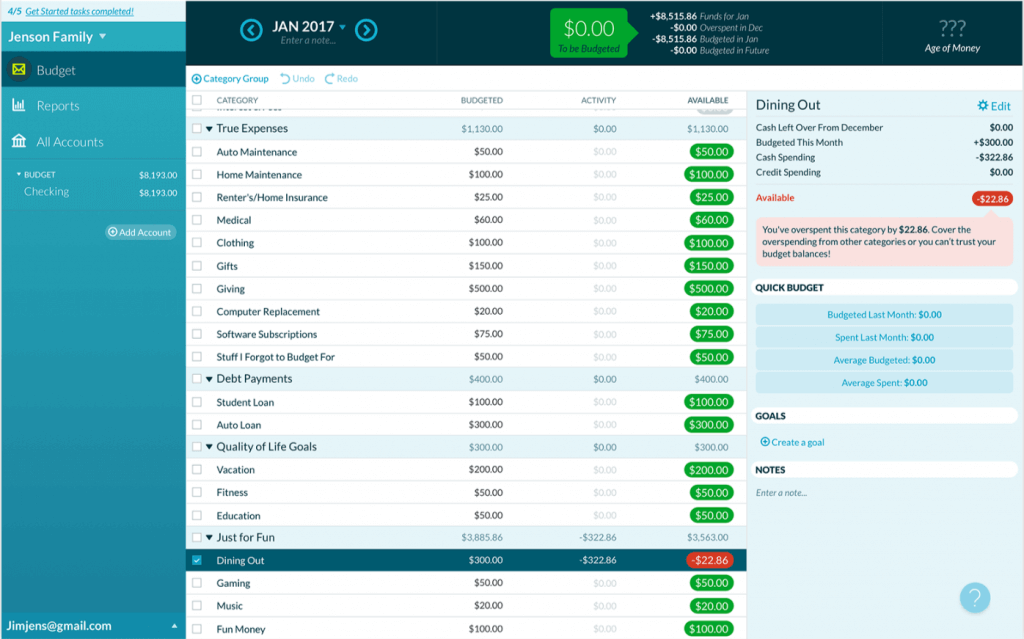

It is easy to manage your net worth with this spreadsheet-based software.YNAB – Best multi-platform tool

YNAB ( You Need a Budget) is a finance management software to track your spending and budget management. However, you can also use it to track your net worth.

It is a premium service that imposes a monthly or annual subscription fee. You get the best bang for your buck if you pick the annual plan.

However, if you are not sure about the service, you can try it out for free for 34 days. It will give you enough time to assess and evaluate the software to figure out its needs and use.

The app offers tools for monitoring income, expenses, and also instructional support to deal with the issues causing financial mismanagement.

You can use YNAB web-based dashboard or download the app on Android or iOS device to access the YNAB accounts.

YNAB is not as sophisticated as Personal Capital or even Mint for that matter, but for what’s it worth, it gets the job done and well.

Notable features offered by YNAB include budgeting, investment tracking, bill management, reconciling transaction, QFX and QIF file format support and online synchronization across your devices.

You can connect all of your bank accounts to YNAB to keep things up to date. You can access all the information related to your accounts from anywhere and also share the finance plans with your partner seamlessly.

Other key features of YNAB include:

- Add-free

- Powerful data encryption

- 2-factor authentication

- Real-time sync with all devices

- Goal tracking

YNAB does not have a whole lot of features. Then again it does not try to be the jack of all trades but the master of one.

