8 Best Automated Trading Platforms For Speed, Precision & Profit

Try our top picks for the best trading software and choose your favorite

9 min. read

Updated on

Read our disclosure page to find out how can you help Windows Report sustain the editorial team. Read more

Looking for the best-automated trading software? You’re in the right place. Today, we’ll walk you through the best options that’ll help you speed up the process, get precision, and take the emotion out of trading.

With these platforms, you can automate your trades, backtest strategies, and access real-time market data, all at the push of a button. Whether you’re into stocks, crypto, or options, we’ve got you covered.

What are the best automated trading software for Windows PC?

Disclaimer: Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

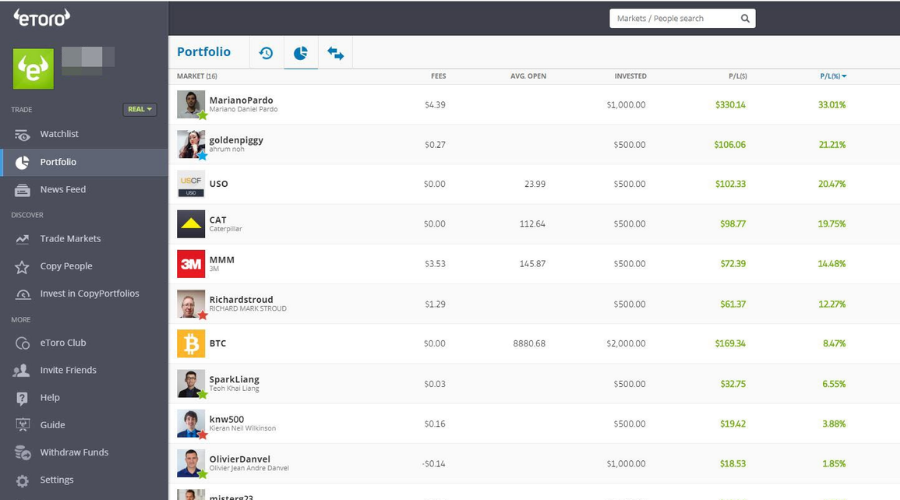

1. eToro – Award-winning CopyTrade technology

eToro is a social trading platform designed for beginners and experienced investors alike. It allows users to automatically copy the trades of seasoned traders, making it ideal for those with limited time or experience.

It supports trading in a wide range of assets and provides transparent fees and educational tools to guide users through their trading journey.

✅ Pros

- Award-winning CopyTrade technology, enabling users to automatically replicate the actions of an experienced investor

- Over 2000 available assets

- Social trading network

- Ready-made portfolios

- Clean and responsive interface

- Advanced charting

- Transparent fees

- Educational content via the eToro Trading Academy

❌ Cons

- eToro USA LLC does not offer CFDs, only real Crypto assets are available

- A withdrawal fee of $5

eToro

Minimize your risks and copy the trades of the most successful investors across the world with eToro.Disclaimer: 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation.