⇒ Get YNAB

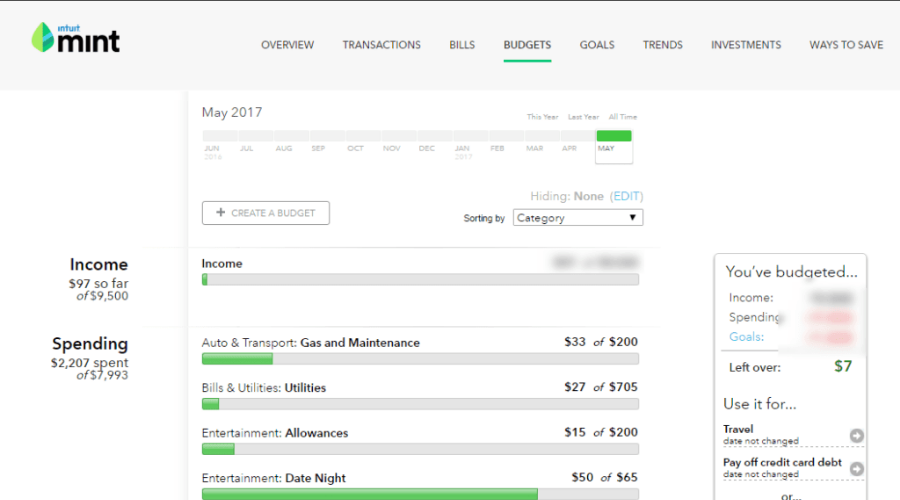

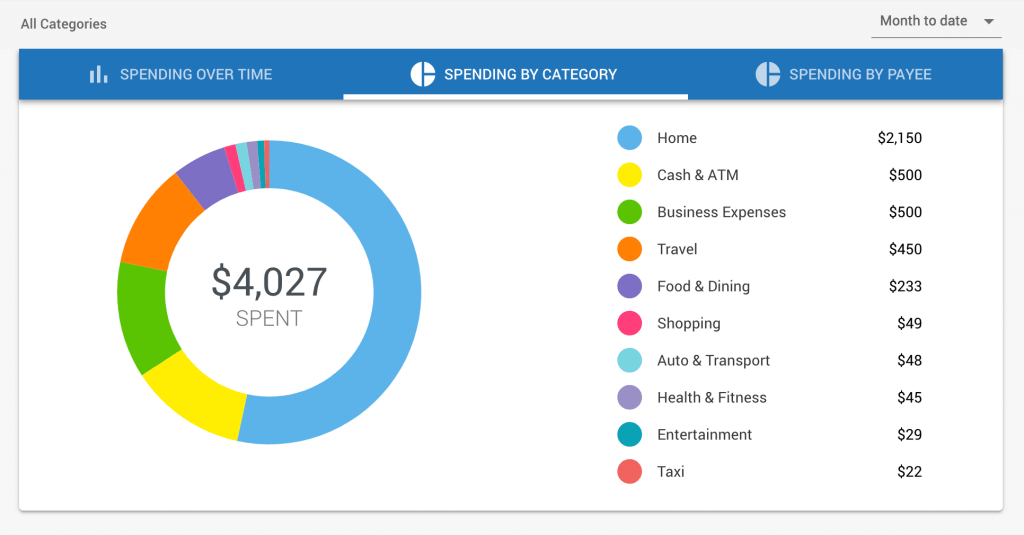

Mint – Advanced automation rules

Mint is one of the most popular net worth tracking apps. It is a full finance management suite that is on par with Capital Control.

Mint is free to use and can be accessed from the website on a desktop or through mobile apps for Android and iOS. Mint displays advertisements related to finance and credit cards to keep the service free.

This personal finance program allows you to add new accounts ranging from credit cards to banking and loan quickly and the app downloads all the financial data in no time.

Mint automatically updates and shows the real-time data on the dashboard. The user interface is simple and easy to use with pretty graphs giving it a modern look.

Mint comes equipped with tools to create budgets, define goals and of course financial account aggregation.

Mint really shines when it comes to tracking your expenses and creating a budget. The software auto categorizes the transaction into pre-defined categories. While it works, the software does take some time to learn from your transaction types and put them in the right sections.

You can also use the software to track goals for your investment, debt settlement, and savings. The credit card score tracking feature offers a sneak preview of your credit score along with payment history and credit accounts.

Other key features of Mint include:

- Categorize bank transactions

- Secure 256-bit encryption and multi-factor authentication

- Financial planning educational resources

Mint is an excellent personal finance tool with essential features to track net worth and manage finance on offer.

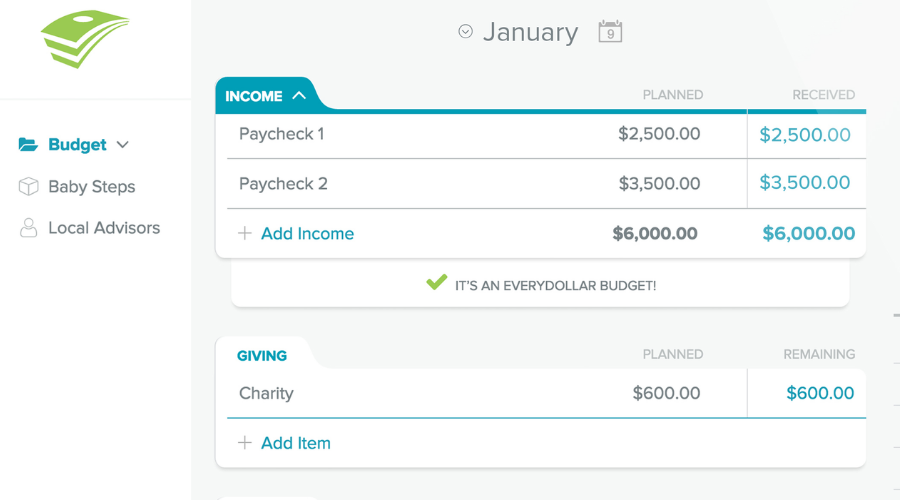

Every Dollar – Easy to use app

Every Dollar is one of the well-known software in the personal finance space. It is a freemium app which means while you can use it for free, some features require a premium account.