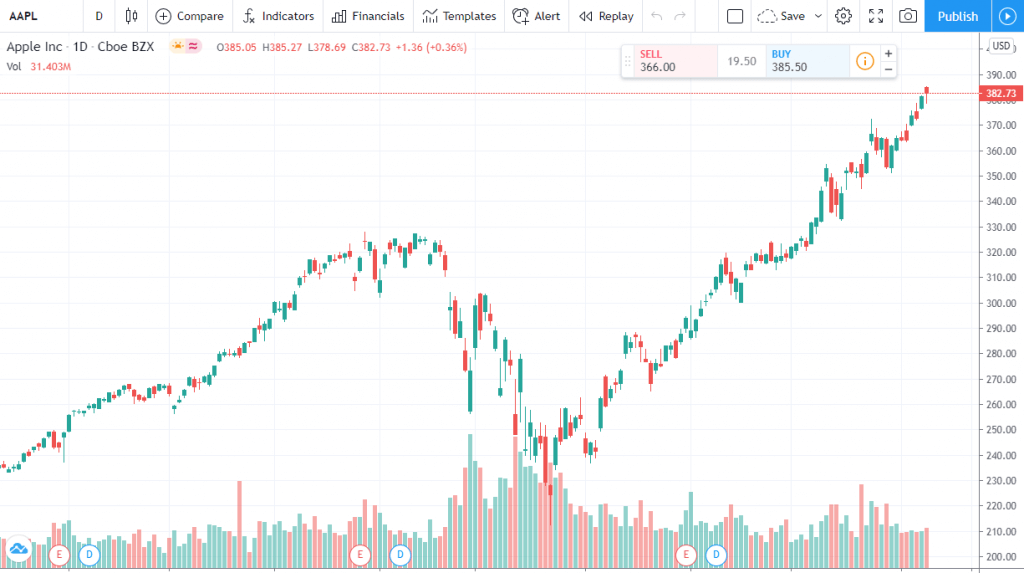

TradingView – Modern and intuitive interface

TradingView is a cloud-based trading platform with a social community of over 10 million investors. It stands out for its intuitive charting and real-time alerts. It offers a vast library of user-generated strategies and technical indicators.

Those can be integrated into your trading approach. The platform is designed for traders who value real-time market analysis and a vibrant social trading community for sharing insights and strategies.

✅Pros

- Over 100,000 strategies generated by the community

- Automated analysis

- Modern and intuitive interface

- Wide library of technical indicators, including over 5000 indicators made by users

- Pine Script Native language, allowing scripts and indicators to be created with fewer lines of codes

- Direct market access

- Cloud-based and server-side trading alerts for price, indicators, strategies, and drawing tools

- Mobile apps for iOS and Android

❌ Cons

- Limited level 2 market data

- No offline usage

TradingView

Explore a modern trading experience with TradingView.ZuluTrade – Strong user community

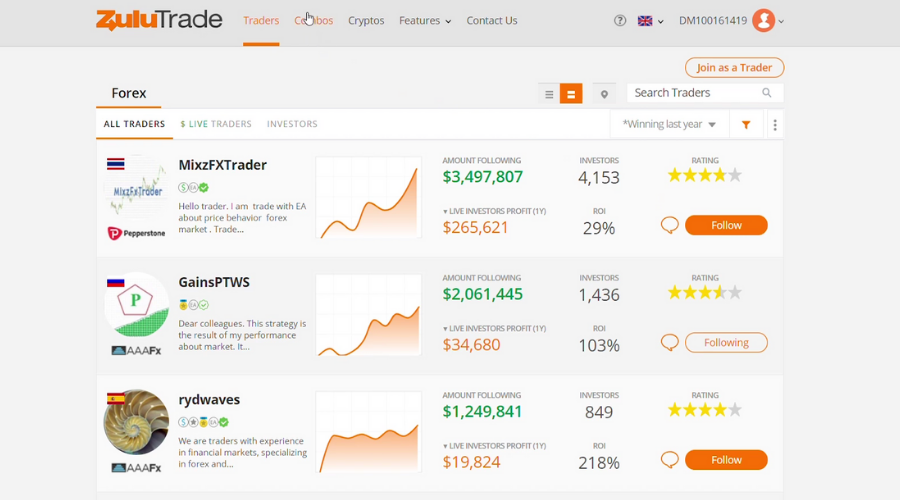

ZuluTrade was founded in 2007. It’s an online trading platform with some social elements and the ability to copy trading options and add automation.

Regulated by the HCMC, they offer APIs for traders, scripts, and auto-execution options. They’ve gained a lot of respect back in 2015 when the platform was awarded an EU Portfolio Management License.

Since you are looking for automated trading software, here are the 3 main features of ZuluTrade.

- The Automator

- As early as 2016, this functionality was added.

- Based on the rules that you add, when certain events occur, the Automator will send you an email notification or will automatically execute certain actions.

- ZuluScript

- Basically, this offers the chance to talk to trading bots by creating scripts.

- This trade automation allows you to perform much more trades than if you were to place orders manually.

- ZuluGuard

- With so much automation going on, you might risk losing everything in case of glitches.

- This unique feature for risk management asks for the amount of capital you have available and calculates a trading exit value for all opened trades.

In case the specified threshold is achieved, then all open positions will be automatically closed, thus minimizing any potential loss.

ZuluTrade

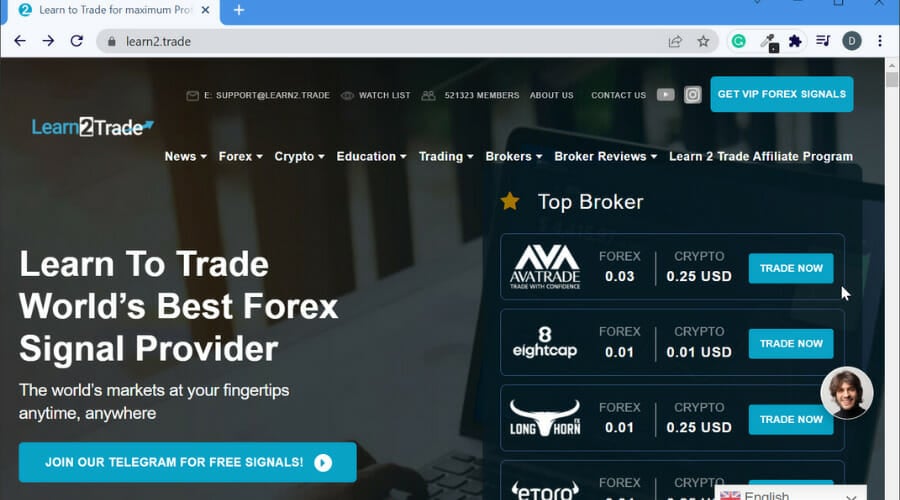

Learn2Trade – Pro-level educational support

Learn2Trade provides forex trading signals and in-depth educational content aimed at both novice and experienced traders.

Through its private Telegram channel, users receive real-time trading alerts and access to expert analysis.

The platform is known for its comprehensive resources, which include forex courses, strategy guides, and market updates, making it an ideal choice for those looking to improve their trading skills.

✅ Pros

- Pro-level educational support

- Risk management guides

- Up to 10 signals per day

- Daily technical information

- Secure, real-time alerts via Telegram

- Free forex signals

- 24/7 chat with pro traders for VIP users

❌ Cons

- Signal accuracy can be quite low

- Unotified auto-renewal of subscription

SierraChart – Lightweight and easily customizable

SierraChart is a powerful charting and technical analysis platform, ideal for traders seeking customization and flexibility.

It allows users to access real-time market data from global financial markets and supports multiple data services.

With its lightweight design and offline data access, SierraChart ensures that users can continue trading and analyzing markets even when disconnected from the internet.

✅ Pros

- It is lightweight and can easily be modified

- Simple, stable and offers helpful Support

- Very good trading software

- It is appealing

❌ Cons:

- The built-in backtesting is buggy and not very elegant when it comes to designing systems to backtest

- Loss of internet connection usually results in malfunction

Ninja Trader – Great technical support

Ninja Trader has multiple interfaces such as the Chart Trader, SuperDOM, and the FX Board.

The Chart trader includes drawing tools and allows users to place and modify orders from one main window. It also includes some trade management features such as profit targets and more.

The second interface option, The Super Dom is configured as a real-time visual order book. It offers live insights into the markets.

The FX Board displays trading trends in a tile-type layout. Users can quickly submit orders and check all active orders in just a few clicks.