The major difference between the free and plus version of Every Dollar is that in the free version you need to add the transaction manually while the premium version automates the same process.

Apart from tracking net worth, Every Dollar emphases on budgeting to help you with your spending plan and track your expenses to every last dollar.

It is easy to use and offers a detailed dashboard with all the options made easily accessible to the users.

To start using Every Dollar you need to signup for a free account. It has around eight different spending categories along with an option to create your own.

For each category, you can add details, make notes, track transaction and favorite it in case you are planning to use it on a regular basis.

There is a Funds account feature which is nothing but your saving accounts that you can set up on the software.

Other key features of EveryDollar include:

- Debt tracking

- Print transaction history

- Financial education resources

On the flip side, the software is more expensive than other options on this list. However, just like YNAB, Every Dollar does excel at the features it offers without cluttering your dashboard with too many options.

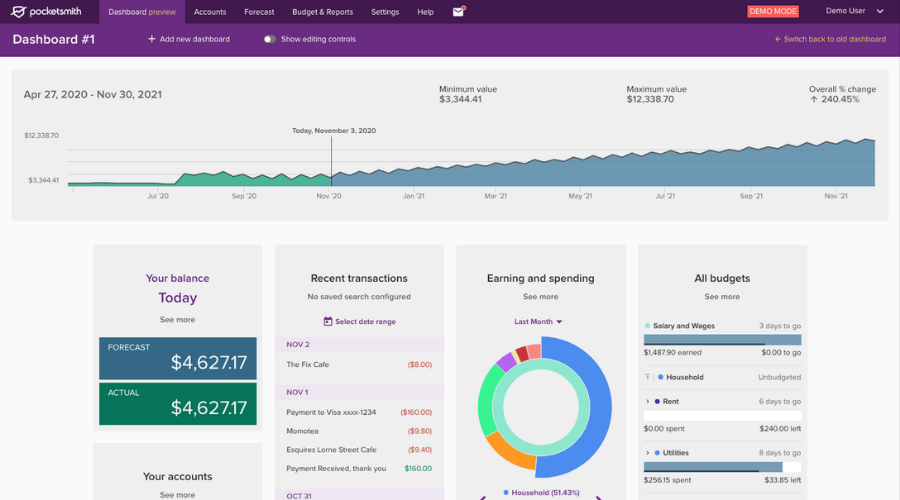

Pocket Smith – Advanced predictive algorithms

Next on our list is yet another great personal finance and budgeting software built to provide the resources necessary to manage multiple types of financial needs and goals.

Pocketsmith is compatible with over 12 000 financial institutions across the globe, allowing users to connect all their accounts.

It lets you keep track of all types of financial accounts as well as assets and liabilities. Pocketsmith supports international currencies and includes an automatic conversion feature based on daily rates.

The tool automatically imports transaction history and financial data to keep track of all spending. It gives you the possibility to categorize, label, and annotate your spending.

The tool is also very useful when it comes to budgeting. It gives several options so you can create budgets and plans based on your needs and preferences.

The tool uses automatic algorithms to determine and predict bank balances up to 30 years into the future.

Along with that, it includes what-if scenarios that test hypothetical financial decisions and their outcomes.

This can be of great help as it may showcase results that you may not expect and give you a new perspective on your financial behavior.

Other key features of Pocketsmith include:

- Dashboard reporting of all activity

- Net worth calculator

- Cashflow statement

- Email notifications

- Compatible with Mint.com

Pocketsmith has a free plan that includes useful personal finance features. It does require manual imports and supports 2 different accounts. For more tools and automatization, you also have the option to get one of the two paid plans.

Conclusion

Life is always good when your expenses are in your control. And these best software to track net worth helps you effortlessly manage your finance and all the other miscellaneous expenses at one place.

To put it in simple terms, your Net worth = assets – liabilities. The net worth is bound to change over time, but tracking net worth allows you to monitor your financial health and keep it healthy.

Our recommended software to track net worth includes multi-purpose software that allows you to monitor your monetary status so that you stop living paycheck to paycheck and save more money while paying off your debt.

Do you use any of this software to track your net worth? Do let us know the personal finance software that has helped you to keep your finances on track in the comments