✅ Pros

- In milliseconds, users can submit and manage their stop loss and profit target orders

- Orders and trades can be placed and managed directly within a chart

- Order Entry Hot Keys: Drive order submission, cancellation, modification, and close positions

- Users can run automated trading strategies

- Various orders can be submitted in order to protect an open position, when one is filled, the other is canceled automatically

- Users can set up complex alerts that will trigger based on pre-defined alert conditions

- Users can make use of tabbed windows in order to maximize screen real estate and enhance the efficiency of the workspace

- SuperDOM Indicators and Columns

- Demo mode is free to use

- Several brokerage offerings

- C# programming provides extreme flexibility

- Several charting types are supported

- Great technical support

❌ Cons

- The data feed is not included

- Programming is usually longer compared to other platforms

- Loss of internet connection will result in a malfunction

- Low supported brokerages

AvaTrade – Risk tolerance

AvaTrade is a versatile trading platform that offers both automated trading and risk management tools.

It supports a wide range of assets, including forex, stocks, and cryptocurrencies, and provides features like AvaProtect, which helps limit potential losses.

AvaTrade’s user-friendly interface makes it easy for traders of all levels to access the tools they need while ensuring compliance with international regulations.

✅ Pros

- Risk tolerance

- Management tools

- Over 1,000,000,000 strategies are available

- A user-friendly interface

- Simple Usage

- Enables advanced strategies for all traders

- Automatic Updates. It updates directly on the platform daily, to ensure strategies and current market status synchronize

- Traders from all levels can easily benefit from their services

- Unique Algorithm

❌ Cons:

- Loss of internet connection usually results in malfunction

Protrader – Professional-looking design

ProTrader is a high-functionality trading platform designed for professional traders. It combines market analysis tools with an attractive, customizable interface.

The platform allows users to trade multiple asset types, such as stocks, forex, and options, with a focus on providing real-time market insights.

ProTrader’s professional design and customizable workspaces ensure that traders can tailor their experience to suit their needs.

✅ Pros:

- Market analysis

- Running of Algorithmic strategies

- Risk management

- Investors are able to set up their trading terminal exactly the way they desire it to be, even down to the color scheme.

- Workspaces view creation

- ProTrader trading platform has two pre-loaded workspaces, the Beginner and Professional, in order for users to select the one that fits their requirements easily without bothering about customization

- The overall design is professional-looking and beautiful

- The platform contains market features that a lot of investors are in need of

- It allows the trading of a wide range of instruments and assets, providing investors the option of selecting forex, stocks, options, CFDs, and futures

❌ Cons:

- The charting area of the ProTrader platform is small

Automated trading software comes with lots of advantages and very few disadvantages. These solutions enable users to trade while sleeping, lower emotion due to its ability to make non-subjective trades, and also it has a micro-second decision processing ability.

Go for the one most suitable for you. Click on the software link available at the end of the description.

Is automated trading worth trying?

Automated trading is not inherently more profitable than human-monitored trading, but it has the benefit of saving a lot of time and completely removing emotion-based decision-making.

They can be very beneficial for beginner traders, as they can automate and copy trades of more experienced investors.

Pros:

- Backtesting

- Increased order speed

- It lets you trade from multiple accounts simultaneously

- Objective decision making

- Convenient

Cons:

- Algorithms may fail

- Risk of overfitting and wrongfully predicting positive results

- Highly dependent on good connection speed

Can you automate day trading?

Day trading can be automated with the help of the above-mentioned tools. Users prefer to implement automation when they already have good indicators that their strategy is going to have a positive outcome.

Automated trading software can be just as valuable for saving time, getting the best price, and removing some of the risks of day trading as they are for any other type of trading.

There is always a risk of loss, both in manual and automated strategies, so it is highly dependent on the user’s intentions and preferences.

To learn more about trading and the tools that help, visit our dedicated Trading Hub.

If you are looking for the right tools to accelerate your business, visit our Business Software section.

User forum

1 messages